Consumer Credit Explodes Higher As Americans Rediscover Their Love For Credit Cards

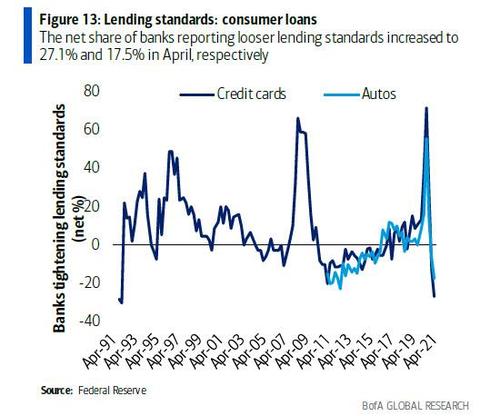

Just yesterday, we showed that only a few quarters after banks effectively shut down, refusing to give out C&I, credit card or auto loans and mortgages to virtually anyone as a result of record Draconian credit standards, credit standards saw a complete U-turn and as of April, lending standards for credit cards and autos were the loosest on record.

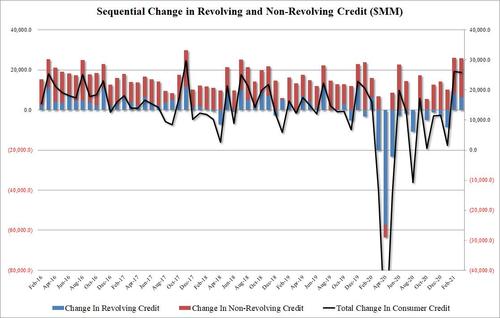

This was not lost on US consumers who after suffering through a miserable 12 months in which they dutifully repaid their credit card debt like total idiots who acted responsibly (instead of doing what US corporations are doing and loading up on even more debt to ensure they all get bailed out during the next crisis), in March aggregate consumer credit surged by $25.8BN, smashing expectations for the 2nd month in a row (as a reminder February was the biggest beat on record) and barely slowing down from last month’s massive $26.1BN increase.

And while non-revolving credit – i.e., student and auto loans – continued its relentless ramp higher, increasing by $19.4BN in March, the most since June of 2020…

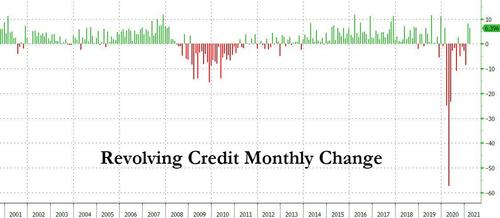

… it was the second consecutive surge in credit card debt in March that made all the difference because after 10 of 11 months of paydowns, revolving (i.e. credit card) debt surged by $8BN in February followed by $6.4BN in March. The combined two month total was the highest since October 2018!

This latest shift in spending patterns, means that things are now indeed back to normal, and that with consumers now spending not just using their debit cards (which is where the stimmy checks arrive) but their credit cards, Americans are once again highly confident about the future, and are spending far beyond their means, as they always tend to do.

Tyler Durden

Fri, 05/07/2021 – 15:34

via ZeroHedge News https://ift.tt/3bcQuoD Tyler Durden