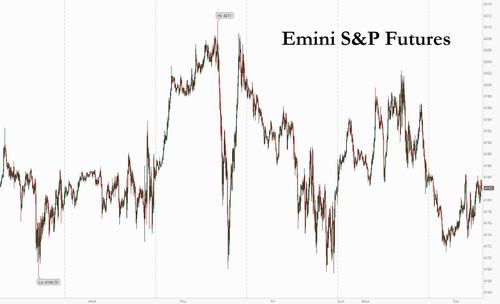

Futures Slide Amid Rising Inflation Fears

For the second day, US equity futures traded in a narrow range, dipping during the muted Asian session where markets in Japan, China and Thailand remained closed on Tuesday, but then rebounding as Europe came online to trade mostly unchanged as investors continued to move out of megacap growth stocks amid fears of rising inflation and into companies that are expected to benefit more from the reopening of economies. At 715 a.m. ET, Dow e-minis were up 17 points, or 0.06%, S&P 500 e-minis were down 4.00 points, or 0.1%, and Nasdaq 100 e-minis were down 42 points, or 0.30%. The dollar jumped, while Treasuries dropped along with most European bonds. Ethereum extended its surge to set another record as larger rival Bitcoin slipped.

Nasdaq 100 Index traded down 0.4% a day after tech giants such as Tesla and Amazon.com dragged the underlying index lower on signs of quickening inflation. Tech shares were also the biggest laggards in the Stoxx Europe 600 Index, with semiconductor firm Infineon Technologies AG slumping as much as 5%. In contrast, cyclical shares such as miners and travel stocks helped power the European benchmark as a gauge of commodity prices hovered at the highest level since 2012.

Here are the notable premarket movers:

- Mosaic continued to slide after missing estimates in results yesterday while CVS Health Corp rose ahead of reporting today.

- FAAMG gigacaps fell between 0.2% and 0.5% in premarket trading

- Big US banks such as Goldman and Wells Fargo added 0.7% and 0.4%, respectively,

- Planemaker Boeing and oil major Chevron gained 0.8% each.

- Dupont de Nemours rose 0.9% after the industrial materials maker raised its full-year profit and revenue forecasts and beat first-quarter expectations as did apparel maker Underarmor which rose 3%.

Copious stimulus measures, speedy vaccination drives and the Federal Reserve’s accommodative policy stance have spurred a strong rebound in the U.S. economy and pushed Wall Street to record highs this year. The so-called “pandemic winners”, however, have recently started to fall out of favor. First-quarter earnings have been largely upbeat. Average profits at S&P 500 companies are expected to have risen 46% in the quarter, compared with forecasts of a 24% growth at the start of April, according to IBES data from Refinitiv.

“While megacap tech companies have been a core part of the solid performance of portfolios throughout the pandemic, we think investors should be careful to avoid overallocation to this part of the market,” Mark Haefele, chief investment officer at UBS Global Wealth Management, wrote in a client note.”In an environment of accelerating growth, we continue to prefer cyclical and value sectors such as financials and energy.”

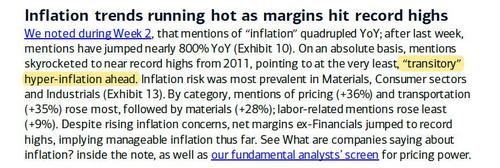

As the global economic recovery gathers pace thanks to successful vaccine rollouts in much of the developed world, inflation has emerged a chief concern, with a gauge of prices paid for materials jumping to the highest since 2008 on Monday and Bank of America going so far as warning of “transitory” hyperinflation.

The breadth of the rebound is also an open question, after Powell said that economic progress has been uneven across racial and income divides.

“We do believe that inflationary pressures will continue this year and that’s driven by the kind of policy we have seen globally,” Rupal Agarwal, a strategist at Sanford C Bernstein, said on Bloomberg TV. “In the shorter term you can expect some pullback in the markets but the broader sentiment remains bullish” as the reopening and reflation trade remains in force.

In Europe, the Stoxx 600 index retreated from session highs to inch down 0.1%, with technology companies weighing on sentiment and the German DAX falling 0.6% while UK’s FTSE 100 rose 0.5% after a long weekend. Miners and oil and gas stocks rose more than 1% each, reflecting a rally in commodity prices, as investors bet on a strong global rebound on the back of massive vaccination drives in developed countries and unprecedented stimulus. Travel and leisure sector rose 0.2%, benefiting from Britain’s expected announcement of a green list for countries that people can travel to on holidays.

