Biggest Rise In Consumer Prices In More Than A Decade Is Understated By Half

Submitted by Joseph Carson, former chief economist of Alliance Bernstein

Inflation has arrived, evident by the 4.2% gain in the consumer price index over the past twelve months. But the most significant increase since 2008 still is not fully capturing “experienced” inflation since it is missing the rise in housing inflation.

The Bureau of Labor Statistics reported that April consumer prices rose 0.8% from the prior month. Also, the widely followed core prices (which exclude food and energy) rose 0.9%, pushing that sub-index to a 3% gain in the past twelve months, the biggest increase since 1995.

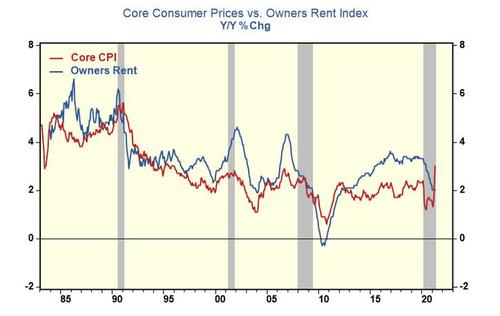

However, the acceleration of core consumer prices in the past twelve months is unlike that of 1995. Owners rent, which accounts for roughly one-third of the core index, is up only 2%, or 100 basis points below the core reading. In 1995, the 3% core reading included an even bigger 3.5% rise in owners’ rent. So the rise in core inflation in 2021 is much broader than what happened more than two and half decades ago.

More importantly, as big and broad as today’s report on consumer prices is on the surface is still does not fully capture the actual rise in consumer inflation. Housing prices are up 18% in the past twelve months, a record increase; nine times the increase in owners’ rent. The old CPI included house prices. Inserting house prices in place of the non-market owner rents, reported inflation would have been twice the 4.2% gain.

Policymakers often measure the scale of monetary accommodation by comparing nominal rates to reported inflation (the so-called real interest rate). By maintaining the zero rate policy in the face of sharply rising inflation, monetary policy has been even more accommodative. Inflation cycles feed on easy money: so the odds increase with each passing day that the new inflation cycle will not prove to be “transitory”.

Tyler Durden

Wed, 05/12/2021 – 12:15

via ZeroHedge News https://ift.tt/3o9inDe Tyler Durden