Treasury Sells $58 Billion 3-Year Notes In Subpar, Tailing Auction

The first refunding auction, the sale of $58 billion in 3Y paper, was just concluded and in keeping with the complete lack of excitement in the secondary Treasury market in recent weeks, today’s auction – the first of this week’s coupon sales – was quite boring too.

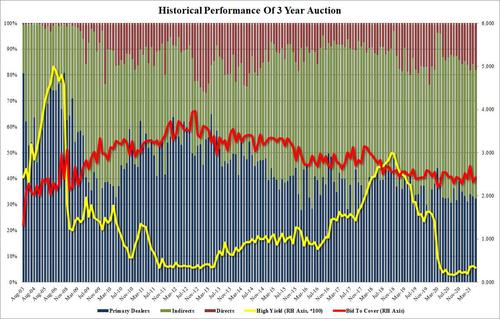

The high yield of 0.329% was the lowest since February (April was 0.378%) but tailed the WI 0.327% by 0.2bps, the first 3Y auction tail since January.

If the tails was disappointing, the Bid to Cover was the opposite, rising from 2.318 last month to 2.422 if just below the 2.432 six-auction average.

The internals were also boring, with Indirects taking down 49.6%, below both April’s 51.1% and the recent average of 50.0%. And with Dealers taking down 32.3% (also below the 6-auction average of 34.2%) Dealers were left holding 18.1% of the auction, higher than both April’s 15.8% and the recent average of 15.8.

Overall, a slightly disappointing, tailing auction which however was boring enough not to make any waves in the broader bond market.

Tyler Durden

Tue, 05/11/2021 – 13:11

via ZeroHedge News https://ift.tt/3eAPVqH Tyler Durden