Gasoline Futures Soar After Colonial Gives No Timetable For Hacked Pipeline Restart

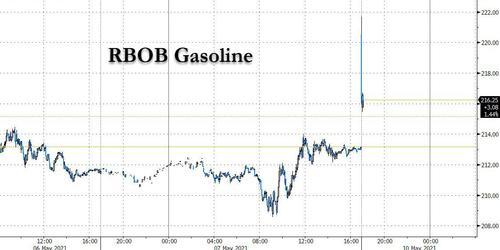

Just in case the US didn’t already have a “transitory hyperinflation” problem, gasoline futures soared more than 4% – and are likely to jump much more – late on Sunday after the Colonial Pipeline announced that while some smaller lateral lines between terminals and delivery points are now operational, its mainlines (Lines 1, 2, 3 and 4) remain offline since late Friday after the company suffered a crippling cyberattack that affected its key IT systems.

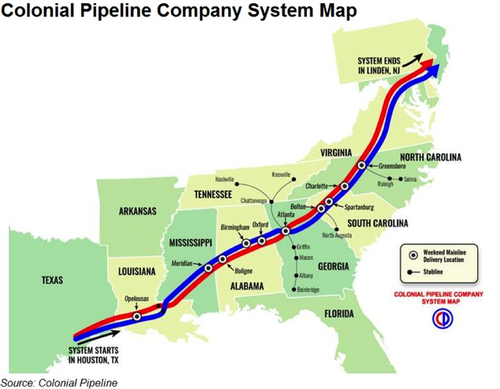

Colonial operates Line 1 for gasoline and Line 2 for diesel and jet fuel from Pasadena, Texas, some 15 miles from the nation’s largest refineries, to Greensboro, North Carolina, at a combined 2.5 million barrels a day. They merge at Greensboro to feed a line carrying about 900,000 barrels a day into New York Harbor, and other East Coast pipelines.

Colonial said that it is “in the process of restoring service to other laterals and will bring our full system back online only when we believe it is safe to do so, and in full compliance with the approval of all federal regulations.” Full statement below:

Update — Sunday, May 9, 5:10 p.m.

On May 7, Colonial Pipeline Company learned it was the victim of a cybersecurity attack and has since determined that the incident involved ransomware. Quickly after learning of the attack, Colonial proactively took certain systems offline to contain the threat. These actions temporarily halted all pipeline operations and affected some of our IT systems, which we are actively in the process of restoring.

Leading, third-party cybersecurity experts were also immediately engaged after discovering the issue and launched an investigation into the nature and scope of this incident. We have remained in contact with law enforcement and other federal agencies, including the Department of Energy who is leading the Federal Government response.

Maintaining the operational security of our pipeline, in addition to safely bringing our systems back online, remain our highest priorities. Over the past 48 hours, Colonial Pipeline personnel have taken additional precautionary measures to help further monitor and protect the safety and security of its pipeline.

The Colonial Pipeline operations team is developing a system restart plan. While our mainlines (Lines 1, 2, 3 and 4) remain offline, some smaller lateral lines between terminals and delivery points are now operational. We are in the process of restoring service to other laterals and will bring our full system back online only when we believe it is safe to do so, and in full compliance with the approval of all federal regulations.

At this time, our primary focus continues to be the safe and efficient restoration of service to our pipeline system, while minimizing disruption to our customers and all those who rely on Colonial Pipeline. We appreciate the patience and outpouring of support we have received from others throughout the industry.

Meanwhile, downstream customers, which includes pretty much the entire Eastern seaboard, are starting to freak out as they face a new week without the primary source of gasoline supply for hundreds of millions of customers.

In response to the news, gasoline futures jumped 4% to $2.21 a gallon, approaching the highest since 2014. WTI and Brent both spiked more than 1%, while other products such as diesel and jet fuel are also likely to jump.

Should Colonial be unable to bring its main pipeline back online, which as a reminder were hacked by a ransomware group called DarkSide, according to Allan Liska, senior threat analyst at cybersecurity firm Recorded Future, there is no telling how high gasoline prices will soar as Colonial supplies nearly half the east coast gasoline.

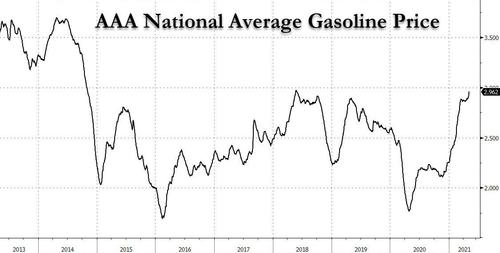

On Friday, the national average stood at $2.96 a gallon Friday, according to auto club AAA, and with national gasoline inventories ample, the pump price wasn’t expected to tick much higher until Memorial Day at the end of May, which is traditionally viewed as the start of the U.S. summer driving season. However, it now appears that we can add gas to the list of items that have seen prices soar. Gasoline last bested the $3 average in October 2014.

Price increases in road fuel may stoke even more worries about inflation as commodities from oil to lumber to corn skyrocket with the world’s major economies emerging from pandemic restrictions. The oil industry was gearing up to meet what is expected to be a surge in fuel demand as newly vaccinated Americans take to the roadways and skies this summer. The downed Colonial Pipeline is a key artery for gasoline, diesel and jet fuel produced by oil refiners on the U.S. Gulf Coast and major metropolitan areas between Atlanta and New York.

“It all comes down to the duration of the disruption. If it lasts longer, it’s likely to result in some location dislocations — shortage of oil products in the East Coast, abundance in the Gulf region. That will support New York product prices and might attract more oil products from abroad,” said Giovanni Staunovo, commodity analyst at UBS Group AG.

According to Bloomberg, traders are already seeking vessels to deliver gasoline that would have otherwise been shipped on the Colonial system. Some tankers are being secured to temporarily store gasoline in the U.S. Gulf in the event of a prolonged shutdown, they said.

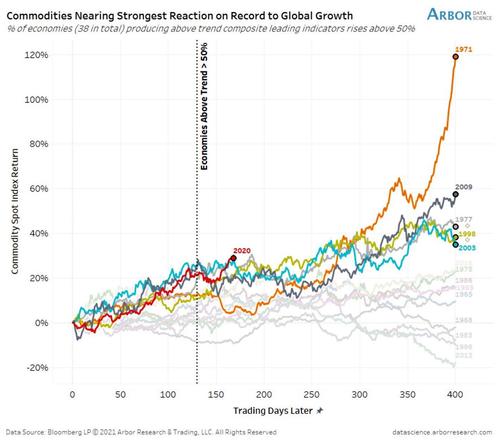

There is some good news: the terminus of the pipeline, New York, was well stocked with fuel ahead of the attack and could weather the upset if missing fuel is replaced or the line restarts quickly. East Coast gasoline stockpiles at the end of April were near five-year seasonal averages. Of course, a lenghty shutdown would mean gasoline shortage the likes of which were last seen in the 1970s…

… which would be poetic justice since price are already soaring at a pace that appears set to surpass America’s hyperinflationary period which ended with the Volcker Fed hiking rates to 20% in 1980.

Tyler Durden

Sun, 05/09/2021 – 18:23

via ZeroHedge News https://ift.tt/3bwHlYr Tyler Durden