Lyft Soars After Beating Estimates; On Verge Of Cashflow Breakeven

With the world slowly emerging from the covid pandemic, ridesharing services are seeing an impressive return to normalcy as the just released results from Lyft showed.

After seeing its revenue crash as much as 61% in the first full post-covid quarter, moments ago Lyft reported that in Q1 2021, earnings were down 36% from a year ago (and up 7% from Q4), the smallest decline in a year, even if total revenues of $609MM (which beat exp of $557.3MM) were still some $350MM shy of the $955MM it made a year ago, thanks to 13.5 million active riders, above the estimated 12.7 million.

Some more Q1 earnings details:

- Adjusted net loss for Q1 2021 was $114.1 million versus an adjusted net loss of $97.4 million in the first quarter of 2020.

- Lyft reported Contribution for Q1 2021 of $337.3 million versus $547.4 million in the first quarter of 2020, down 38 percent year-over-year but up 7 percent from $316.0 million in Q4 2020. Contribution Margin for Q1 2021 was 55.4 percent, which was down by 1.9 percentage points year-over-year but down by just 10 basis points quarter-over-quarter. Contribution Margin for Q1 2021 exceeded the Company’s outlook of 51 to 51.5 percent1.

- Lyft reported $2.2 billion of unrestricted cash, cash equivalents and short-term investments at the end of the first quarter of 2021, roughly unchanged on the quarter.

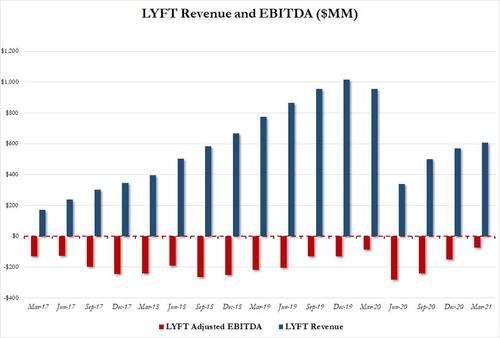

But what was most impressive, was the remarkable improvement in EBITDA, which shrank to just a loss of $73MM, nearly half the expected loss of $143.5MM, and on pace to turn cash flow positive despite still generating well below pre-covid revenues.

The company’s revenue and EBITDA over time:

“The improvements we’ve made over the last year are paying off – we’ve built a much stronger business. As the recovery continues, we are confident that we will be able to deliver strong financial results” said Logan Green, co-founder and chief executive officer of Lyft.

“We had an exceptionally strong Q1 as more people started moving again. Our results meaningfully exceeded our outlook driven by elevated demand across our network,” said Brian Roberts, chief financial officer of Lyft.

“With the pending sale of our Level 5 self-driving division, Lyft is set up to win the transition to autonomous through our hybrid network of human drivers and AVs, advanced marketplace tech, and leading fleet management capabilities,” said John Zimmer, co-founder and president of Lyft.

Remarkably, unlike most of its covid vaccine beneficiary peers who have seen their stock tumble despite beating, LYFT shares jumped after hours, rising as high as $59 after closing at $56 in the regular session…

… although the company’s announcement that it plans to increase driver incentives in the coming months – i.e., hike net pay, could end up hitting the stock once the news is digested.

Tyler Durden

Tue, 05/04/2021 – 16:34

via ZeroHedge News https://ift.tt/3eiwxi2 Tyler Durden