Here Comes A Big Miss In Retail Sales

Bank of America’s economists have been on a roll in the past three months.

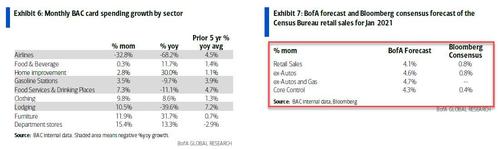

Back in February, the bank looked at its credit and debit card spending data and concluded that consensus was far, far too low, predicting that the stimmy-fueled January retail sales print would be above 4.1%.

Not only was BofA’s outlier forecast right, but the headline retail sales number came in even higher: at a whopping 5.3%, nearly 5x higher than the consensus estimate of a 1.1% rise.

One month later, when the Wall Street herd scrambled to make up for its clueless January forecast by being overly optimistic, Bank of America again took the contrarian approach, not because it wanted to but because that’s what the data showed: spending on BofA branded credit and debit cards tumbled in February, prompting BofA to predict a -3.0% retail sales print.

Once again, BofA was spot on to the dot, with the official retail sales print coming at -3.0%.

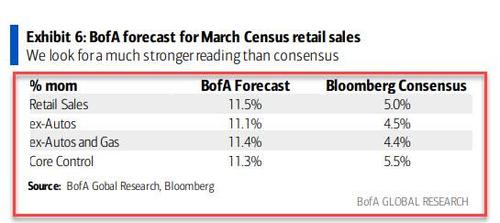

The bank’s immaculate record continued again last month, when BofA was again a stark outlier to consensus predicting a more than double blowout in March retail sales compared to expectations, looking for a 11.1% print (ex-autos and 11.5% headline)…

… and once again the actual spending-driven forecast was the most accurate, with the actual number coming in just shy of the BofA forecast, at 9.8% M/M, and almost double the consensus forecast of 5.8%.

So with the April retail sales on deck tomorrow, Wall Street can take its perpetually wrong consensus estimate and shove it, all that matters is what BofA’s economists expect, which will likely be market moving as it is once again in direct opposition to the Wall Street consensus.

To be sure, following a burst of red-hot inflation data, first from the booming CPI print and then again today, from the overheating PPI, the market is on edge about any more “good news” as any incremental upside surprises could restore the taper timeline to a June FOMC discussion of the fateful event. Which is why any downside surprise would likely be quite welcome by a stock market starved for some deflationary bad news.

It just may get it.

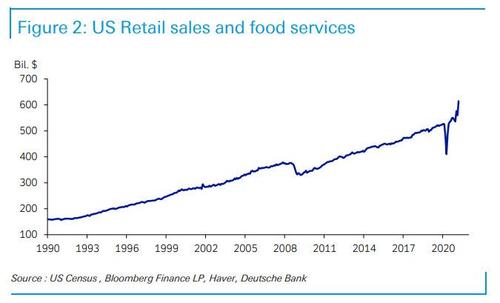

But first, we note that without making a prediction, Deutsche Bank’s Jim Reid notes that one of the many things that has broken out recently – in addition to inflation – has been US retail sales:

It’s remarkable how quickly this has bounced. We’ve arguably brought forward 5 years of trend retail sales growth since the pandemic started due to stimulus. Is this helping to contribute to the various bottlenecks and inflation? Will this increasingly filter through?

As Reid concludes, “one thing is for certain, the most unusual recession and recovery in history will continue to confound traditional economic models. I certainly don’t envy the Fed over the months ahead as the challenge to their central narrative and policy response will likely build.”

But before we get to the Fed’s narrative shaping, we have to go through tomorrow’s retail sales print which will be among the key economic indicators watched by the Fed in making its decision when the time comes.

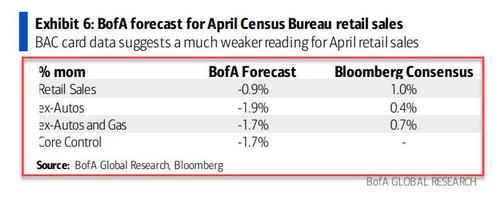

And it is here, that BofA’s forecast is once again material because with Wall Street once again expecting a continuation of the recent momentum and expecting a 1.0% increase in retail sales and 0.4% ex-autos, BofA is essentially a mirror image of this cheerful outlook, looking for a -0.9% decline in headline retail sales and a sizable -1.9% drop ex-autos as the latest stimmy-funded spending spree comes to a grinding halt.

Here is how BofA economist Michelle Meyer frames her downbeat forecast:

Based on aggregated card data, retail sales ex-autos declined 1.9% MOM SA in April, which is only a slight reversal of the incredible 8.4% MOM SA gain in March…. plugging in the public data from Wards, we think total retail sales will be down only -0.9% mom SA in April.

What’s the reason for the slowdown? No surprise here: it’s the obvious one.