“Notably the UK seems to be moving through the gears on reigniting the engine of the economy without hitting a road bump of rapidly rising infections or hospitalisations,” said AJ Bell investment director Russ Mould.

Tech stocks, however, slumped 1.2% after their Wall Street peers came under pressure on Monday. Here are the most notable European movers:

- Jewellery maker Pandora jumped 4.8% on reporting quarterly operating profit above estimates, fuelled by strong online sales and plans to push for sales growth in the United States and China.

- Dassault Aviation jumped 7.9% after Egypt’s defence ministry said it had signed a contract with France to buy 30 Rafale fighter jets.

- Italy’s top commercial broadcaster Mediaset gained almost 3% after it agreed on a consensual break-up from its second-largest investor Vivendi. Vivendi’s shares slipped 0.3%.

- Chipmaker Infineon fell 4.5% after CEO Reinhard Ploss said he was expecting supply constraints in the automotive segment to only ease in the second half of this year, with lost volumes likely to be made up in 2022. Europe’s automakers fell 0.5%.

- German meal-kit delivery company HelloFresh fell 4.5% as worries about consumer behaviour, amid easing lockdowns, overshadowed a surge in first-quarter customer base.

Earlier in the session, Asian stocks fell as a resurgence of Covid-19 cases in the region dragged shares in Taiwan and India lower. The MSCI Asia Pacific Index slipped as much as 0.3% before paring losses. The Taiex index slid 1.7%, clocking its worst two-day drop since August, after Taiwan reported two local virus cases on Monday. That slump took some of the shine off one of the world’s top-performing stock markets this year.

“Some near-term pullback may be expected after the strong April,” said Bloomberg Intelligence analyst Marvin Chen of the Taiwan stock market which rose 6.9% last month. India’s Sensex index fell as much as 1.2% as the country continues to witness more than 300,000 new Covid-19 infections daily. There was some evidence of investors snapping up cheaper shares, however. Vietnam’s stock gauge ended the day up 0.2% after declining as much as 2.2%. Local governments implemented movement restrictions after the country reported domestic coronavirus cases last week for the first time in a month. Communication services and health care shares were the gauge’s biggest decliners. Gains in New Zealand and Hong Kong provided support. Markets in Japan, China and Thailand were closed Tuesday

Meanwhile, threats of a return to deflation continue to rumble as fierce new Covid-19 waves are enveloping India and parts of Southeast Asia, placing severe strain on their health-care systems and prompting appeals for help.

In rates, Treasury futures drifted lower as S&P 500 E-minis erase Asia-session losses, leaving 10-year yields cheaper by more than 2bp. Treasury 10-year yields around 1.62%, lagging bunds and gilts by ~1bp and cheapening more than 3bp on 2s10s30s fly; front-end yields higher by 1bp, steepening 2s10s by 2bp. With cash trading still closed for a Japanese holiday, Asia-session activity was muted and futures volumes were low. Dollar issuance slate includes Shinhan Financial PerpNC5 and Newcastle Coal 10Y; almost $10b priced Monday with $35b projected for the week, and another active slate skewed toward non-financial borrowers is expected Tuesday.

In FX, the Bloomberg Dollar Spot Index advanced as the greenback was higher versus all of its Group-of-10 peers after extending gains in the European session, with many crosses giving up Monday’s gains and the Kiwi leading losses. The euro fell to an almost 2- week low of 1.2007 and tested its 21-DMA. The pound fell to a one- week low amid speculation that Bank of England policy makers this week will start discussing how and when they can ease their foot off the stimulus pedal; investors also focus on a Scottish vote on May 6, pitched on whether there should be a second independence referendum. The Australian dollar extended losses and the nation’s sovereign bonds fell after the central bank upgraded its economic growth outlook and said it will review its bond programs in July.

In commodities, oil continued its recent ascent, with WTI rising above $64.50/bbl and Brent north of of USD 67.50/bbl. There has been minimal development for oil with volumes also thin as Mainland Chinese and Japanese participants are away from their desks. Saudi Aramco released its earnings in the early hours but in line with its European counterparts, it has reaped in profits from the rise in oil prices whilst maintaining an optimistic outlook. Next up, the weekly Private Inventory data is the next scheduled catalyst for the complex. Elsewhere eyes remain on geopolitics but there is little new to report in terms of JCPOA.

