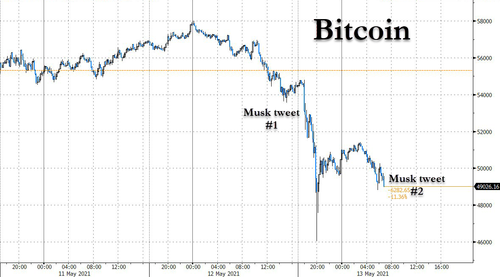

Bitcoin Plunges Further As Musk Claims Energy Usage Trend Is “Insane”

Just when you though Elon Musk’s change of heart on bitcoin could be short lived, he has again taken to Twitter on Thursday morning, furthering his “environmental” case against the cryptocurrency.

At about 0600 EST, Musk followed up on yesterday’s statement about no longer accepting bitcoin by Tweeting out a chart of bitcoin electricity consumption. Musk wrote that the energy usage trend for bitcoin over the past few months “is insane”.

Energy usage trend over past few months is insane https://t.co/E6o9s87trw pic.twitter.com/bmv9wotwKe

— Elon Musk (@elonmusk) May 13, 2021

The Tweet sent bitcoin, which was already hovering around support at $50,000, plunging lower again…

The reasoning for Musk’s stark turnaround on bitcoin isn’t yet clear.

Some attributed it to potential regulatory issues:

I agree w/ others who think @SEC_Enforcement told $TSLA they can’t book auto revenue using fake currency; as a matter of fact, $TSLA might have to restate 1Q21 earnings for illegally including #Bitcoin trading gains in operating income $TSLAQ $ARKK $MS $GS

— Patrick Comack (@patrickcomack) May 13, 2021

Some said they simply “didn’t get it”:

$TSLA so Elon won’t accept transactions in $BTC due to energy consumption yet was perfectly fine buying billion+ of BTC for the Balance Sheet? Makes ZERO sense. Either shows a lack or initial diligence or questionable fiduciary decision making. I like Elon, but, I don’t get that

— The_Ravid (@The_Ravid) May 13, 2021

Others didn’t speculate on the cause, but just noted the stark change in Musk’s attitude.

This is wild. Musk is presenting the case against Bitcoin. Something has changed wildly in his world. And no matter what it is, we can’t go back on this: Elon Musk has officially called out Bitcoin for not being environmentally friendly. This is a seismic pivot. Seismic. https://t.co/qqtxj5FwIU

— Quoth the Raven (@QTRResearch) May 13, 2021

And have speculated it has to do with Tesla wanting to enter the U.S. renewable fuel credit market, while others have speculated that the U.S. (or perhaps even Chinese) government may have prompted the sudden change of heart. As we suggested in jest yesterday – if it’s really about the environment – wouldn’t Musk have to stop accepting the Yuan, too?

Next: TSLA stops accepting yuan pic.twitter.com/Iy9kEbwCPg

— zerohedge (@zerohedge) May 13, 2021

Recall, we noted yesterday that after announcing plans to accept payment for Tesla’s cars in bitcoin back in February, Musk announced via tweet that the company was suspending bitcoin payments over concerns about the environment. “We will not be selling any bitcoin,” he added.

As perhaps the biggest booster of bitcoin in corporate America, Tesla announced during its Q1 earnings report released last month that it made a $272 million profit selling some of the bitcoin it had purchased on the company’s balance sheet. Earlier this week, Musk joked about the possibility that the firm might accept Doge for payment.

In a note published on Twitter, Musk wrote that while he is still personally a believer in the cryptocurrency, Tesla has become concerned about the role of fossil fuels in bitcoin mining, a common criticism made by environmentalists against bitcoin. “Cryptocurrency is a great idea on many levels and has a promising future but this cannot come at a great cost to the environmet,” Musk wrote. He added that the company “will not be selling any bitcoin and we intend to use it for transactions as soonas mining transitions to a more sustainable energy.”

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

While the initial reaction in crypto was anything but bullish, analysts quickly noted that this could be good news for ethereum, as Musk noted in his tweet that Tesla will be looking at alternatives in the crypto space that use “<1%" of bitcoin's energy consumption.

As JPM recently pointed out in a note to clients, ESG factors are one reason ethereum’s explosive move higher, which has made it a standout crypto performer in recent weeks, will likely continue. The greater focus by investors on ESG has shifted attention away from the energy intensive bitcoin blockchain to the ethereum blockchain, which in anticipation of Ethereum 2.0 is expected to become a lot more energy efficient by the end of 2022. Ethereum 2.0 involves a shift from an energy intensive Proof-of-Work validation mechanism to a much less intensive Proof-of-Stake validation mechanism. As a result, less computational power and energy consumption would be needed to maintain the ethereum network.

In other words, this is one area where ethereum can out-compete bitcoin in the long run.

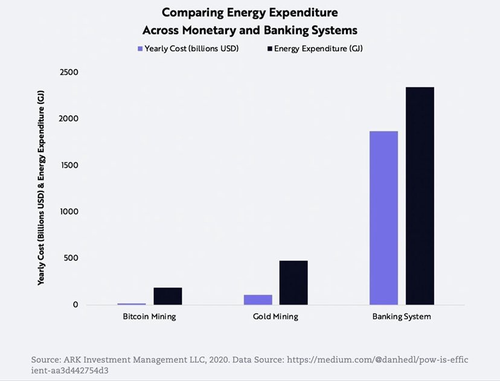

But when it comes to fossil fuel consumption, the traditional banking system has crypto beat.

Tyler Durden

Thu, 05/13/2021 – 07:03

via ZeroHedge News https://ift.tt/3w1iq6N Tyler Durden