Gold’s Recent Headwind Shifts To A Tailwind

Authored by Jesse Felder via TheFelderReport.com,

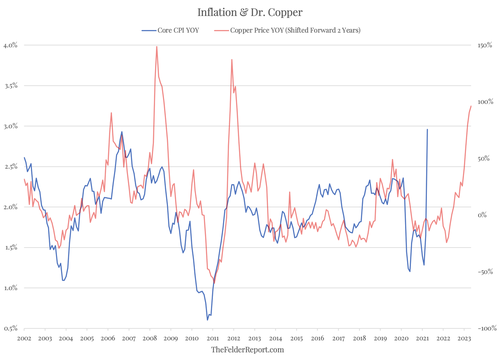

A couple of months ago, I wrote, “They call copper ‘doctor’ because he’s supposedly got a PhD in economics. And when it comes to inflation, it’s certainly true that he is far more accurate with his forecasts than the vast majority of economists. The recent breakout in the copper price suggests core inflation is likely too low at present and will soon begin to trend higher over the next couple of years.”

Yesterday’s CPI reading validates this view. Core inflation in April came in at nearly 3%, surpassing even most the aggressive forecasts. And while the economists at the Fed would encourage us to view this surge as “transitory,” copper prices would appear to suggest otherwise. According to the doctor, inflation should generally trend higher from its recent lows for a prolonged period of time.

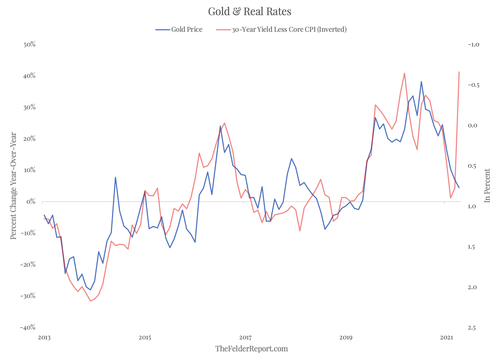

A week after that earlier blog post on inflation, I wrote, “Recently, nominal interest rates have been rising faster than inflation creating a headwind for the gold price. However, there is good reason to believe that this trend could soon shift and become a strong tailwind for the gold price again.”

With inflation now rising much faster than interest rates, real rates have now fallen (inverted in the chart below) to a level that should be about as bullish for gold prices as anything we have seen in recent years.

So far, investors don’t seem to read it this way and the gold price is giving back some of its recent gains. However, should these nascent trends in inflation and interest rates prove to be more than “transitory,” as Dr. Copper would seem to suggest, it would appear that the gold price could be significantly undervalued at present.

Tyler Durden

Thu, 05/13/2021 – 15:40

via ZeroHedge News https://ift.tt/3tFLfEh Tyler Durden