In metals, spot gold and silver are again uneventful as the precious metals once again await US presence for directionality. LME copper prices are back on the rise and attempt to close in on the $10,000/t mark despite headwinds from the firmer Buck and the red metal’s largest buyer China away from markets. Aluminium prices meanwhile rose amid concerns that efforts by the Chinese government to reduce emissions would impact supply. Elsewhere cryptocurrency ether powered to another record peak, this time nearing $3,500 as speculators drive white-hot crypto markets higher. It last sat at $3,471.

Looking at today’s session, Pfizer, DuPont and T-Mobile US will post numbers. Economic data includes U.S. trade balance, factory orders and durable goods.

Market Snapshot

- S&P 500 futures down 0.17% to 4,178.50

- STOXX Europe 600 little changed at 439.78

- MXAP little changed at 205.60

- MXAPJ up 0.2% to 692.85

- Nikkei down 0.8% to 28,812.63

- Topix down 0.6% to 1,898.24

- Hang Seng Index up 0.7% to 28,557.14

- Shanghai Composite down 0.8% to 3,446.86

- Sensex little changed at 48,711.40

- Australia S&P/ASX 200 up 0.6% to 7,067.85

- Kospi up 0.6% to 3,147.37

- Brent Futures up 1.1% to $68.30/bbl

- Gold spot down 0.38% to $1,786.08

- U.S. Dollar Index up 0.44% to 91.346

- German 10Y yield fell 0.1 bps to -0.205%

- Euro down 0.5% to $1.2004

Top Overnight News from Bloomberg

- While bond investors are showing growing faith in Europe’s recovery, rates traders doubt that higher borrowing costs will come imminently, underscoring the uncertainty in store for markets once central banks exit crisis mode

- British Prime Minister Boris Johnson said coronavirus lockdown rules are set to be scrapped in seven weeks’ time, as he hailed the U.K.’s successful vaccine rollout ahead of key elections this week

- A major investment deal reached in December between the European Union and China — after seven years of painful negotiations — may end up being the high-water mark for ties that are quickly deteriorating again

Quick look at global markets courtesy of Newsquawk.

Asian equity markets traded somewhat mixed following on from a mostly positive US session after sentiment was underpinned amid an easing of COVID restrictions in the Tri-state area and for Florida. The Nasdaq underperformed with tech pressured by losses in work-from-home stocks and US equity futures also marginally pulled back in overnight trade. ASX 200 (+0.6%) was positive with the index kept afloat as the commodity-related sectors benefitted from recent upside in the complex but with gains limited by weakness in tech and a lacklustre mood for the top-weighted financials, while the RBA announcement and soft Trade Data added to the tentativeness. KOSPI (+0.6%) swung between gains and losses as some inflation concerns re-emerged following firmer than expected CPI data which printed 2.3% vs exp. 2.2% and was the fastest pace of increase since 2017, as well as the first time above the 2% target in 2 years. Hang Seng (+0.7%) was mildly underpinned after the recent stronger than expected Hong Kong GDP data for Q1, but with relatively light newsflow and continued absence of participants in mainland China and Japan, keeping price action in the region tepid.

Top Asian News

- Citi’s Australia Unit Sale Draws Interest From Major Local Banks

- Hyflux Gets Six Final Offers With One Covering Retail Investors

- India Suspends Cricket League After Players Test Covid Positive

- Singapore Finance Sector to Add 6,500 Jobs This Year: MAS

- Foreign Investors Dominate Short Sellers After Korea Lifts Ban

Major bourses in Europe trade mixed (Euro Stoxx 50 Unch) after the optimism seen at the cash open waned as newsflow remains light and as participants look ahead to the US entrance for direction, as has been the case over recent sessions. US equity futures remain subdued with the NQ (-0.3%) narrowly lagging its peers, although the breadth of the price action is relatively narrow. Back to Europe, the FTSE 100 (+0.6%) is outperforming as it plays catch-up after yesterday’s bank holiday, whilst the DAX (-0.4%) resides on the other end of the spectrum – pressured by Infineon (-5.1%) as earnings overall underwhelmed with the global chip shortage also in mind. Sectors are also mixed with somewhat of a more pro-cyclical bias, as Basic Resources top the charts, closely followed by Oil & Gas. Travel & Leisure is bolstered by reports that France, Greece, and Spain are among nations that could be added to the UK’s safe “green list” by the end of June. Tui (+4%), easyJet (+3%), and IAG (+4%) are among the beneficiaries, with the latter also underpinned by an upgrade at JPM. Elsewhere, Mediaset (+2%) remains supported after reaching a deal with Vivendi (-0.2%) to settle their dispute – which would see a EUR 26.3mln outflow from Vivendi’s subsidiary Dailymotion. Earnings-related movers include Pandora (+5.6%), Telenor (+1.8%), AMS (-0.4%), Adecco (-4%) and Vonovia (-1.4%).

