“It Could Get Weird”: Stocks Puke As “Extreme” Negative Gamma Strikes

Just like late February when we had the first inflation scare-cum-Treasury tantrum, Tech is breaking down, and look no further than Amazon for the evidence.

In just the three days since reporting blowout Q1 earnings which sent its stock to a new all time high, AMZN stock is down over 9% and is on the verge of a correction. Other FAAMGs, most notably Apple which had a just as impressive quarter, are not faring any better.

However, unlike late February when tech was monkeyhammered mostly as a result of sharply surging yields, this time there is the double whammy of deeply negative gamma.

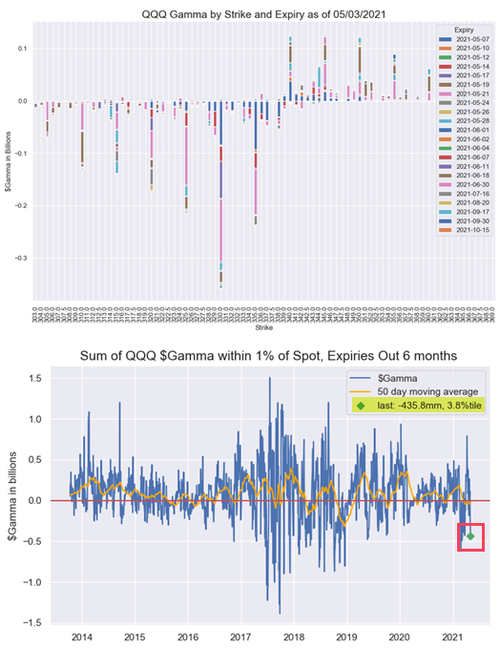

As SpotGamma wrote overnight, “both SPY & QQQ remain in negative gamma territory which implies higher relative volatility.”

Nomura’s resident x-asset expert, Chalie McElligott, picks on this and in a note this morning writes that while “there is nothing exceedingly bulky or “whale-like” by itself”, there has “been a pick-up with broad Vol / Gamma selling from clients in recent weeks.” The details:

- This has show via standard overwriter flows in singles and index, but also to the systematic strangle-selling mentioned in the press last week (which looks like the odd-lottish flows in ratios that trade ~3-4x’s a week, while there too is a separate daily overwriter program in one month straddles for example)…all of which has contributed to what has been a very “long gamma” dynamic for Dealers—and thus the “stuck” S&P for about three weeks, pinging around the gravity of the big strikes at 4150-4200

- The %ile rank of the overall $Gamma magnitude across US Equities index has come-off after recent expirations (SPX / SPY consolidated now a middling 56.6%ile $Gamma / IWM 35.9%ile; EEM 37.4%ile); however, Nasdaq / QQQ’s continue to be the epicenter for how broad index movement could get weird, with -$435.8mm $Gamma which is extremely negative at just 3.8%ile

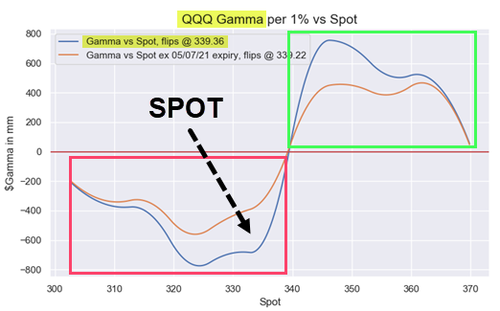

Needless to say, negative QQQ gamma + tech selloff = explosive combination, and as McElligott summarizes, “with this “extreme” negative $Gamma in QQQ, we see Dealers increasingly moving into “short Gamma vs spot” territory as well (Gamma “neutral line” at 339.36 vs spot 333.55); similarly, we currently see Dealers “short Gamma vs spot” too in both IWM (226.19 “neutral line” vs 224.79 spot) and EEM (54.29 “neutral line” vs spot 53.59)”

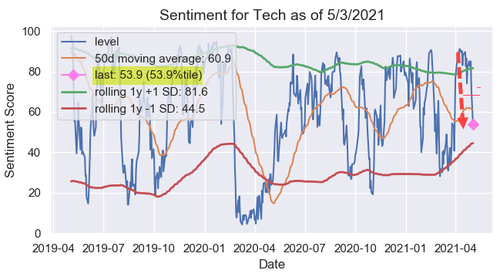

Tech’s inability to breakout higher has crippled sentiment, and as the Nomura quant concludes, following what had been a strong recovery in April for the Tech sector and “Secular Growth” (aided by the stabilization in USTs and relative “bull-flattening” off the extremes of the March Rates selloff / “bear-steepening”) “our Nomura Sector Sentiment analysis shows that WoW, we have seen Tech sector sentiment collapse (again)–with an 85.1%ile score a week ago, but today printing down at 53.9%”

And as the tech revulsion spreads, dragging Nasdaq lower…

… it is starting to hit broader indexesm such as the S&P and Russell…

… which just dipped below its 50dma.

Tyler Durden

Tue, 05/04/2021 – 09:59

via ZeroHedge News https://ift.tt/3gXQ6xV Tyler Durden