Here Comes The Hwangover: Prime Brokers Begin Slashing Hedge Funds’ Leverage After Archegos Debacle

Given that rates have stopped soaring and earnings have been red-hot, many have questioned why growthy stocks have dramatically underperformed recently.

Source: Bloomberg

We may have found the answer… and it’s a major problem for those hoping to buy-the-dip.

As momentum charged higher last year, riding a sea of liquidity, every stock market ‘guru’ bought the junkiest junk…

Source: Bloomberg

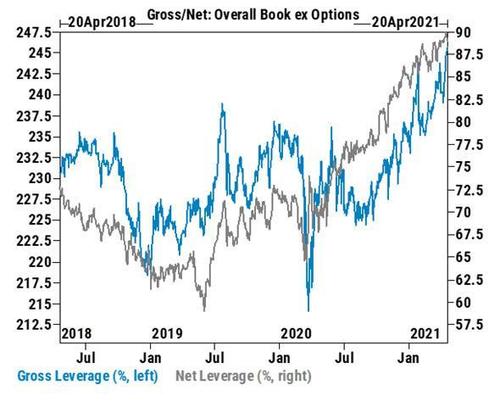

In fact, hedge fund leverage – both gross and net – hit record highs in late April, according to Goldman’s Prime Brokerage.

And that’s a problem going forward, because, as Bloomberg reports, across the entire street, amid fallout from the Archegos debacle, Prime Brokers are slashing available leverage for their hedge fund clients.

…managers of small hedge funds who lack the negotiating clout of trading whales are grousing. For the little guy especially, the saga will make it harder to borrow money from banks to finance bets.

While specific measures will vary by bank and client – and in many cases are still being ironed out – the talks and tensions point to greater pressure on clients to reveal their biggest wagers, stricter margin limits on those positions, more frequent collateral adjustments and more rigorous audits. The deliberations were described by executives close to prime brokerage desks and money managers.

At its most extreme, Credit Suisse, which was the hardest hit among Archegos’ primes, drastically adjusted risk tolerances and practices, slashing lending to hedge funds by a third.

“There will be more calories expended, both in terms of those desks doing due diligence in the market as well as in some cases they may outright ask clients about that,” Mike Edwards, deputy chief investment officer at Weiss Multi-Strategy Advisers, a $3 billion hedge fund.

Previously, it was “not a requirement at most places that you would disclose to a swap counterparty that you have the same position on at multiple places.”

While smaller money managers have always generally faced more-onerous terms on trades, Bloomberg warns that the Archegos blowup is going to make that situation all the worse, two veteran managers atop smaller firms said. Deeper due diligence costs prime brokerages time and money.

Fewer mid-sized prime brokerages will offer as much margin or the breaks on trading terms that were available just months ago. The money managers worry that they face a more take-it-or-leave-it environment than interest in doing business.

And the riskiest, most-levered members of the stock market (and the small/medium sized hedge funds who trade around this junk) will feel the pain the most as deleveraging forces unwinds and kill any momentum that remained.

As Larry McDonald warned in his latest Bear Traps Report, Archegos may be the catalyst that triggers a deleveraging cycle.

Bull markets never, EVER die of valuation old age, its the leverage blow-up which triggers the deleveraging and takes the madness out of the crowd. Just look at the ARK ETFs, the marginal – over the top buyer is taking the sword as we speak.

Every hedge fund compliance officer across the Street is now in search of the next Archegos, and they have as much trust in their prime broker as the lovely Maryilyn Monroe had in the playboy that was JFK.

Marshall Wace co-founder Paul Marshall raged over how Archegos caught prime brokers by surprise using opaque swaps.

“The prime brokers have paid the price for extending so much risk,” he wrote last month, chiding them for not asking enough questions. “PBs will improve.”

Tyler Durden

Thu, 05/06/2021 – 14:21

via ZeroHedge News https://ift.tt/3eoiVSA Tyler Durden