Top European News

- Lufthansa CEO Pitches $6.6 Billion Capital Increase to Investors

- U.K., India Seek to Double Trade by 2030 as Johnson, Modi Speak

- Berlusconi’s Mediaset, Vivendi Resolve Five-Year Pay- TV Spat (2)

- ECB’s Villeroy Says Don’t Fret About Europe’s Insolvency Risks

- Carbon Hits Record 50 Euros on Tighter Pollution Rules

In FX, the Buck has already stopped the rot and is turning tables back on all major counterparts with the DXY firmly back above 91.000 and marginally eclipsing Monday’s peak between 91.393-90.985 extremes. Next up, NY ISM and factory orders before more Fed speak via Daly who is a current voter and neutral, dove and non-voter Kashkari and hawk Kaplan who also resumes FOMC voting rights in 2023.

- NZD/AUD/CHF/EUR – The Kiwi is hovering just over 0.7150 after probing 0.7200 again briefly in the run up to NZ jobs data that is much more likely to provide independent direction or impetus than the latest bi-weekly GDT auction. Similarly, the Aussie has pulled back from overnight highs to sub-0.7750 levels, and more so on disappointing trade factors rather than the RBA’s policy meeting that ended with no change to dovish policy guidance even though the 2021 GDP forecast was upgraded appreciably. Elsewhere, the Franc has retreated through 0.9150 irrespective of a marked improvement in Swiss Q2 consumer sentiment and the Euro is back under the 100 DMA and trying to retain hold of the 1.2000 handle or at least stay close to decent option expiry interest at 1.2035 (1.1 BN).

- CAD/JPY/GBP – Also unwinding gains vs their US rival, with the Loonie straddling 1.2300 ahead of Canadian trade and building permits, while the Yen is back under 109.00 on another Japanese holiday (Greenery Day), albeit keeping afloat of 109.50 and a key Fib retracement that was breached fleetingly yesterday (109.64) and Pound has bounced from circa 1.3851 having temporarily fallen beneath the 50 DMA (1.3864). However, Cable appears to be getting further assistance from the Euro as Eur/Gbp eyes 0.8650 to the downside amidst reports that the EU may prepared to be more flexible about business checks in Northern Ireland.

- SCANDI/EM – Firmer oil prices have helped the Nok revisit 10.0000+ terrain vs the Eur, but the Sek is still under 10.1500 on the back of standard neutral to dovish remarks from Riksbank Governor Ingves and EM currencies are underperforming against the Usd with the Rub also undermined by a marked slowdown in Russia’s manufacturing PMI towards the 50.0 threshold and the Zar ruffled by Gold’s latest fade into Usd 1800/oz.

In commodities, a relatively directionless start to the European session for the crude complex before experiencing upside it what is seemingly a detachment from the broader sentiment and Dollar dynamics, with WTI front-month above the USD 64.50/bbl mark (vs low USD 64.39/bbl) and its Brent counterpart on north of of USD 67.50/bbl (vs low 67.37/bbl). There has been minimal development for oil with volumes also thin as Mainland Chinese and Japanese participants are away from their desks. Saudi Aramco released its earnings in the early hours but in line with its European counterparts, it has reaped in profits from the rise in oil prices whilst maintaining an optimistic outlook. Next up, the weekly Private Inventory data is the next scheduled catalyst for the complex. Elsewhere eyes remain on geopolitics but there is little new to report in terms of JCPOA talks thus far. Turning to metals, spot gold and silver are again uneventful as the precious metals once again await US presence for directionality in the absence of European news flow. LME copper prices are back on the rise and attempt to close in on the USD 10,000/t mark despite headwinds from the firmer Buck and the red metal’s largest buyer China away from markets. Aluminium prices meanwhile rose amid concerns that efforts by the Chinese government to reduce emissions would impact supply.

