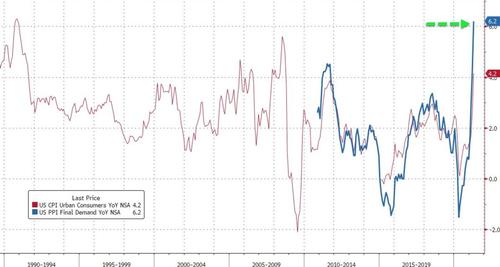

US Producer Prices Surge Most On Record

After consumer prices exploded higher yesterday – and were immediately rejected by establishment types as ‘transitory’, despite the market’s obvious disagreement – all eyes were on this morning’s producer prices for signs of more pressure. Many were fearful of a repeat of last month’s debacle delay (and there were rumors of a softer PPI print leaked earlier today)

The rumors were wrong as April Producer Prices exploded 6.2% YoY (well ahead of the 5.8% expected) rising 0.6% MoM (double the +0.3% expected).

Source: Bloomberg

That is the biggest YoY jump on record.

“There is more inflation coming,” Luca Zaramella, chief financial officer at Mondelez International Inc., said on the food and beverage maker’s April 27 earnings call.

“The higher inflation will require some additional pricing and some additional productivities to offset the impact.”

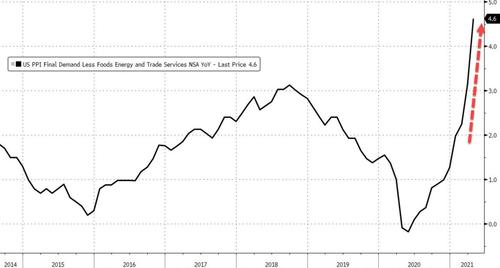

Excluding volatile food and energy components, the so-called core PPI advanced 0.7%.

Under the surface even further, ex-food, energy, and trade, producer prices soared 4.6% YoY, by the most on record also…

Source: Bloomberg

Yesterday’s data – which showed the strongest monthly gain in the overall consumer price index since 2009 – suggested companies are passing along at least some of the input-price inflation.. and today’s PPI surge suggests that push through to CPI is far from over.

Not transitory.

Tyler Durden

Thu, 05/13/2021 – 08:37

via ZeroHedge News https://ift.tt/3bkw4dh Tyler Durden