Rabo: Please Don’t Make Us Look At The Inflation

By Michael Every of Rabobank

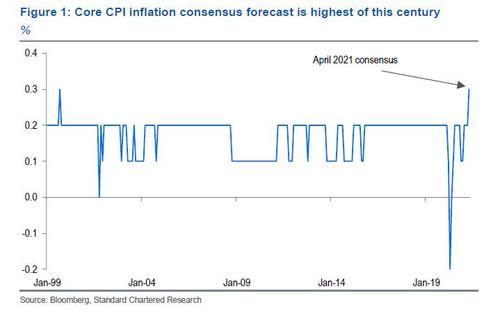

Markets continue to reel: “Risk crumbles”, says Bloomberg. Why? Because there is a plaintive plea from everyone from the Fed and the Treasury down to simple peddlers of exotic derivatives: please don’t make us look at the inflation! Yes, it’s US inflation-data day – and nobody wants to see any. If there is an upside surprise in CPI, to reflect the surges in the prices of so much around us, it will embarrass the Fed, and the US Dollar, and Yellen, and many others. Some pre-emptive positioning may already be underway: the White House said Tuesday it takes “the possibility of inflation seriously”, or should that have been “serious inflation is possible?”; and the Fed’s Bullard added the US will see inflation in 2021 and some will “hang on” in 2022. Is that still transitory?

China’s PPI surprised to the upside, which may prove a worrying harbinger: and, anecdotally, prices for shipping between to the US this summer is now up to seven times what it was a year ago on some routes. Of course, the delayed 2020 census was a harbinger too – of mercantilism. (See “A Midwife Crisis”: and thinking Fudd not Fed, this should have been titled “A Midwife Cwisis”, with the subtitle “Be Vewy, Vewy Quiet. I’m hunting positive demogwaphics. Huh huh huh.”

The German ZEW survey (of analysts, so irrelevant) perked up too, while the US NFIB survey (of businesses, so relevant) showed that despite the weak payrolls number on Friday, it is now the most difficult to find workers ever. Crucially, “owners are raising compensation, [and] offering bonuses and benefits to attract the right employees,” the survey added. Watch that trend like a hawk – presuming we have any Fed hawks, rather than chicken hawks who keep saying ‘Nothing to see here, move along’, even as nobody is moving along because they are all still at home.

Meanwhile, the situation between Israel and Gaza, and inside Israel too, has the UN’s special coordinator for the Middle East peace process warning things are “escalating towards a full-scale war”. Russia-Ukraine tensions are still in the background – as is key Russian military hardware. Even The Economist has been prompted to cover Taiwan on its front page (if only to then editorially scold Australia rather than China, of course). And the massive cyber-attack on a US oil pipeline is now causing gasoline prices to surge and choking supply, as Bloomberg notes a “temporary, but major shortage” of fuels.

While there are proximate causes of these separate events, and blame can be laid in many places, one can also point out this is what foreign-policy experts (not economists) said would happen under a new US president promising U-turns from the last: the world would test the White House to see where bayonets meet resistance, and where they continue to sink in. This presents multiple, conjoined crises for the US to deal with.

In that regard, I cannot help but think “Everything’s coming up Milhous(e)”. That cartoon shmendrick shares his first name with the middle name of former US president Richard M Nixon. Tricky Dicky, who had previously been Vice President –and lost a presidential election to JFK marred by allegations of a dirty vote– was the last US president to face a major economic crisis involving soaring inflation; and gasoline; and supply chains; and the Middle East; and superpower rivalry; and the US Dollar itself. Recall that to try to deal with this Nixon:

- Broke the link between the US Dollar and gold in 1971, de facto killing Bretton Woods 1 and ushering in a global fiat money era. That was around the last time the NFIB found it this hard to find workers, while just yesterday Druckenmiller became the latest to say the Fed is debasing the US Dollar towards losing its global reserve currency status;

- “Went to China” to triangulate against the USSR in 1972, opening the door to the economic reforms there that have changed the global economy and the global balance of power. Many voices in the US are wondering how that has really worked out for them; and

- Imposed wage and price controls for 90 days after the 1973 Yom Kippur War and Arab oil boycott saw energy prices soar.

So what is the ideal –US– solution to the present confluence of problems? First understand that there doesn’t have to be one. Things can just get messy. If every country understood what to do best in all circumstances, the world would not look the way it does. But assuming someone can see the bigger picture, and for anyone wanting to strategize accordingly…

To go back ‘on gold’, or any such form of Austrianism under whatever techno veil, would see “risk crumble” to put it mildly. So would almost everything else – and rapidly. Yet more of the same policy clearly doesn’t work. Which leaves what exactly – MMT? The fact we don’t know is as pressing as the problem. But someone at the Fed or Treasury better come up with an idea quickly.

In turn, what the US can get away with on the Dollar will reflect its global hegemony – which links directly to the multiple geopolitical fires being lit by those who would prefer a different (im)balance of power. 1971 might well have been the end of the US Dollar – but instead its ubiquity only grew as first the petro-dollar then the Eurodollar supplanted it. But all iterations have US military primacy behind them – and that involves supply chains, key inputs, a highly-trained workforce, and tech leadership. None of those sit well within the globalised world system built since the 70s. Some parts of the White House grasp this. The Fed, and other regulatory bodies, will be made to understand it once a tipping point is reached. (Yes, children, presidents lean on the Fed. Nixon certainly did. It’s just how they lean from now on.)

Intervention in the form of price controls or rationing is unlikely to work, but state action in some form on some key inputs, or some form of industrial policy, cannot be ruled out. In the meantime, the market will ration by price: there are already reports of five-hour queues at the pump for gasoline; semiconductors simply aren’t available, forcing product changes; and wait until the prices of food surges too. (My wife insists I now quote her related, favourite Simpson’s clip: Lisa is looking out the living-room window and says “Oh, Milhouse is selling seeds and he’s coming this way…oh, the birds got him.”)

Perhaps higher prices and shipping costs might prompt more efficient and more local production, and/or near-shoring? That could support higher wages without the need for so much stay-at-home stimulus; make the US more ‘anti-fragile’; and support the industrial part of the military-industrial complex that props the US Dollar up. But let’s forget about all that and focus on whether the BLS can manage to get a headline m/m CPI reading of no more than 0.249% and core CPI of no more than 0.349%, eh? So many will be hoping their worries go away. At least for another month anyway.

On which, don’t think the US is the only one flapping for old solutions now new again. As French social tensions rise, Michel Barnier –the EU negotiator during Brexit, seen as driven by the UK’s desire to control immigration– argue for a five-year French moratorium on immigration from outside the EU, and warn of its links to terrorism(!) He will be saying he wants to take back control and fund the NHS next.

Tyler Durden

Wed, 05/12/2021 – 08:09

via ZeroHedge News https://ift.tt/3bgH0J9 Tyler Durden