US Event Calendar

- 8:30am: March Trade Balance, est. -$74.3b, prior -$71.1b

- 10am: March Cap Goods Ship Nondef Ex Air, prior 1.3%; Orders Nondef Ex Air, est. 0.9%, prior 0.9%

- 10am: March Durable Goods Orders, est. 0.5%, prior 0.5%; – Less Transportation, est. 1.6%, prior 1.6%

- 10am: March Factory Orders, est. 1.2%, prior -0.8%; Factory Orders Ex Trans, est. 1.8%, prior -0.6%

DB’s Jim Reid concludes the overnight wrap

We were on holiday here in the U.K. yesterday and my bank holiday saw me visit Pret a Manger for the first time in 14 months after previously going there virtually every day for lunch. It then took a dramatic turn as gale force winds led to me seeing our new paddling pool fly by our window as we were having dinner last night. I had to go outside mid-meal and run after it. Fortunately I rescued it before it could be truly liberated.

With us being off yesterday it’s worth recapping our monthly performance review that we published early on Monday (link here). It was a decent month for risk but commodity prices exploded with agricultural prices in particular seeing an astonishing surge. The key industrial bellwether of copper topped the leaderboard with a +12.1% increase, which takes the metal to its highest level in a decade. Meanwhile oil prices maintained their existing YTD lead, with WTI (+7.5%) and Brent (+5.8%) both moving higher, to take their YTD gains to +31.0% and +29.8% respectively. Bloomberg’s agriculture spot index rose +13.4% over the last month, which is its biggest monthly gain since July 2012, and leaves the index up +72.3% year-on-year. Finally, corn (+31.1%) saw the biggest monthly increase since June 1988.

Although yesterday’s highlight was a slowdown in the US manufacturing ISM (60.7 vs 65.0 expected and down from a 37yr high of 64.7) the release contained plenty of supply disruptions and inflation nuggets. Prices paid (89.6 vs 85.6 last month) were at their highest level for nearly 13 years and have only been higher 18 times in the 73-year history. Meanwhile the accompanying presser said, “the Employment Index expanded for the fifth straight month, but panelists continue to note significant difficulties in attracting and retaining labor at their companies’ and suppliers’ facilities.”

The other notable quote that accompanied the ISM print points to a topic we have discussed a few times over the past few weeks: “The current electronics/semiconductor shortage is having tremendous impacts on lead times and pricing. Additionally, there appears to be a general inflation of prices across most, if not all, supply lines.” This dovetails with what many companies are reporting during this earnings season, and has caused more than a few to lower production guidance for 2021 even as consumer demand continues to rebound with the overall economy. In terms of future production, this month saw the highest readings ever recorded for order backlogs (68.2 vs. 67.5 last month) and the lowest on customer inventories (28.4 vs. 29.9 prior) which means factories could be playing catch-up for an extended period.

Global equities gained slightly yesterday as investors weighed the generally positive economic data against the persistent worries on inflation. By the close, the S&P 500 had risen +0.27% and the STOXX 600 was up a greater +0.58%, while the MSCI World index was up +0.34%, with all within 1% of their all-time highs. The S&P’s gains were driven by cyclical industries such as energy (+2.91%), transportation (+1.83%) and materials (+1.53%), while large-cap tech shares lagged as the NYFANG+ index fell -1.18% and the NASDAQ was dragged back -0.48%. It was a similar story in Europe where equities were led in part by the auto (+1.17%) sector, along with construction & materials (+0.88%) and industrial goods (+0.76%)

Even with inflation talk picking up, real yields fell back (-4.5bps) yesterday causing 10yr US Treasury yields to fall -2.8bps to 1.598%. 10yr yields fell nearly -5.0bps shortly after the ISM print, before moderating somewhat into the end of the day. Inflation expectations rose for the 6th session in the last 7 after falling back slightly on Friday, with the 10yr breakeven measure closing at 2.43% – once again its highest level since April 2013. European sovereign bonds similarly gained – though to a smaller degree – with yields on 10yr bunds down -0.3bps to -0.21% and French yields came in -0.8bps to 0.15%.

