What Was Behind Friday’s “Literally Shocking” Payrolls Miss

By Steve Englander, head global G10 FX research at Standard Chartered bank

Summary:

- We see sampling issues and child-care concerns as the most likely drivers of the NFP weakness

- We are skeptical of the work disincentives explanation as the number of UI benefit recipients and of long-term unemployed dropped sharply

- Seasonality was normal, so this does not seem to have been a major issue

- We doubt the Fed will change its stance, even if an abnormal May bounce offsets the April shortfall

Work disincentives likely a future issue, but not in April

There is a lot of discussion on the big forecast miss of April non-farm payrolls (NFP). The consensus was for around 1mn jobs, our forecast was 1.5mn and the outcome was 266,000 (Bloomberg even called it “literally shocking data“). Against much commentary in recent days, we doubt that the generosity of unemployment insurance (UI) benefits played an important role in April, but we do not underestimate its future impact. We suspect sampling issues in the survey were the main source of the miss but find evidence that child-care issues played an important but secondary role. The run-up in average hourly earnings seems abrupt but is consistent with anecdotal reports of labor shortages.

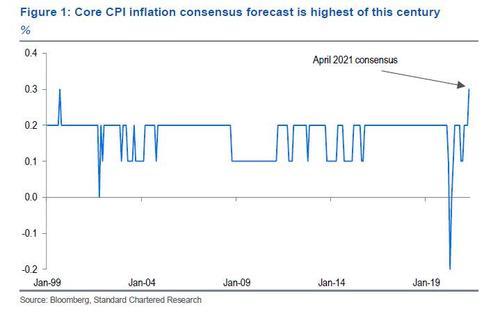

We see the main takeaway for markets as USD weakness, accompanied by an upward drift in breakevens and commodity prices. Manufacturing wages lagged other sectors but were still up 0.6%. Labor shortages and wage growth in sectors open to competition add up to lost competitiveness, absent USD weakness. If disincentives to work grow in importance there will likely be added depreciation pressure. We think investors may be uncertain on how literally to take the disappointing NFP outcome but see the cost pressures as persistent. The consensus forecast for April core CPI is 0.3% m/m, the first time the consensus has been above 0.2% in the 21st century!

April disincentive effect was probably exaggerated

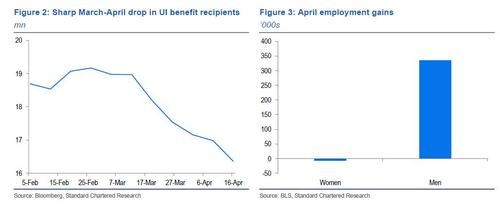

Many analysts have cited the potential impact on the labor supply of generous unemployment benefits. However, if these disincentives to work were the driver, we probably would not have seen the number of those receiving benefits drop as sharply as they did in March and April (Figure 2). It is hard to believe that NFP are capturing an unemployment effect invisible in claims and UI expenditure data. In addition, in the household survey the number of long-term unemployed continued to fall, while the number of those unemployed five weeks or less rose. We would expect the disincentives to show in the long-term unemployed hanging onto benefits.

A separate Bureau of Labor Statistics survey of the impact of COVID-19 indicates that 1.7mn fewer workers were unable to work in April than in March because their employers closed or lost business due to COVID-19. While it is hard to link this survey directly to the Current Employment Survey from which NFP are derived, it does seem as if workers are going back to work once COVID-19 constraints are removed. We dismiss the supply-side impact in April because the data do not support it, but see risk that it becomes a bigger factor down the road.

Tentative evidence that chid-care constraints matter

Employment in the BLS household survey increased 326,000, but employment of women dropped 8,000. Only women aged 16-19 years showed an appreciable employment increase. This is consistent with the possibility that child-care responsibilities may have limited women’s ability to accept jobs. The drop from March to April in the category ‘Did not look for work in the last 4 weeks because of the coronavirus pandemic’ was steeper for men than for women and steeper for those without children under 18 than for those with; but the differences were not big enough to explain the shortfall in job gains.

What makes this driver tentative is that women’s job gains over the past year have exceeded men’s. It is possible that child-care constraints increased in April but we are not sure why this would have happened as reopening extended.

Note also that even had women’s employment gone up as much as men’s, the outcome would still be disappointing (we assume that men’s ability to accept employment was far less constrained).

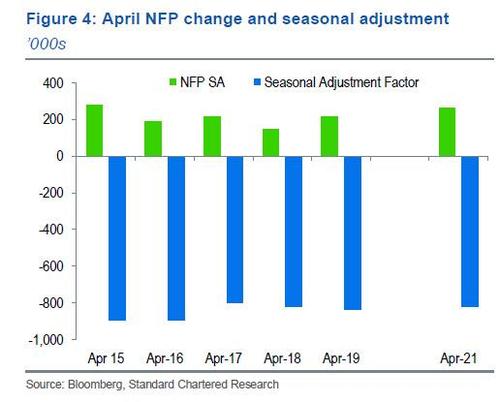

Non-seasonally-adjusted NFP were up 1.089mn, but the seasonal adjustment reduced the gains to 266,000. At first glance this looks like an aggressive seasonal adjustment, but in fact this is pretty typical for the pre-COVID-19 period.

The non-seasonally adjusted April NFP average over 2015-19 was 1.1mn jobs that the seasonal adjustment reduced to 215,000. For the seasonal factor to be relevant there would have to be an argument that seasonal effects were distorted; for example, that seasonal layoffs in Q1 were less than normal, so April rehiring was similarly less than normal. We do not see these as easy arguments to make.

Sampling error

We put forward sampling error as an explanation with caution, as the temptation to resort to sampling error after a big forecasting miss is significant. We see three arguments for considering sampling error seriously:

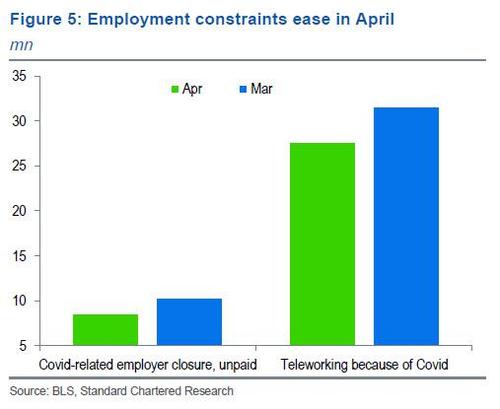

- The supplementary BLS shows continuous easing of COVID-constraints on working. For example the number of people teleworking dropped by almost four million from March to April (Figure 5). This drop cannot be mapped directly into NFP gains but indicates improving conditions. Almost by definition, the ramping up and easing of COVID-19 related constraints should not be seasonally adjusted away.

- The BLS birth and death model that adjusts for firms (re-)opening and shutting down may be particularly imprecise under current circumstances. The BLS has adjusted its estimation procedures, but it is unclear how much their revised adjustment captures.

- Most other labor-market indicators were showing robust conditions. There is no direct link between the BLS surveys and these other indicators, but the lackluster BLS releases are at odds with the ISM, other surveys and other labor-market indicators.

Tyler Durden

Mon, 05/10/2021 – 21:30

via ZeroHedge News https://ift.tt/3f9sIer Tyler Durden