Just As Inflation Explodes, It Has Never Been Easier To Get A Credit Card

In typical procyclical fashion, after a year of clamping down on new credit card, mortgage and commercial loan issuance in the aftermath of the covid pandemic, US commercial banks have released the spigots to full blast, and almost a year after we wrote that “It’s Now Virtually Impossible To Get A Bank Loan As Lending Standards Soar“, we can now saw that it is virtually impossible not to get a loan or a mortgage.

According to the Fed’s latest April senior loan officer survey released earlier this week, banks took a machete to their lending standards across the board for C&I, mortgage, credit card and auto loans (with the exception of CRE loans for construction and land development purposes). At the same time, and coinciding with the latest burst in inflation, loan demand strengthened for almost all categories according to the April survey, including small C&I, CRE, mortgage, credit card and auto loans, while large/medium C&I loan demand weakened a touch as banks cited lower M&A financing needs and borrowers having shifted to other bank or non-bank sources as the key reasons.

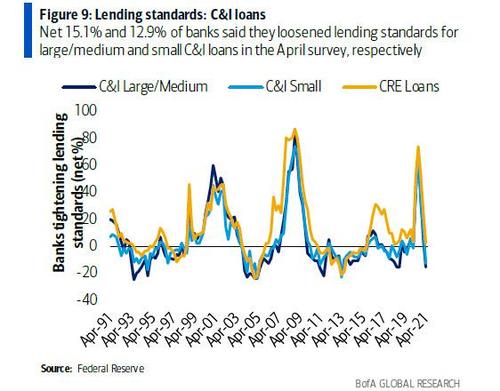

Here are the details, starting with C&I and CRE loans:

Net 15.1% and 12.9% of banks said they loosened lending standards for large/medium and small C&I loans in the April survey, respectively, after net 5.5% and 11.4% of banks reported tightening lending standards in the prior January survey. As a result, lending standards for C&I loans are now the easiest they have been in years. Meanwhile, the share reporting tighter standards for CRE loans declined to 2.5% in April from 25.4% in January (the CRE value reported is the average for the three separate questions on loans for construction and land development (tighter standards), loans secured by nonfarm nonresidential structures (unchanged standards), and loans secured by multifamily residential structures (looser standards).

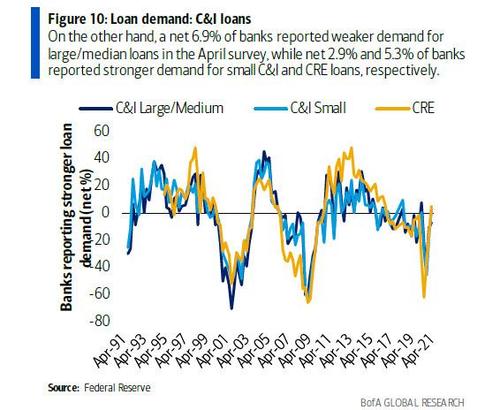

On the other hand, a net 6.9% of banks reported weaker demand for large/median C&I loans in the April survey, while net 2.9% and 5.3% of banks reported stronger demand for small C&I and CRE loans, respectively. This follows net 11.1%, 17.6% and 14.2% of banks reporting weaker demand for large/median C&I, small C&I and CRE loans in the prior January survey, respectively (Figure 9).

Mortgages

With the US housing market a bubbly, frothy mess the likes of which have not been seen since the 2006 housing bubble, banks did their part to make it even frothier, and a net 6.3% and 19.0% of banks reported looser lending standards for GSE-eligible and QM-jumbo mortgages in April, respectively, up from net 3.2% and 1.7% in the prior January survey. As shown in the chart below, this is on par with the loosest resi mortgage credit standards since before the financial crisis! Not surprisingly as Americans scrambled to lever up and buy a house (or 2nd, or 3rd) the net share of banks reporting stronger demand increased to 12.7% and 19.7% in April from 6.5% and 6.6% in January, respectively.

