“The Sixth Turning”: In Rare Downgrade, Citi Cuts Google, Facebook On Peak Online Ad Spending

Sometimes – very rarely – Wall Street bites the hand that feeds it, and no hand has fed Wall Street more than the FAAMG companies which have spent tens of billions on brokerage commissions and internet advisory fees.

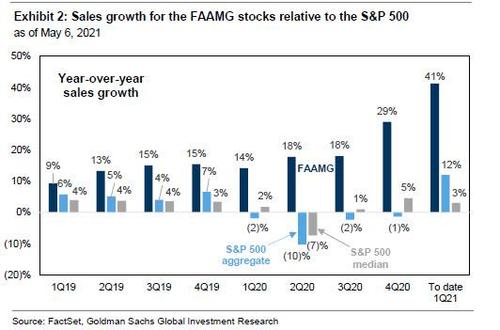

Which is why we found it very surprising that around the time Goldman and Morgan Stanley reiterated their positive views on the FAAMG “Generals”, with Goldman’s David Kostin writing over the weekend that “many investors have expressed the view that economic deceleration should support the outperformance of the largest “Big Tech” stocks in the market”, a view he agrees with…

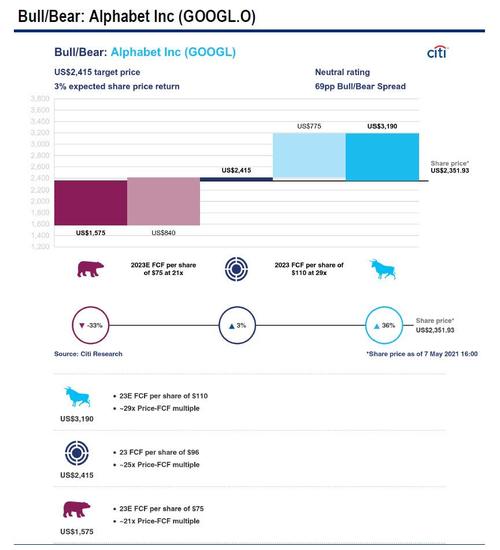

… in a note from Citigroup, the bank’s internet analyst Jason Bazinet downgraded Apple and Facebook to Neutral from Buy as “caution is in order” for companies that derive revenue from digital advertising, and “The Sixth Turning is coming” for online ad revenues.

What does Bazinet means by that?

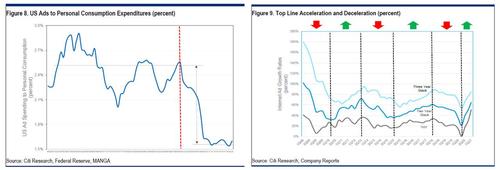

The Sixth Turning — During last 15 years, Internet ads enjoyed three periods of accelerating growth: ’10 to ’12, ’15 to ’18 and today. But, they also exhibited three periods of decelerating growth: ‘08 to ‘10, ‘13 to ‘15 and ‘18 to ‘20. Even if the bullish sell side forecasts are right, next wave of deceleration – the 6th turning – begins in 3Q21 (when yoy comps are tough) or 2Q22 (when two year stacked growth rates peak). Recent shifts – from accelerating to decelerating growth – has typically not been bullish for multiples.

With that in mind, Bazinet’s bearish thesis is that ehile strength in internet ads was very robust in the past two quarters (due to: 1) better macro, 2) robust eCommerce and 3) higher retailer web traffic), growth is likely to decelerate given difficult year-over-year comparisons ahead for three reasons.

- First, among the top 10 Internet ad firms, in absolute dollar terms, sell side expects ~2x the annual growth from ’21 to ’25 versus ’18 to ’20.

- Second, many investors believe ad intensity per dollar of economic activity is rising. We see little evidence of this.

- Third, even if the sell side estimates are right, growth will likely decelerate after 2Q21 (on tougher comps)

“Historically”, Bazinet cautions, “that usually isn’t bullish for multiples” and as such he downgrades Alphabet and Facebook to Neutral.

We’re downgrading Alphabet and Facebook from Buy to Neutral. We now aren’t recommending any large cap, ad centric, Internet stock except Roku. We like Roku because we believe the connected TV market is still nascent.

A few more key highlights from the Citi report:

- Recent Strength Makes Sense – Internet ad strength was very robust in the last two quarters. From 1Q16 to 1Q21, Internet ad revenue was highly correlated (R2 of 0.97) to: US personal consumption (PCE), eCommerce spend and global retailer web traffic. In short, most of the recent strength makes sense to us.

- Sell Side Extrapolates the Strength – The sell side has taken 4Q20 and 1Q21 strength and extrapolated it over the next five years. Indeed, the sell side expects ~$75B of annual growth per year through 2025 versus ~$40B of annual growth in 2018 to 2020.

- Ad Intensity Not Rising – Many investors believe the ad intensity (or ad spend per dollar of economic activity) is rising. We see little evidence of this. For the last six years, US ad spend (across all mediums) has represented (a flattish) 1.6% of Personal Consumption Expenditures (PCE). As such, we see little evidence of ‘below the line’ ad spend moving up to advertising.

Of course, with Google and Facebook making up nearly half of the FAAMGs, is Citi’s downgrade effectively a shot at the “Generals”? Well, not according to Citi, which is quick to explain that “Amazon remains our favorite Internet stock because we see ample growth in B2B services beyond ads (e.g. AWS, FBA, Commissions and Logistics).”

Shares of GOOGL were down 0.7% premarket, while FB was down 1.3%.

Tyler Durden

Mon, 05/10/2021 – 08:47

via ZeroHedge News https://ift.tt/2R03k2U Tyler Durden