The US Government Is On Track To Top Last Year’s Record-Breaking Deficits

Authored by Ryan McMaken via The Mises Institute,

The Treasury department has issued its spending and revenue report for April 2021, and it’s clear the US government is headed toward another record-breaking year for deficits.

According to the report, the US federal government collected $439.2 billion in revenue during April 2021, which was a sizable improvement over April 2020 and over March 2021. Indeed, April 2021’s revenue total was the largest since July of last year when the federal government collected 563.5 billion following several months of delays on tax filing deadlines beyond the usual April 15 deadline. (Not surprisingly, in most years, April tends to be the federal government’s biggest month for tax collections.)

In spite of April’s haul, however, the federal government managed to spend much more than that, with spending topping $664 billion during April. This means the federal government ran a sizable deficit in April of 225.6 billion. This was a middling sum compared to other monthly deficits this fiscal year (which began on October 1), but deficits are adding up fast.

For the first seven months of this fiscal year combined, the US government collected $2.1 trillion in revenue, yet it spend nearly twice as much: $4.1 trillion, or 90 percent more than it collected.

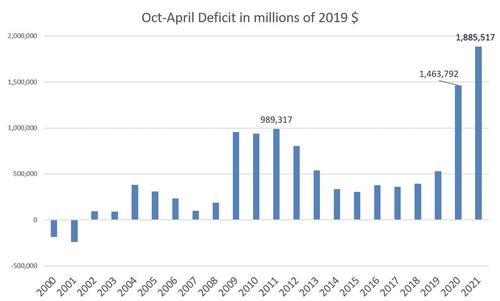

Put another way: for the first seven months of this fiscal year (2021), the total deficit already totals $1.9 trillion. During the same period of last year, this total was $1.5 trillion.

For the first seven months of each year going back to 2000, even if adjusted for inflation, we see that 2020 and 2021 ran much larger deficits even than was the case during the Bush-Obama spending spree kicked off in late 2008 and peaking in 2011.

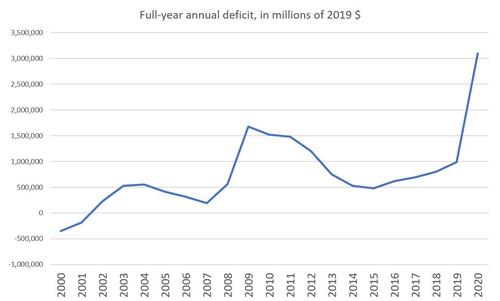

With five months left to go in the fiscal year, and with the deficit already approaching 2 trillion, it won’t take more than Biden’s $2 trillion infrastructure bill to ensure that 2021’s deficit soars to new record-breaking levels. That is, the US on course to beat last year’s full-year deficit by the time this fiscal year comes to an end.

In the second graph, we see that the full-year deficit for the 2020 fiscal year was a record-breaking 3.1 trillion. This was far in excess of any previous year, even adjusted for inflation. During 2009, for example, the deficit reached “only” $1.4 trillion.

The total national debt is now approaching $30 trillion, and was $27.7 trillion at the end of the fourth quarter of 2020. Taken as a percentage of GDP, the debt is now exceeding even the extraordinary levels reached during the Second World War, making the current fiscal crisis the largest one, proportionally, to have ever occurred during peace time. In terms of annual deficits, only three years in American history exceeded 2020’s deficit as a percentage of GDP: 1943, 1944, and 1945.

The administration has yet to even begin talking about scaling back these astronomical spending levels. This is partly due to the fact that April’s jobs report was such a disappointment. In spite of predictions of over a million new jobs, the actual estimate came in around 266,000. As I noted in an article last week, a lack of new hires is due partly to the fact that more than nine million American workers are collecting some form of unemployment insurance payment. But that’s not all. Over the past year, 4 million workers have left the labor force altogether for a variety of reasons, and they’re not actively looking for work.

To some this might suggest it is time to scale back unemployment payments, but the Biden administration used the job figures to justify additional spending, claiming “we’ve got work to do.” What he means is: “we need to spend more money.”

These record-breaking deficits are also likely to mean more monetization of debt. Last March, after several months of some small declines in the size of its portfolio, the Fed again began buying up Treasuries and other assets to inject liquidity into the financial sector yet again. The Fed was already sitting on $4 trillion in assets in early 2020, but by June, total assets had skyrocketed to $7 trillion. Much of this was Treasuries, since as Bloomberg reports:

When the Fed began buying Treasuries in March 2020 to calm the market during the pandemic panic, it targeted the sectors that were under the most stress, in quantities as large as $75 billion a day. By June, the program stabilized at $80 billion a month…

In other words, the debt is being converted to cash. Needless to say, these purchases are badly needed not just to “calm the market” and keep hedge funds and bankers liquid. The purchases are part of an essential game to augment demand for Treasuries, and thus keep interest rates low so the US government doesn’t face an explosion of its total costs for debt service. In 2020, the US spent approximately $350 billion on interest payments. (For context, the budget for all veterans’ benefits is about $250 billion.) This number is only going to go up and consume more and more of the federal budget. Moreover, if interest rates go up, interest payments will increase even faster than the total debt.

Since January, the yield on the 10year Treasury has increased 50 percent from approximately 1 percent to 1.5 percent. If this trend continues, the US taxpayer will be on the hook for big increases in interest payments which will have to come out of other areas of the budget, or by printing more money which will only further devalue the dollar.

There’s no easy solution, and this is why those old-fashioned, fuddy-duddy economists have been warning against runaway spending for years. Eventually the taxpayers have to pay for it, either through a ruined currency, or by slashing government spending in other areas. Or through tax increases. But for now, politicians will keep kicking that can down the road, and hope they can blame someone else when the reality becomes undeniable.

Tyler Durden

Fri, 05/14/2021 – 14:40

via ZeroHedge News https://ift.tt/2RivINH Tyler Durden