The Problem Of Pulling Forward Sales & Revenue

Authored by Lance Roberts via RealInvestmentAdvice.com,

There is a problem of pulling forward sales and revenue when it comes to future outcomes.

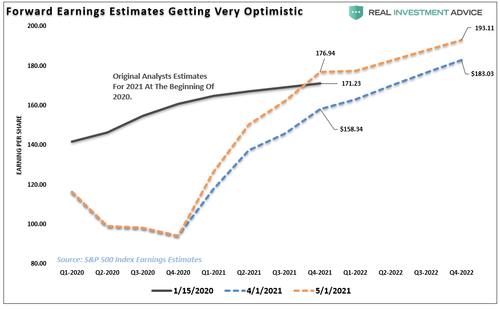

Currently, analysts are incredibly exuberant about earnings for the S&P 500 index. In just the last month, they sharply increased 2021 earnings. The chart below shows where 2021 estimates were in January 2020 versus the previous two months.

The near $20 jump in EOY estimates for 2021 over the last month is highly optimistic. The increase was a function of expectations for a “sugar rush” of economic activity from the stimulus. Of course, after the surge, the growth rate of earnings quickly fade.

But are analysts too optimistic?

A Fading Support

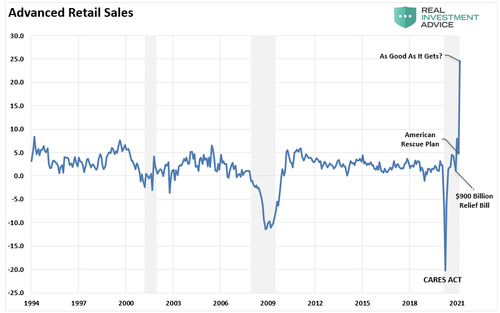

One of the potential issues over the next few quarters is 3-successive rounds of financial stimulus led to a spending spree by recipients.

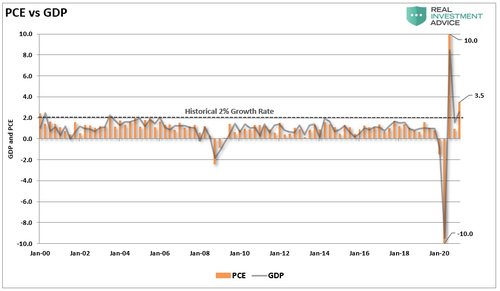

Retail sales make up roughly 40% of Personal Consumption Expenditures (PCE). Importantly, PCE comprises almost 70% of the GDP calculation.

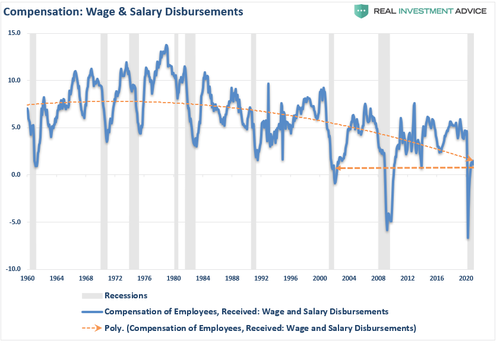

Given that recipients likely spent the bulk of their stimulus, and each dollar spent has a smaller impact on growth, the rate of change is slowing. With no more stimulus in the pipeline, and other supports fading this year, economic growth will slow to the rate of wage growth.

The problem with all stimulus is that it does not lead to productive activity in the economy.

Therefore, the question becomes, “what happens next?”

Pulling Forward Future Sales

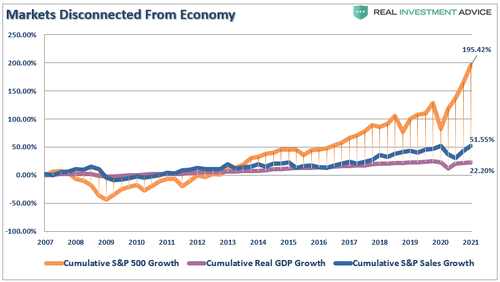

I have shown the following chart previously. It shows the cumulative increase from 2007-present of the S&P 500 index compared to sales and economic growth.

Notably, the outsized growth of the market reflects repetitive interventions into the financial markets by the Fed. Those interventions detached financial asset growth from their long-term correlation to GDP growth, where corporate revenue comes from. Historically, when the S&P 500 becomes detached from economic growth, a reversion occurred.

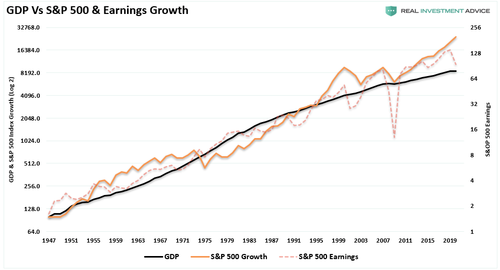

Currently, analysts are expecting earnings to surge well above economic growth rates. However, the flaw in the analysis is the assumption earnings growth will continue its current trend.

