Disney Tumbles On Subscriber, Revenue Miss

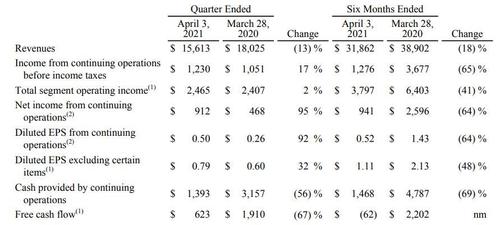

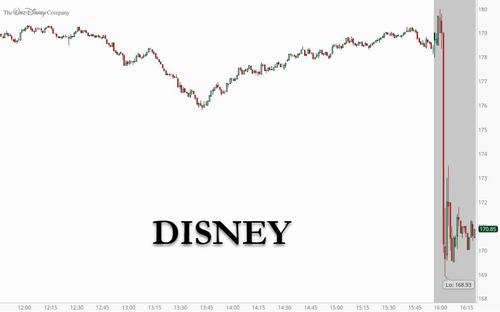

After several impressive quarters of huge gains for its recently launched Disney+ subscription service, Disney couldn’t quite make it this time and moments ago the company reported Q1 earnings that beat on the bottom line but missed on revenues and subscribers, sending the stock sliding in after hours.

Here are the details: first the good news:

- Adjusted EPS 79c, more than double the estimate of 32c

And now the bad:

- Disney+ subscribers 103.6 million, estimate 110.3 million (Bloomberg Consensus)

- Revenue $15.61 billion, estimate $15.85 billion (range $14.94 billion to $16.93 billion)

Similar to Netflix, the torrid growth of Disney+ is also stalling fast:

- Nov 2019: launches

- Feb 2020: 29 million

- Apr 2020: 50 million

- May 2020: 55 million

- Jun 2020: 58 million

- Aug 2020: 61 million

- Oct 2020: 74 million

- Dec 2020: 87 million

- Jan 2021: 95 million

- Mar 2021: 100 million

- Apr 2021: 104 million

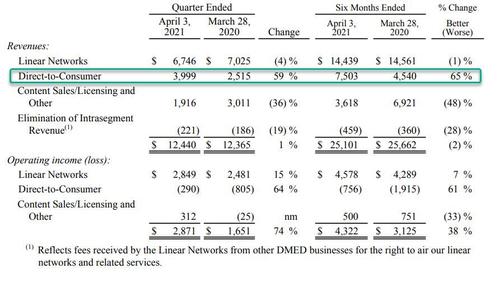

The top-line breakdown showed softness in the media and entertainment distribution even as parks came in line:

- Media and entertainment distribution revenue $12.44 billion, estimate $12.64 billion,

- Parks, experiences and products revenue $3.17 billion, estimate $3.17 billion

Of note: had it note been for the 59% increase in direct to consumer revenue, Disney’s revenue would have been an ugly mess:

Despite the top-line miss, media and entertainment distribution operating income of $2.87 billion was $1 billion higher than the estimate of $1.87 billion, while parks, experiences and products operating loss $406 million was slightly higher than the estimated loss $369.4 million. Even so, both Operating and Free Cash Flow tumbled 56% and 67% respectively, YoY,.

Looking ahead, Disney said that costs “to address government regulations and implement safety measures for our employees, talent and guests” may total approximately $1 billion in fiscal 2021:

We have incurred, and will continue to incur, additional costs to address government regulations and implement safety measures for our employees, talent and guests. The timing, duration and extent of these costs will depend on the timing and scope of our operations as they resume. We currently estimate these costs may total approximately $1 billion in fiscal 2021. Some of these costs may be capitalized and amortized over future periods.

Commenting on the quarter, CEO Bob Chapek said that “we’re pleased to see more encouraging signs of recovery across our businesses, and we remain focused on ramping up our operations while also fueling long-term growth for the Company. This is clearly reflected in the reopening of our theme parks and resorts, increased production at our studios, the continued success of our streaming services, and the expansion of our unrivaled portfolio of multiyear sports rights deals for ESPN and ESPN+.”

Investor however did not share his enthusiasm and hammered the stock after hours.

Tyler Durden

Thu, 05/13/2021 – 16:25

via ZeroHedge News https://ift.tt/2RTvAE5 Tyler Durden