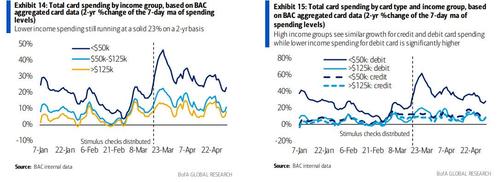

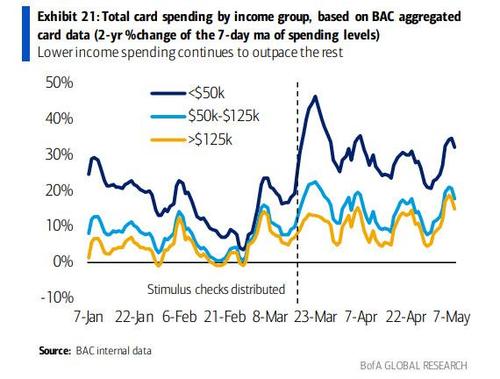

The outperformance since early March has been decidedly amongst lower income households owing to the stimulus: the 2-year growth rate of total card spending for low income households (<$50K) is running at 23% vs. 8.3% for the high income (>$125K). This is driven by debit card spending where most of the incremental spending for this population seemed to occur: spending on debit cards for the low income population is up 27.8% over the 2-years vs. 12.5% for credit card in this cohort. The outperformance of low income spending is apparent across categories, including leisure such as travel, restaurants and entertainment and durable goods such as furniture and home improvement spending. We expect a convergence ahead where higher income households accelerate spending and low income spending moderates. This gap is not sustainable absent further rounds of stimulus, in our view.

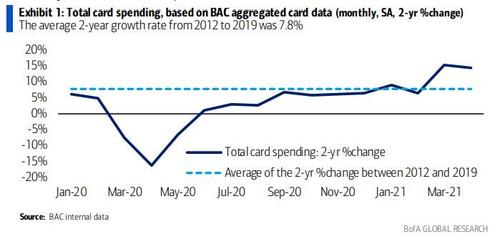

That said, while the official April data may indicate that the (low-income) US consumer is pausing for breath as the latest stimmy checks were largely spent, BofA’s latest aggregated credit and debit card data shows that in May spending has again picked up, with total card spending up 37% on a 1-year basis and 21% on a 2-year basis for the 7-days ending May 8th. Smoothing through the weekly gyrations, total card spending has been running at a roughly 20% pace over a 2-year period since mid-April: “This is considerably above the average pre-pandemic 2-year growth rate of about 8% (from 2012-2019). “

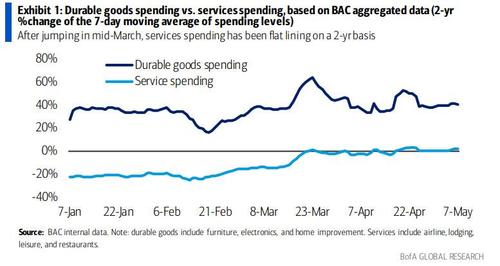

Digging into the data we find that spending on durable goods (furniture, home improvement, and electronics) has remained extraordinarily robust, growing at a nearly 40% 2-year growth rate, as the stimulus provided a jolt in spending to a peak of a 64% 2-year growth rate in mid-March but the rate of growth has since stabilized. On the other end, spending on discretionary services – airlines, lodging, leisure and restaurants – is up only slightly on a 2-year basis. The biggest turnaround in spending on services occurred from mid-February to late-March when the 2-year growth rate increased 20bp. However, since then, services spending has been stable, failing to make further incremental gains. This means that the consumption basket between goods and services spending has been largely stable for the past 4 weeks.

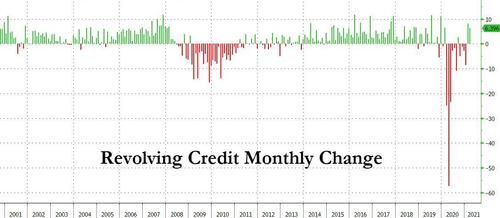

Meanwhile, as we predicted last week when looking at the surge in credit card usage after months of deleveraging…

… when we said that going forward Americans will once again rush to “charge it”, BofA confirms this hypothesis as well, writing that “there was a notable increase in credit card spending this past week with the 2-year growth rate doubling to 12% from the prior week, reaching the strongest level since the recovery began. Households may have increased spending on credit cards as we move further away from the stimulus distribution.” And that’s precisely what the Fed’s monthly consumer credit data indicate too.

One final observation from BofA, confirms that the recent burst in spending has been driven entirely by lower social classes, with the low-income total card spending running at 32% over a 2-year period, about double the rate for the high income consumer. In time, BofA

expects the gap to narrow as spending for lower income consumers slow while the higher income household ramps up spending as the reopening progresses. Or vice versa.

Tyler Durden

Thu, 05/13/2021 – 15:20

via ZeroHedge News https://ift.tt/3og4wLm Tyler Durden