Was The Worst Payroll Miss In History Inflationary?

By Jim Reid, chief credit strategist at Deutsche Bank

Does the biggest downside miss in history for employment mean higher inflation? That’s the debate raging through markets and indeed DB research.

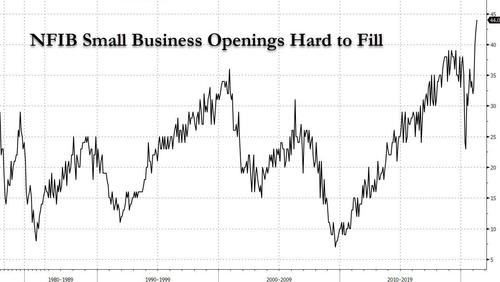

I lean towards the inflation side. Remember the Chart of the Day on Thursday showing small business “jobs hard to fill” was at record levels last month – a good guide with hindsight to the payroll number issues. (as of this morning, this has since grown to an even record-er high).

Further on this theme, DB’s head of rates strategy Francis Yared has written an interesting blog highlighting that fiscal policy is reducing labor supply, thereby supporting wages.

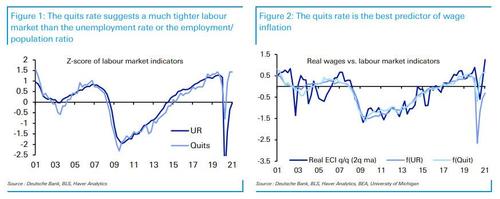

He particularly likes the quits rate, which should reflect voluntary departures and workers’ true bargaining power. This shows a much tighter labor market than the unemployment rate and has seen a better correlation to wages since the pandemic started than the u/e rate.

So were Friday’s payrolls indicative of more inflation not less? That’s the multi-trillion dollar debate at the moment.

Tyler Durden

Tue, 05/11/2021 – 14:40

via ZeroHedge News https://ift.tt/3w03uWM Tyler Durden