Foreign Buyers Shun Ugly, Tailing 30Y Auction

In stark contrast to yesterday’s stellar 10Y auction, moments ago the Treasury concluded its refunding issuance when it sold $27BN in 30Y paper in an ugly, tailing auction that was disappointing in every category.

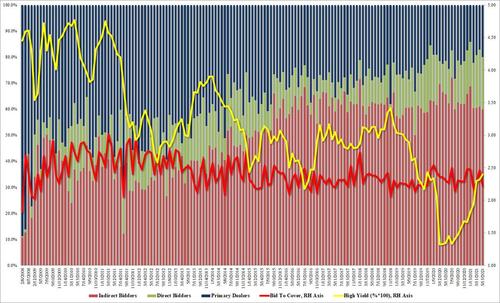

The High Yield of 2.395% was the highest since November 2019, and tailed the When Issued 2.377% by 1.8bps, the biggest tail since August 2020. The bid to cover of 2.219 was a big drop from 2.466 last month, and also well below the 6-auction average 2.36%.

The internals were sloppy as well, with Indirects – a proxy for foreign buyers – taking down just 59.9%, the lowest since August 2020, below the recent average of 63.1%, with Directs just below April’s 21.9% at 20.1% and above the recent average of 18.3%. This left Dealers taking down 20.1% of the auction, higher than both last month’s 17.1% and the six-auction average of 18.6%.

Overall, a sloppy, disappointing auction as nerves about reflation are finally starting to become all too apparent.

Tyler Durden

Thu, 05/13/2021 – 13:11

via ZeroHedge News https://ift.tt/3yb6JfZ Tyler Durden