We also heard from Fed Chair Powell yesterday, who spoke publicly for the first time since non-voting Fed President Kaplan broached the topic of tapering on Friday, causing markets to react somewhat negatively. Powell said that the economic outlook “in the United States has clearly brightened,” but “it has been slower for those in lower paid jobs,” noting that nearly 20% of workers in the lowest earnings bracket are still unemployed after a year from last February. On the topic of rising housing prices, Powell cited a sharp increase in demand fueled by low mortgage rates and fiscal stimulus and expects that “it is going to be a tight housing market for some time now because demand is just very, very high.”

Overnight in Asia equities have posted a pretty mixed performance, with the Hang Seng (+0.27%) moving higher whilst the Kospi (-0.24%) has seen a similar move in the other direction. Nevertheless, a number of markets are closed for public holidays, including the Nikkei and the Shanghai Comp. Meanwhile in the US, futures are pointing to a lower move at the open, with those on the S&P 500 down -0.26%. The other main news came from the Reserve Bank of Australia, who kept their main policy settings on hold in line with expectations. Nevertheless, the statement pointed towards an important meeting in July, saying that at this meeting “the Board will also consider future bond purchases following the completion of the second $100 billion of purchases under the government bond purchase program in September.”

In terms of the pandemic, the US plans to start talks this week with the WTO to expand access to Covid-19 vaccines according to White House Chief of Staff Klain, who said “intellectual property rights is part of the problem, but really, manufacturing is the biggest problem.” The Biden Administration will also support Pfizer’s decision to start exporting US-made vaccines. India and South Africa are among the countries seeking a WTO waiver to ease IP protections for the current Covid-19 vaccines. Thankfully new cases in India slowed to the lowest in nearly a week (368k), but this could be a weekend effect and the numbers continued to put an incredible amount of strain on the nation’s health care system. On the topic of vaccines, Moderna announced plans to provide as many as 500 million doses of its shot to the Covax program targeted at lower-income nations, however the vast majority of these shots will only arrive next year.

Here in Europe, the European Commission’s new travel proposal will require approval from member states and could be adopted by the end of this month. The new rules would replace the current blanket ban for non-essential travel to the EU that has been the law of the land for just about a year. The commission is reportedly working on some form of a vaccine passport system. German Health Minister Spahn said yesterday that the government is planning to introduce legislation in the coming days that will exempt people fully vaccinated against Covid-19 from restrictions in the country. The US also continues on the path toward normalisation as cases there rose at the slowest rate (1.07%) since the pandemic began over the week ending this past Sunday, though that still amounts to over 344k cases.

To an abbreviated week ahead now and the biggest scheduled event will be Friday’s US jobs report for April, where our economists are expecting nonfarm payrolls to have grown by another +1.275m, which would follow the strong +916k reading in March. Fed Chair Powell has said that they “want to see a string of months” like the March report in order to reach the Fed’s goals, so all eyes will be on whether this report fits that definition. On the unemployment rate, our economists are expecting another decline to a post-pandemic low of 5.7%.

Here in the UK, the main event this week will be on Thursday when an array of local and regional elections will be taking place. This year there are an unusually large amount because last year’s set were delayed to 2021 because of the pandemic, meaning this is likely to be the biggest mid-term electoral test the parties face this side of the next general election. One of the main highlights will likely be the Scottish Parliament elections, where a majority for pro-independence parties would lead to fresh calls for another referendum on independence from the rest of the United Kingdom. For more details on these contests and the other votes that day, our UK economists have written a preview (link here).

Staying on the UK, the Bank of England will be making their latest monetary policy decision on Thursday as well, though our economists write in their preview (link here) that they don’t expect any change to their policy settings. In terms of when they might begin to taper their QE operations, they think it’s a close call between May and June, but ultimately the BoE will wait until June.

Earnings season is well developed now with a majority of the companies in the S&P 500 having reported. The releases will continue apace this week however, with over 100 companies in the S&P making announcements by the end of the week. Among the highlights in the S&P and more broadly are Pfizer, T-Mobile and Ferrari today. Then tomorrow we’ll hear from PayPal, Novo Nordisk, General Motors, Booking Holdings and Uber. Thursday sees reports from Moderna, Linde, Volkswagen, AB InBev, Rio Tinto, AIG, Societe Generale and UniCredit. Finally on Friday, Siemens, Adidas, Credit Agricole and BMW will all be releasing earnings.

Tyler Durden

Tue, 05/04/2021 – 07:52

via ZeroHedge News https://ift.tt/3eVCK2y Tyler Durden