Hedge Funds Are The ‘Most Short’ Junk Debt Since Lehman

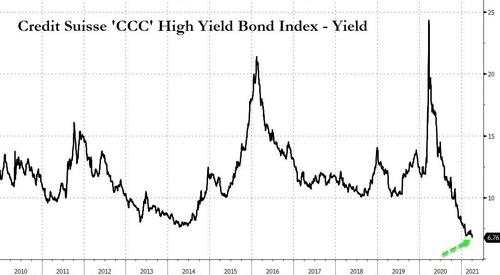

A month ago we warned that The Fed’s incessant intervention had put distressed investors out of business as the remarkable rally in even the lowest quality junk debt (‘CCC or triple hooks’) had created party time for zombie companies everywhere as “high yield” is now officially “low yield.”

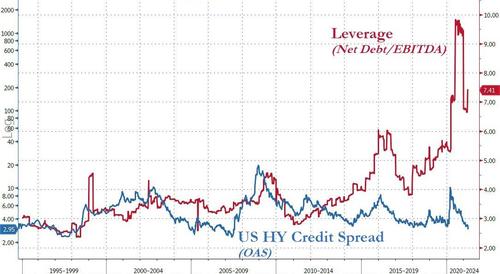

And, while the party can and will go on as long as there are greater fools, one look at the fundamentals…

… confirms that the party will only last as long as central banks keep injecting hundreds of billions into the market each and every month.

“People aren’t investing, they’re just chasing.”

That is the ominous, ponzi-like warning from Adam Cohen, Caspian Capital’s managing partner as the distressed debt investor has chosen to return some money to investors because the rewards don’t justify the high risks anymore.

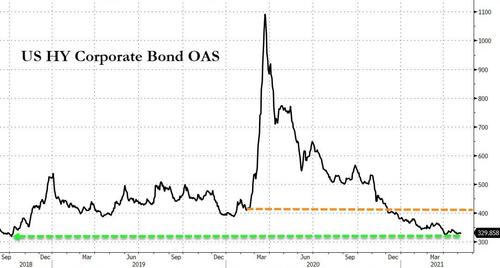

He’s right. Despite soaring debt levels and forward economic uncertainty, US HY debt risk spreads are 100bps tighter than pre-COVID levels…

And all that has sparked a resurgence in hedge funds betting against this farce continuing.

In fact, as Bloomberg reports, global high-yield bonds worth as much as $55 billion are on loan to traders seeking to profit if prices drop, according to data from IHS Markit.

That is the largest balance since the fall of 2008, and compares with about $35 billion at the start of the year.

“I would expect that to get bigger as spreads tighten and/or people get worried about rates rising,” said Tim Winstone, a portfolio manager at Janus Henderson, which oversees 294 billion pounds ($409 billion).

“At these levels of valuations, I’m not surprised more people, such as hedge funds, are setting shorts.”

And we are starting to see the impact of this drop in bullish/momo-chasing malarkey in the performance of deals in the secondary market. Almost one out of four high-yield bonds sold this year is indicated below the price it was issued at, based on data compiled by Bloomberg.

With The ECB already hinting at scaling back its asset-purchases, and BoE having already done so, The Fed continues to ignore talk of its own tapering, but between HY shorts, and deleveraging, investors are starting to signal the build-up of defenses against a potential scaling back of central-bank support.

Tyler Durden

Sat, 05/08/2021 – 17:39

via ZeroHedge News https://ift.tt/3ttP9Ag Tyler Durden