Historic Reversal: For The First Time Ever Ether Options Trading Volume Surpasses Bitcoin’s

The world is gradually realizing that whereas bitcoin is a one-trick pony (one which may or may not be replaced by central bank digital currencies), it is ethereum that is the truly revolutionary architecture powering the new digital realm. We saw this on Monday when not only did ethereum soar as bitcoin prices stagnated, but that’s also when Crypto derivatives exchange Deribit experienced an unusual trend for the first time ever: its ether (ETH) options trading volume (which we previewed here last week) surpassed that of bitcoin’s (BTC’s).

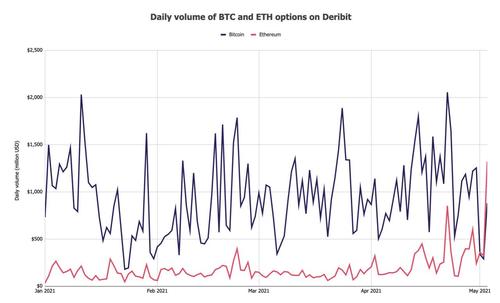

According to The Block Crypto, while total trading volume for bitcoin options was $879.5 million on Monday, ether’s was $1.32 billion, which is 50% more. Options are derivatives contracts that give their holders the right to buy or sell an underlying asset at a stated price within a specified period.

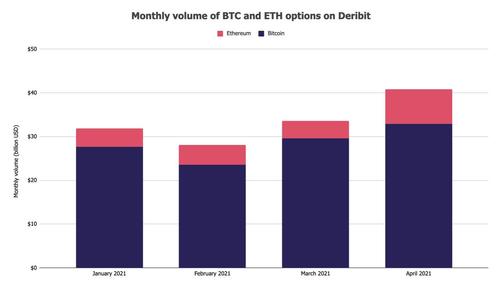

On a monthly basis, BTC options’ trading volume on Deribit remains four times higher than ETH’s, although the lead is shrinking fast. In April, the exchange saw around $33 billion in BTC options trading volume, while around $8 billion in ETH options. Deribit is the largest bitcoin options exchange, having a market share of over 85%, according to The Block’s Data Dashboard.

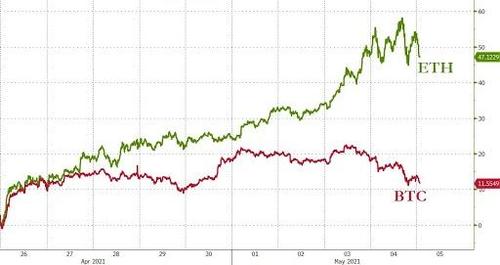

While Deribit said it has no opinion on the flip of the trade, the likely reason is that ETH has significantly outperformed BTC in price over the past several months. ETH’s price has gained over 1,400% over the past year, while bitcoin’s has gained about 550%.

This confirms what we wrote on April 25 in “Ethereum About To Make An Epic Breakout Over Bitcoin” – just 8 days later, Ethereum has outperformed Bitcoin by 35%…

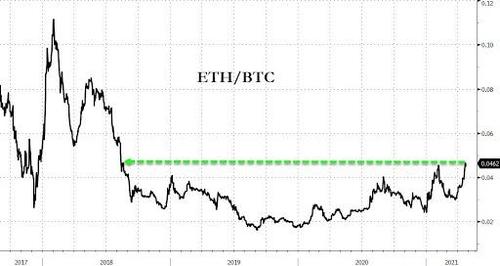

… and with attention increasingly shifting to ethereum, its outperformance is only just starting. As a reminder, as we showed on April 25, the outperformance of ETH over BTC is unlikely to stop until the previous ETH/BTC record of 0.1 is taken out.

Should ETHBTC hit its historical high, Ethereum would be well above $5,000, and if Tom Lee is correct, we may be looking at a $10,000+ print.

Tyler Durden

Tue, 05/04/2021 – 19:25

via ZeroHedge News https://ift.tt/3thKdOH Tyler Durden