Biden Plan To Recover $700 Billion Through IRS Audits Is Unrealistic: Former Officials

The Biden administration’s plan to count on $700 billion over the next decade from enhanced IRS audits of the wealthy and corporations – a major source of funding for his economic agenda – is wishful thinking, and will probably take years to bear fruit at all, according to Bloomberg.

The analysis comes after the administration announced a plan to boost IRS funding by more than 10%, or $80 billion over the next decade to vastly increase the agency’s auditing staff and replace outdated technology. Biden made the promise of recovered tax-dollars a central source of funding for his $1.8 trillion American Families Plan released last week.

Yet, according to some former IRS officials, it will take ‘several years’ to begin bearing fruit – particularly once one accounts for the time required to hire and train new employees to conduct audits of ‘highly complex’ tax returns. What’s more, such high-dollar audits are far more likely to be met with appeals and litigation which could tie up payments for years. According to the report, previous attempts to recoup unpaid taxes have returned just a tiny fraction of what the administration thinks is possible.

A Biden admin insider, however, says they’ve accounted for that:

A person familiar with the administration’s plans said the $700 billion projection does reflect that the IRS will need several years to ramp up and that the highest revenue-raising years will be toward the end of the 10-year timeframe. The administration predicts some of the biggest gains will come in the following decade, raising as much as $1.7 trillion to $1.8 trillion during that period, the person said.

“It will take some considerable period of time, even if IRS gets that funding, to actually show material results or returns on that investment,” said former IRS Chief Counsel Michael Desmond, who left the agency at the beginning of this year to join Gibson, Dunn & Crutcher LLP.

The anonymous Biden insider, however, argues to Bloomberg that the figures are actually conservative because they don’t factor in technological advancements in IT and the overall deterrence effect of increased enforcement. The insider is joined by former IRS Commissioner Charles Rossotti, who called the $700 billion goal ‘conservative’ – and that a more realistic figure was $1.4 trillion given that the Biden proposal includes expanding reporting by third parties, plus enhancements in IRS technology.

Another skeptic, however – Nina Olson, the former head of the IRS’s Taxpayer Advocate Service – says the $700 billion projection is unrealistic, noting that the agency’s offshore voluntary disclosure program which ran from 2009 to 2018 raised just $11.1 billion at the height of a US crackdown on Swiss bank accounts. The program allowed taxpayers with undisclosed offshore assets to come clean and pay taxes and penalties with no risk of criminal prosecution.

And a report by the University of Pennsylvania projects that the Biden plan will raise just $480 billion of the $700 billion figure over a decade.

Treasury Secretary Janet Yellen waxed eloquent about re-funding the ‘benevolent’ IRS in a Thursday series of tweets:

The IRS went through a great transformation, adapting during the pandemic. An agency that mainly manages the nation’s tax filings and returns once a year, IRS has marshaled its resources to send nearly $800 billion to Americans & implement several rounds of relief programs.

— Secretary Janet Yellen (@SecYellen) May 6, 2021

We know that over the next decade the amount of unpaid taxes is expected to be at least $7 trillion unless we take steps to reverse the trend. A substantial chunk of this tax gap comes from the highest earners.

Our goal is to correct this imbalance.— Secretary Janet Yellen (@SecYellen) May 6, 2021

Over the past year @IRSnews & @FiscalService have shown through tireless effort that they are among the effective, hardworking agencies in gov’t.

I am truly proud to be their @USTreasury colleague & glad to be working together to build a better, stronger economy for generations.

— Secretary Janet Yellen (@SecYellen) May 6, 2021

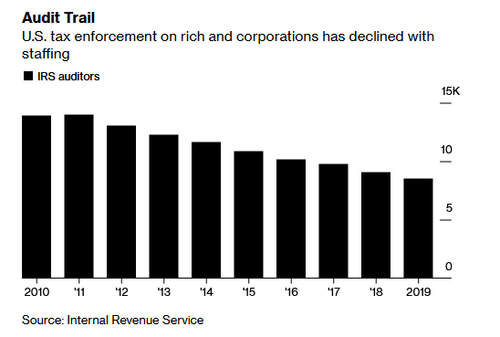

The IRS’ budget has dropped by about 20% over the last decade after accounting for inflation, according to the Treasury Department. This has resulted in approximately 17,000 fewer enforcement agents since 2010, while the agency’s auditors who focus on high-end evasion and large corporate cases has fallen by 35% according to the department.

Intense training will be required for new auditors – who must gain the necessary experience over the course of several years in order to handle complex returns, according to an IRS spokesman.

To immediately start increasing high-end audits, the IRS could move already-skilled auditors working on smaller cases to those more difficult returns, said John Dalrymple, a former deputy IRS commissioner for services and enforcement. But it’s important not to just focus attention on one specific area, because compliance in other places could slip, he said.

To recruit skilled talent the IRS will have to compete with the private sector. Faster recruitment and offering salaries above the normal pay scale for federal employees would help but would require Congress’s approval, said Olson, now executive director of the Center for Taxpayer Rights. The IRS already has this ability for IT positions.

The individuals and corporations the Biden administration is targeting are those with the resources to prolong the enforcement process. They’re also among the most complex returns. -Bloomberg

Meanwhile, epic court battles are likely to ensue. Bloomberg notes the case of Facebook, which is in a legal struggle with the IRS over a tax bill dating back to 2010 which could amount to more than $9 billion if the social media giant loses.

Typically, the IRS has three years from the date a tax return is due or filed to audit it and charge additional tax, penalties and interest – however this can be expanded to six years if the dollar amount involved is large. There is no time limit if a taxpayer never filed a return or committed fraud.

For extremely complex audits, which typically involve several tax years at once, the IRS and taxpayers will often agree to more time than usual – which can drag the process out for several years, according to former officials. Following the conclusion of an audit, the taxpayer can then challenge the IRS’s position through an internal appeals process.

“Litigation can go another five-plus years beyond that easily,” according to Desmond.

We can’t help but wonder if the Biden-Harris administration will engage in using the IRS to target political enemies like the Obama-Biden administration did.

Tyler Durden

Thu, 05/06/2021 – 13:00

via ZeroHedge News https://ift.tt/2RAd8AA Tyler Durden