A Pile Up Of Epic Proportions: Hedge Funds Short Tech Shares For 10th Straight Day

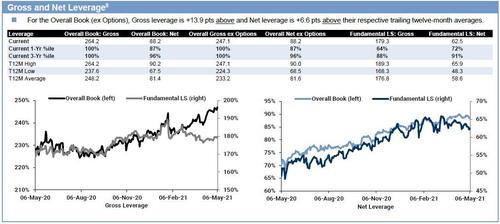

Late on Monday, we made two important observations: i) hedge funds had never been more levered to market moves, with gross leverage at all time highs, as hedge funds strive to extract every last ounce of beta from the market (net leverage was also extremely high, but not record high, and is more a reflection of any given hedge fund’s alpha preference)…

… and ii) hedge funds had scrambled to short tech shares explaining the recent decline in the Nasdaq, with Goldman Prime pointing out that Info Tech stocks were net sold for a third straight week and saw the largest week/week $ net selling since last August, and that Info Tech was by far the most net sold sector on the GS Prime book driven by short sales outpacing long buys 7 to 1.

One day later and the bearish pile up is reaching epic proportions.

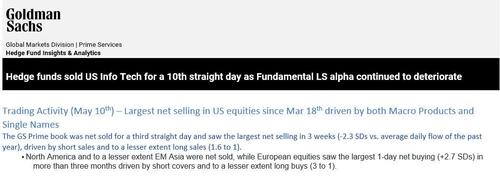

According to the latest daily update from Goldman Prime, Monday was “the largest net selling in US equities since Mar 18th driven by both Macro Products and Single Names.” The division which rushed to dump its Archegos exposure before everyone else also said that the Goldman Prime book was “net sold for a third straight day and saw the largest net selling in 3 weeks (-2.3 SDs vs. average daily flow of the past year), driven by short sales and to a lesser extent long sales (1.6 to 1).“

The liquidation was largely indiscriminate, with “7 of 11 sectors net sold on the day led in $ terms by Info Tech, Consumer Disc, Financials, and Materials, while Comm Svcs, Energy, and Health Care were the most net bought.”

But what caught our attention was Goldman’s revelation that, explaining Monday’s tech rout, “Info Tech stocks were net sold for a 10th straight day, driven by equal $ amount of long sales and short sales.“

This unprecedented bearish pile in a sector which for much of 2020 was Wall Street’s darling also means that…

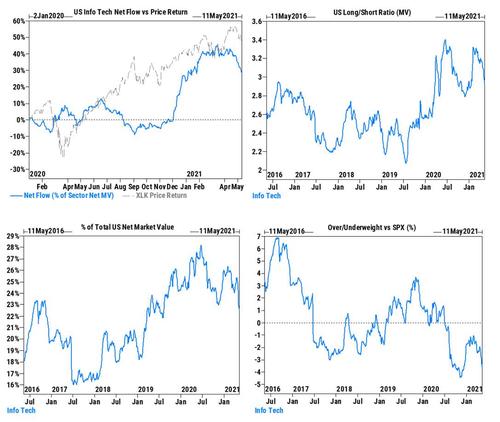

- Yesterday’s $ net selling in US Info Tech stocks was the 4th largest YTD and the 5th largest in the past five years (-2.5 SDs vs. the average daily flow of the past year). The sector accounted for three of the five most net sold industries across the GS Prime book yesterday.

- Long/Short Ratio (MV) – Info Tech long/short ratio now stands at 2.84, the lowest level since December and in the 74th percentile vs. the past five years.

- Sector Weighting –Info Tech stocks now make up 22.2% of the total US net market value on the GS Prime book, the lowest level since Aug ’19 and in the 52nd percentile vs. the past five years.

- Over/Under-Weight vs. the SPX – The GS Prime book is now U/W Info Tech stocks by -3.7%, the lowest level since early December and in the 3rd percentile vs. the past five years.

What does this mean? Well, so far the hedge fund pile up in bearish tech positions has worked. But after yesterday’s oversubscribed $18.5BN bond offering by Amazon, which will be used to fund buybacks, and is already in process of buying back AMZN stock pushing it from down 2% to up 1% in early trading…

… we expect a cascade of short covering…

buybacks engage

— zerohedge (@zerohedge) May 11, 2021

… to be triggered any moment as hedge funds retreat facing the relentless Goldman buyback desk, sending the NASDAQ green in very short notice.

Tyler Durden

Tue, 05/11/2021 – 11:31

via ZeroHedge News https://ift.tt/2RHOg9V Tyler Durden