3 Reasons Why Goldman Now Sees Almost No Upside For Stocks In 2021

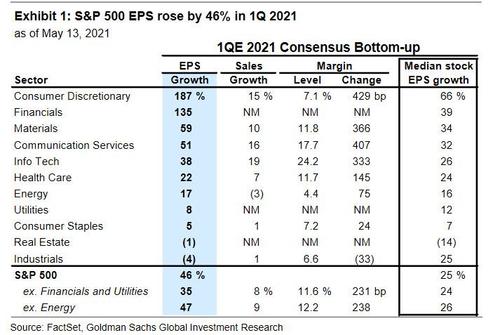

Just over a month ago, in our preview of earnings season, we said that “Q1 earnings will be stellar, but are fully priced in and only guidance will matter“, and sure enough the broader market is now below where it was a month ago despite the strongest earnings season in modern history: with 90% of S&P500 companies having reported, the results show EPS rose by 46% year/year…

… the fastest pace since 1Q 2010, while a whopping 68% of S&P 500 firms have beat consensus by more than one standard deviation, a record high. Even crazier, equity analysts expected EPS growth of 20% at the start of the season, but realized growth was more than double that 46% with Consumer Discretionary (+187%) and Financials (+135%) posting the strongest results. Behind these shockingly good results? Better-than-expected net profit margins… although with inflation soaring, fears are spreading that profit margins are about to get clobbered.

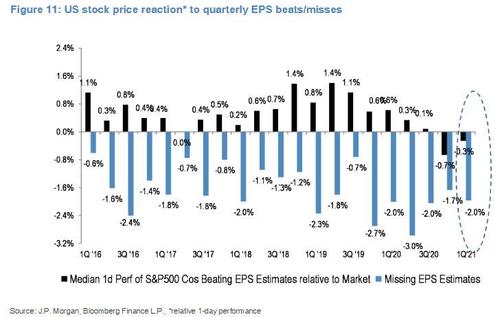

It’s this growing realization that “goldilocks” is behind us and profit-crushing inflation – or worse, stagflation – lies ahead that explains why the market was not impressed and punished both companies that missed as well as those that beat expectations:

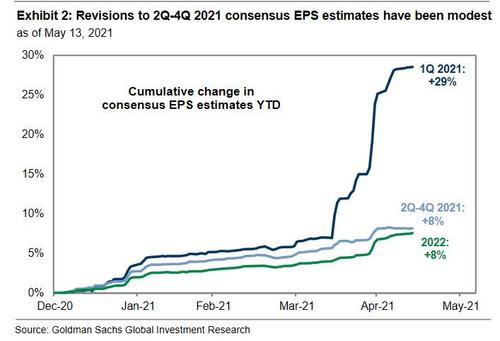

It’s also why as Goldman notes, even though 1Q EPS came in 20% above expectations, analyst estimates for 2Q-4Q 2021 and 2022 have been revised up by less than 5%.

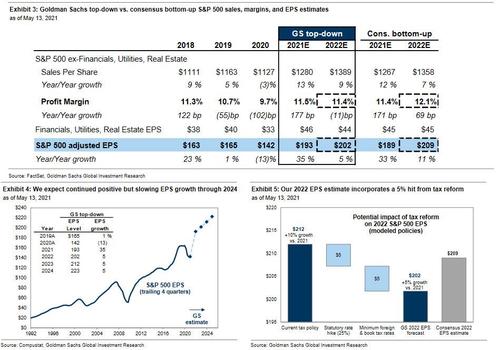

Here Goldman disagrees with the near-term consensus and as chief strategist David Kostin writes on Friday, “we raise our 2021 EPS forecast to $193 (from $181), driven by a roughly equal contribution from 1Q beats and our expectation of stronger EPS in the remainder of 2021. We also raise our 2022 EPS estimate to $202 (from $197). The combination of global reopening, elevated consumer savings, and strong corporate operating leverage will drive sharp recoveries in both economic and earnings growth. GDP growth is generally the primary driver of earnings growth. Our economists expect real US GDP growth will average +7% in 2021 and +5% in 2022. Following EPS growth of 35% in 2021 and 5% in 2022, we forecast growth of 5% in 2023 and 5% in 2024 as GDP growth decelerates to trend (see Exhibits 3 and 4)”

