TSMC Set To “Double Down” And Vastly Increase U.S. Semi Production Investment In Arizona

At the beginning of May, we noted that Taiwan Semiconductor was considering bolstering its production in the U.S., and that President Biden’s Commerce Secretary was urging more domestic production. Now, it looks like TSMC could be within striking distance of a serious U.S. expansion.

The chipmaking giant is “weighing plans to pump tens of billions of dollars more into cutting-edge chip factories in the U.S. state of Arizona than it had previously disclosed”, a Reuters exclusive revealed Friday morning.

The company had already said it was going to invest $10 billion to $12 billion in Arizona. Now, the company is mulling a more advanced 3 nanometer plant that could cost between $23 billion and $25 billion, sources said. The changes would come over the next 10 to 15 years, as the company builds out its Phoenix campus, the report notes.

The move would put TSMC in direct competition with Intel and Samsung for subsidies from the U.S. government. President Joe Biden has proposed $50 billion in funding for domestic chip manufacturing – a proposal the Senate could act on as soon as this week. Intel has also committed to two new fabs in Arizona and Samsung is planning a $17 billion factory in Austin, Texas.

TSMC CEO C.C. Wei said on a call last month: “But in fact, we have acquired a large piece of land in Arizona to provide flexibility. So further expansion is possible, but we will ramp up to Phase 1 first, then based on the operation efficiency and cost economics and also the customers’ demand, to decide what the next steps we are going to do.”

TSMC has also said that talks in Europe regarding expansion have gone “very poorly”, increasing the likelihood that the chip giant will be focused more on the U.S.

There are no plans for a plant in Europe, a TSMC spokesperson said.

TSMC has, however, been poaching talent from companies like Intel. The company recently hired 25 year Intel veteran Benjamin Miller to head up its human resources in Arizona. TSMC chairman and founder Morris Chang has warned about a thin talent pool in the U.S., stating: “In the United States, the level of professional dedication is no match to that in Taiwan, at least for engineers.”

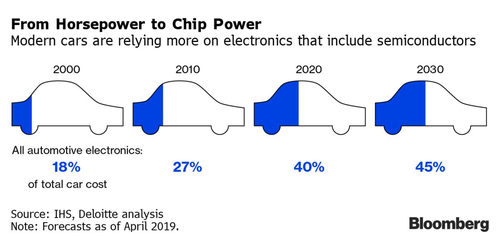

Commerce Secretary Gina Raimondo, earlier this month, called for a “major increase” in U.S. production capacity of semiconductors. She commented: “Right now we make 0% of leading-edge chips in the United States. That’s a problem. We ought to be making 30%, because that matches our demand. So, we will promise to work hard every day, and in the short term also see if we can have more chips available so the automakers can reopen their factories.”

“In the process of building another half a dozen fabs in America, that’s thousands of Americans that get put to work,” Raimondo commented.

We also noted recently that Stellantis said there would be “no end in sight” to the shortage and that the company was making changes to its lineup, including changing the dashboard of the Peugeot 308, to try and adapt to the crisis. Ford was another auto manufacturer to slash its expectations for full year production as a result of the shortage this year.

The chip crisis has hit the auto industry so hard that it has forced rental car companies – already under immense pressure from ride sharing companies – to buy up used cars at auction to fulfill their inventory needs, Bloomberg also noted earlier this month.

Intel’s CEO, speaking on 60 Minutes earlier this month, said: “We have a couple of years until we catch up to this surging demand across every aspect of the business.” Days prior, we wrote that Morgan Stanley had also suggested the shortage could continue “well into 2022”.

Prior to Ford’s report, we wrote about how the chip shortage was becoming a self-fulfilling prophecy, due to a shortage of chipmaking equipment. In the days leading up to that report, we wrote that Taiwan

In early April, we wrote that U.S. exporters of semiconductor chipmaking tools were struggling to get licenses to sell to China. The U.S. government had been dragging its feet in approving licenses for companies to sell chipmaking equipment to Chinese semi company SMIC, we noted at the time.

Tyler Durden

Fri, 05/14/2021 – 18:00

via ZeroHedge News https://ift.tt/3w3kLOP Tyler Durden