While there will be an economic recovery to pre-pandemic levels, a recovery is very different from an expansion. Following the shutdown, companies such as Zoom, Peleton, Apple, and Microsoft saw a surge in demand due to the shift to “work at home.” Then, following the massive amounts of stimulus, there was a surge in other products. Consumers flush with cash ran out to purchase automobiles, computers, phones, durable goods, home refurbishings, and food. Apple, Home Depot, Etsy, Pinterest, and others saw a surge in demand as shopping sprees ensued.

Today, with much of the money spent, companies are providing warnings about weaker future growth. Such is the problem of stimulus, which pulls forward “future consumption” to “today.” The void it creates must get filled in the future. The question is, with what?

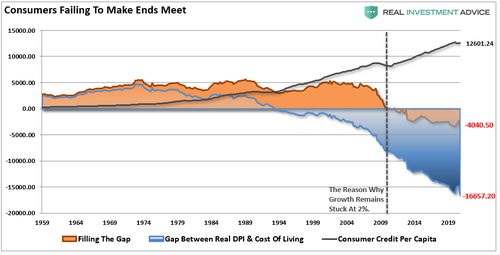

Without more stimulus, the demand for goods and services fades as the ability to consume reverts back to base wage growth.

But inflation presents another problem.

Inflation Is Also Problematic

While providing stimulus is indeed helpful in boosting short-term demand, it leads to inflationary pressures. When businesses realize consumers have money to spend, the ability to pass on higher prices becomes easier. However, given the nature of the economic shutdown and disruption of supply chains, those price increases occur everywhere.

Companies have two choices to deal with inflationary pressures:

-

They can absorb the higher costs, which impact profit margins; or,

-

They can pass the cost on to consumers.

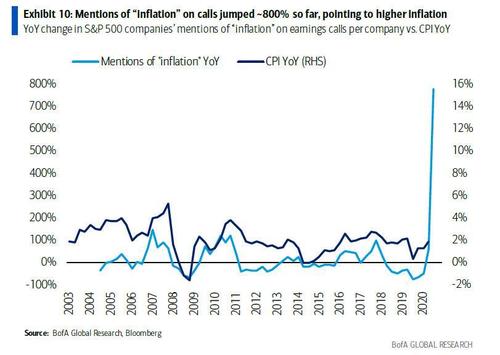

Given the number of companies mentioning inflation during the latest earnings season calls, I suspect we will see their decision sooner than later.

We bet that we will see it passed on to consumers either in the form of “shrink-flation,” where the price for a good remains the same but less is provided, or “inflation” through higher prices. With stimulus fading, higher costs eat into the discretionary income of households that largely live paycheck-to-paycheck. Once the top-20% of income earners are removed, and we factor in the cost of living, the problem becomes apparent.

What Are You Going To Do For Me Now?

The two-fold problem of the temporary nature of stimulus and inflation leaves the market vulnerable to a downshift in earnings expectations over the next couple of quarters. As is always the case, Wall Street has ratcheted up expectations to try and justify current prices.

However, a bit of analysis suggests that over-estimating earnings will lead to a price correction when it becomes realized. While that is something we do not expect immediately, we expect that markets will wake up to this reality in the last half of the year.

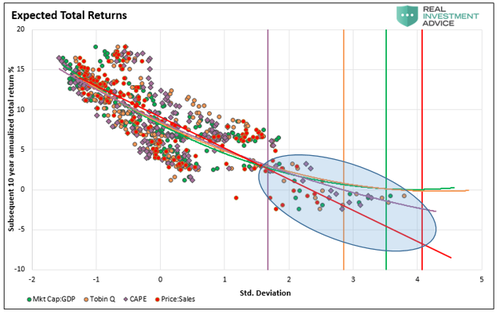

By no measure is the market valued at a level that supports current valuations. The average of the 10-year expected returns from four of the most popular measures is -0.75%.

While The Fed will continue to supply liquidity, their programs’ efficacy has become less with each iteration. While monetary interventions allow market participants to ignore the reality of the economic ties to the market, such does not preclude hair-raising volatility and large declines as in March 2020.

In 2021, earnings are likely to come in once again substantially lower than analyst’s exuberant estimates. But such shouldn’t be a surprise since they are never accurate historically. More importantly, if the Fed backs off, whether by its design or due to inflation, slower economic growth, or massive debt overhead, rich valuations will matter.

The risk of disappointment is high. And so are the costs of being “wilfully blind” to the risks.

Tyler Durden

Mon, 05/10/2021 – 15:19

via ZeroHedge News https://ift.tt/2SBw3v7 Tyler Durden