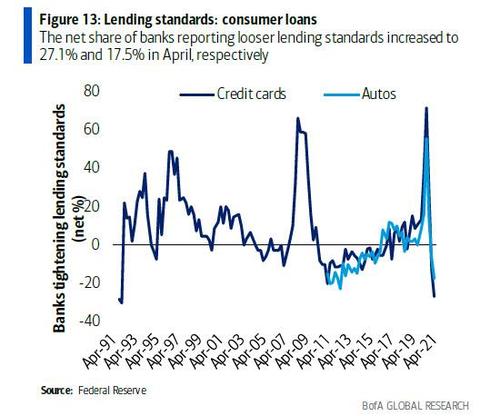

Consumer Loans

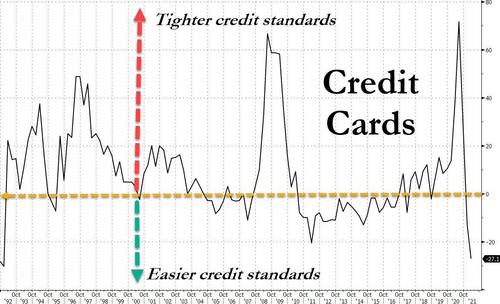

The credit spigots were also pushed to 11 in consumer loans, where the net share of banks reporting looser lending standards increased to 27.1% and 17.5% in April from 12.8% and 7.0% in January for credit card and auto loans, respectively. As shown below, credit card standards have not been this loose since around the time records began in 1991, while auto loans are similarly among the loosest on record. This means that anyone that can fog a mirror is now eligible for a credit card!

And here is a chart looking at just the record loose print in credit card standards:

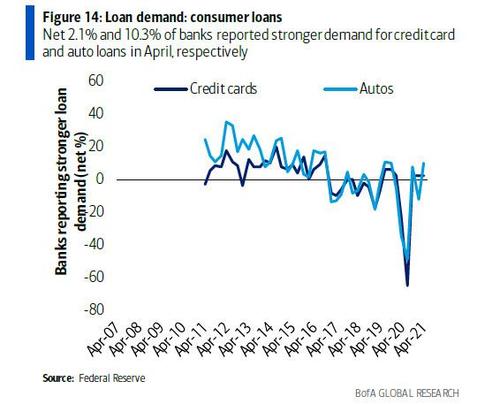

And with the economy overheating and prices soaring, it will also hardly be a surprise that a net 2.1% and 10.3% of banks reported stronger demand for credit card and auto loans in April, respectively, following net 2.2% of banks reporting stronger credit card demand and net 12.3% reporting weaker auto loan demand in January.

Finally, the April survey asked special questions on changes in lending standards compared with pre-pandemic levels. For C&I loans, large banks reported tightening lending policies for most firms, except to large IG firms for which they eased credit policies on net, thereby ensuring that the big can get even bigger and take over the market share of all those millions of small and medium home businesses that failed in the past 12 months.

But what we find most remarkable is that after a year of often draconian lending standards when most Americans desperately needed access to cash during the post-covid crash period, it is only now that virtually anyone who applies for a credit card, car or commercial loan, or a mortgage, will get one. This is problematic because with prices soaring, Americans will now have the liberty of charging purchases for goods and services at any price point, making sharply higher prices “sticky”, and allowing companies to believe they can get away with charging much higher prices indefinitely, when in reality the hangover will come as soon as the first few sets of credit card bills are mailed.

By then, however, lumber will cost more than gold and inflation – real inflation not the grotesque CPI or PCE measure – will be in the double digits. In other words, after a burst of credit-card fueled spending during the summer and fall, when Biden’s trillions in stimulus will also still percolate within the economy, we now expect the US consumer to hit a brick wall some time in the late fall or winter at which point the US economy will go right into free fall unless yet another “crisis” emerges allowing the Biden administration to extend the Universal Basic Income experiment for another 3-6 months until it eventually becomes permament.

Tyler Durden

Thu, 05/06/2021 – 14:04

via ZeroHedge News https://ift.tt/3b9E4Oj Tyler Durden