Nasdaq Explodes Higher, Gold Gains, Dollar & Bond Yields Crash After Dismal Jobs Data

Well that escalated quickly. The dismally disappointing payrolls data has sparked chaos across capital markets as investors consider ‘tapering the taper’ talk.

The equity market is very mixed as the rotation back to ‘growth’ explodes with Nasdaq soaring and Small Caps plunging…

Treasury yields have crashed to two-month lows…

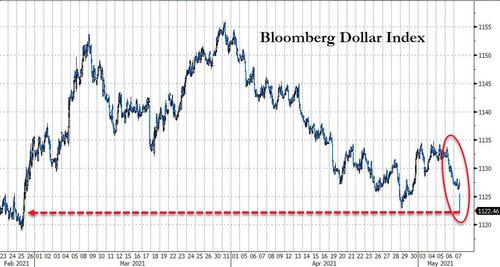

The dollar is puking back to its weakest since February…

Which is sending gold higher, back above $1840 at two-month highs…

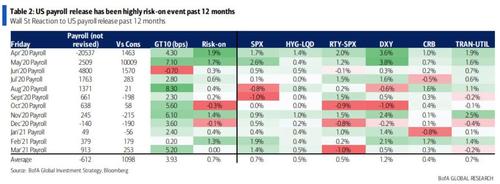

But as a reminder, BofA notes that US payrolls release has been a highly risk-on even over the last 12 months…

Get back to work Mr.Powell.

Tyler Durden

Fri, 05/07/2021 – 08:43

via ZeroHedge News https://ift.tt/3f30KRC Tyler Durden