Ether Soars Above $3500 – Now Bigger Than Walmart

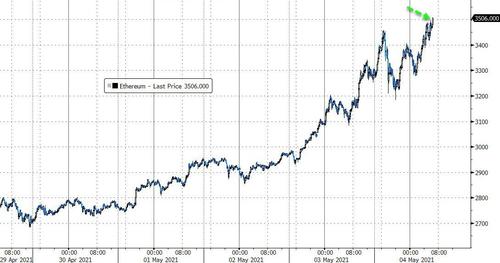

The rise of altcoins continues as Ethereum has accelerated above $3500 for the first time ever this morning (less than 48 hours after first crossing above $3000)…

Source: Bloomberg

“The market is realizing how fundamentally undervalued Ether is given all the development activity on the network,” said Vijay Ayyar, head of Asia Pacific at crypto exchange Luno Pte.

“While one may think Ether has risen a lot, when you compare it to Bitcoin, there is a long way to go.”

Ayyar sees Ether hitting $5,000 to $10,000 by early next year. Evercore ISI technical strategist Rich Ross has revised up his target to $4,100 from $3,900. Many traders are eyeing a run toward $10,000 before the end of 2021, Edward Moya, a senior market analyst at Oanda Corp., wrote in a note.

“Ether will have much volatility, similar to Bitcoin, but can increase in value as more institutional investors become aware of it,” Pat LaVecchia, chief executive officer of crypto broker Oasis Pro Markets LLC, wrote in an email. Ether at $25,000 is possible over the next few years, he said.

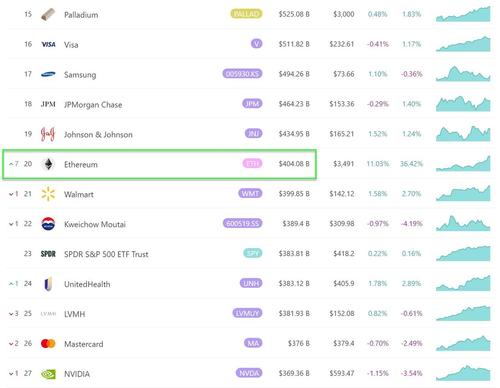

The recent surge has pushed Ethereum’s market capitalization above $400 billion. That’s larger than Walmart and just shy of JPMorgan…

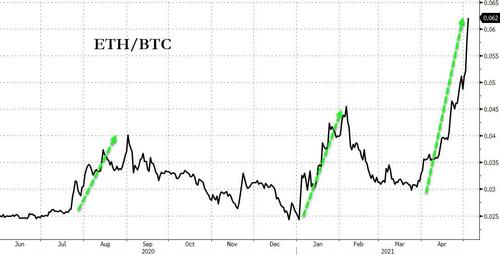

Bitcoin is down this morning, testing $56,000, sending the ratio of ETH to BTC to 0.06x as the latest DeFi boom accelerates…

Source: Bloomberg

As The Wall Street Journal reports, the rally in ether is tied to the recent burst of activity on the network. About seven million new Ethereum addresses—or accounts able to hold ether balances—were created in the first four months of 2021, bringing the total to more than 55 million, according to analytics firm IntoTheBlock.

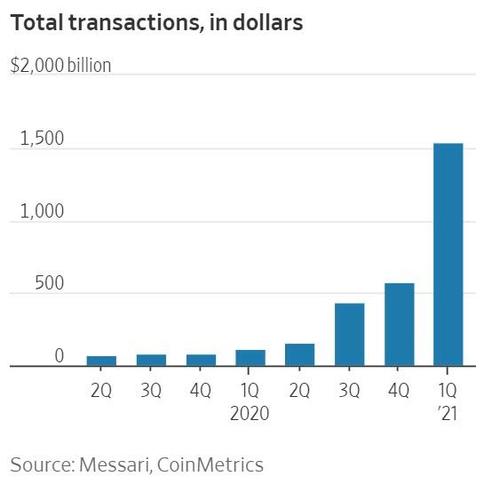

And the dollar value of transactions on the platform totaled $1.5 trillion in the first quarter, according to research firm Messari, more than the previous seven quarters combined.

The growth in markets like NFTs and defi has been “mind-boggling,” said Jean-Marie Mognetti, the chief executive of asset manager CoinShares.

“Ethereum as a network is what makes this all possible.”

The total amount of crypto held in defi protocols on Ethereum – a number referred to as “total value locked” – has skyrocketed to $68 billion, according to website DeFi Pulse, from about $900 million a year ago.

When new investors come to crypto the first asset they generally hear about and buy is Bitcoin before learning about other assets and allocating across the space. As FundStrat recently noted, the same learning curve is playing out with institutional investors right now where the crypto narrative is shifting from Bitcoin to Ethereum and other segments like DeFi and Web 3 apps.

Tyler Durden

Tue, 05/04/2021 – 09:37

via ZeroHedge News https://ift.tt/3unDELS Tyler Durden