China Trade Soars In April As Global Economies Reopen

Another month, another blowout trade report from China.

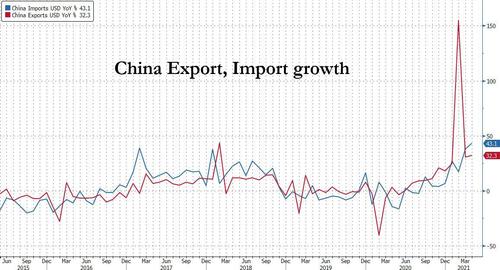

China’s April exports rose 32.3% yoy in dollar terms, well above market expectations of 24.1%, suggesting its trade out-performance could last longer than expected this year, fueled by global fiscal stimulus. This implies a sharp sequential rebound of 9.4% in April vs. -6.6% in March. At the same time, imports soared 43.1% yoy on strong domestic demand and soaring commodity prices, in line with consensus expectations of 44.0%, and the sequential growth moderated to +2.1% sa non-annualized in April (vs. +3.7% in March). The surge in exports led to a bigger-than-expected trade surplus of $42.85 billion, above the $27.7 billion consensus.

Here are the key numbers (USD-denominated):

- Exports: 32.3% yoy in April (Bloomberg consensus: +24.1%). March: +30.6% yoy. Sequential growth (seasonally adjusted by GS): +9.4% non-annualized in April vs. -6.6% in March.

- Imports: 43.1% yoy in April (Bloomberg consensus: +44.0%). March: +38.1% yoy. Sequential growth (seasonally adjusted by GS): +2.1% non-annualized in April vs. +3.7% in March.

- Trade balance: US$+42.9bn NSA (Bloomberg consensus: US$+27.7bn) in April. March average: US$+13.8bn.

- RMB-denominated:

- Exports: +22.2% yoy in April vs. +20.7% yoy in March.

- Imports: +32.2% yoy in April vs. +27.7% yoy in March.

“The export figure clearly reflects a recovering and expanding global economy,” said Hao Zhou, an economist at Commerzbank AG in Singapore. “Robust imports and exports also mean that China’s manufacturing industry is still outperforming the services sector to lead the economic rebound.”

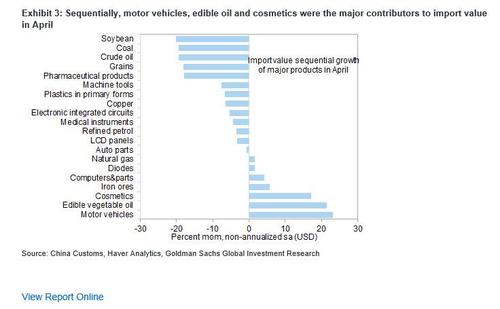

Higher oil and metal prices continued to support commodity imports in value terms. Crude oil imports accelerated to 73.2% yoy mainly on a low base, and iron ore imports rose 89.6% in April. Import growth of integrated circuits remained strong and rose 22.6% yoy in April (vs. +23.3% yoy in March). In volume terms, crude oil imports fell 0.2% yoy, vs. +20.8% yoy in March. Iron ore imports rose 3.0% yoy, decelerating from +18.9% yoy in March.

“Imports were lifted mainly by higher commodity prices, but also due to a recovery in domestic demand. These factors that supported China trade look set to continue in the near term.” said Bloomberg’s David Qu.

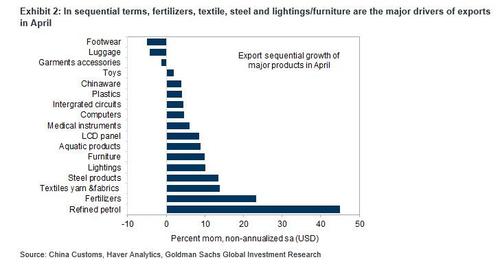

Exports grew more than expected in April, supported by solid demand for housing related products and sequential increases in COVID-19 related personal protection supplies due to resurgence in infections in major trade partners in April. Higher commodity prices continued to support commodity import value, although import volume growth slowed.

The base effect also came into play. According to an analysis by Bloomberg Economics the low base from a year ago also helped to underpin the strong results, but even on a two-year average growth basis which strips out those effects, April’s export growth was 16.8%, much stronger than pre-pandemic levels.

China’s soaring trade reflected rising global appetite for Chinese goods thanks to stimulus packages introduced by developed economies that’s helped to fuel demand for household goods, furniture and electronic devices. As Bloomberg notes, with vaccine rollouts accelerating and more economies opening up, China’s export growth was widely expected to moderate this year as consumers start to spend more on services. But April’s data shows that hasn’t happened yet.

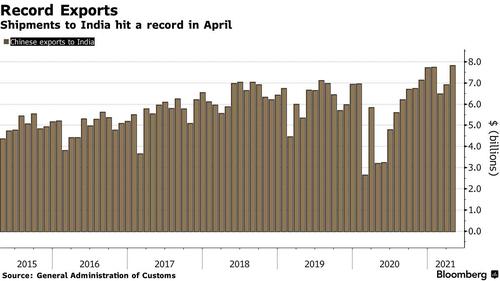

By major export destination, exports to major DMs slowed. Exports to the US moderated to 31.2% yoy in April (vs. 53.3% yoy in March) and growth of exports to EU slowed to 23.8% yoy from 45.9% yoy in March. Exports to Japan only rose 0.4% yoy (vs. +7.6% yoy in March). In contrast, exports to major EMs accelerated. Exports to India rose significantly by 143.8% yoy in April likely on a surge in COVID-19 related medical supplies. Exports to ASEAN also accelerated meaningfully to 42.2% yoy (vs. 14.4% in March). Export growth to Korea accelerated to 23.1% yoy in April (vs. 20.9% in March).

The U.S. was the biggest export market last month, accounting for 15.9% of Chinese goods sold abroad. Southeast Asian nations bought 15.6% of exports while the European Union purchased 15.1%. Meanwhile, exports to India surged 144% in April from a year earlier with the monthly value hitting a record $7.8 billion.

“We expect China’s export growth will stay strong into the second half of this year,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd, citing strong growth in U.S. demand and continued coronavirus outbreaks in developing countries such as India causing production to shift to China. Those trends are likely to support China’s currency, he added.

Liu Peiqian, an economist at Natwest Group Plc, cited increased global demand for microchips, where Chinese companies are a key part of the supply chain, as another reason why “exports outperformance will likely remain a key theme” in China’s recovery. In volume terms, imports of industrial metals and energy products softened slightly in April, she added, suggesting that the domestic demand recovery could still be relatively weak.

At the Communist Party’s Politburo meeting last week, China’s top leaders pledged to accelerate the recovery in domestic demand and reiterated there would be “no sharp turn” on economic policy. But the government is focused on raising consumer spending on goods and services, while taking a cautious stance on property and infrastructure investment, which tends to be more import-intensive.

A strengthening recovery in Chinese consumer spending was indicated by the April services purchasing managers’ index compiled by Caixin Media and IHS Markit, which rose to 56.3 from 54.3 the previous month, well above the 50 reading that marks an expansion from the previous month. However, data from a recent five-day public holiday in China showed spending below pre-pandemic levels, suggesting China will remain dependent on overseas demand for much of its growth this year.

Tyler Durden

Fri, 05/07/2021 – 08:24

via ZeroHedge News https://ift.tt/3uuQIPs Tyler Durden