The key reason, however, why Goldman is feeling especially optimistic on the near-term is another blockbuster quarter for tech names as well as bank which stand to benefit from sharply higher rates (unless of course we get a huge flattener next):

At the sector level, our $12 upward revision to 2021 EPS is driven primarily by Financials (+$7) and Info Tech (+$3). The two sectors accounted for half of the beat vs. consensus 1Q estimates. Financials benefited in large part from the release of $10 billion in reserves. While future reserve releases are difficult to forecast, our Banksanalysts estimate only 36% of the reserves built since the peak of the COVID crisis have been released. Info Tech earnings, particularly among the largest stocks, continued to impress; the sector posted sales growth of 19% and record high margins of 24.2% in 1Q 2021. Tech’s growing share of S&P 500 revenues have helped lift S&P 500 profit margins back to the 3Q 2018 record high of 11.6%

A strong 2021 notwithstanding, Goldman is far less optimistic about 2022 where its EPS estimate of 202 for the S&P is $7 below consensus largely due to expectations of higher corporate tax rates next year:

We assume a smaller version of President Biden’s tax proposal will be passed later this year. Our EPS estimate assumes a hike in the federal statutory corporate tax rate from 21% to 25% as well as a higher tax rate on foreign income. The 5% earnings impact of tax reform that we model reduces our 2022 EPS estimate from $212 (10% growth) to $202 (5% growth) – see Exhibit 5 above. Both our investor conversations and the performance of our tax baskets suggest portfolio managers have not incorporated higher taxes into their forecasts, meaning negative revisions to 2022 EPS are likely later in the year.

This, together with other factors is why Goldman is turning increasingly cautious on the market and unlike many of its Wall Street peers, has refused to chase price action higher by lifting its S&P price target. Instead, as Kostin admits, Goldman’s year-end price target remain 4300 for 2021 (+3% from today) and just 7% higher – or 4,600 – for 2022, reflecting Goldman’s expectation that US equities will continue to appreciate, “albeit at a slower pace than has characterized the past 12 months.” As Kostin also notes, this dynamic is consistent with the typical pattern as economic growth peaks and starts to decelerate – i.e., the best is now behind us – which the bank’s economists believe is currently the case in the US and will be true on a global basis later this year. This phase of the cycle is also consistent with the view that earnings growth will drive returns while valuations cease to expand.

Combining these observations, Kostin concludes that what little upside is left for the S&P, it will come entirely from earnings growth as valuation will only shrink going forward, or as Kostin puts it: three factors will prevent further valuation expansion during the remainder of 2021:

- Decelerating US growth,

- a real rate-driven rise in interest rates

- the likely passage of tax reform.

While we previously expanded on point 1 here last week, regarding point two Goldman writes that its rates strategists expect the 10-year Treasury yield to rise to 1.9% in 2021 and 2.1% in 2022. And with breakeven inflation now a blistering 2.5%, the highest since 2006…

… they expect higher yields will be primarily driven by real rates, a mix that has historically been less favorable for equities. In addition, echoing what he wrote above, Kostin says that the passage of Biden tax reform – even if watered down substantially – later this year should weigh on equity multiples. Along with higher corporate rates, Goldman’s political economists expect the capital gains tax rate for those making more than $1 million in annual income will rise to roughly 28% (below the 43% proposed). And although past capital gains hikes have been associated with lower equity prices and allocations ahead of the hike, these effects were ultimately short-lived.

Finally, since Goldman still expects the S&P to rise modestly (instead of dropping), and since all of this upside will come from profit increases, the bank expects the S&P 500 P/E multiple to remain flat at roughly 21-22x through 2022.

And addressing his preferred valuation measure (since it is the only one that says markets are not a crazy bubble right now), Kostin says he models the S&P 500 equity risk premium as a function of growth expectations, policy uncertainty, the size of the Fed balance sheet, and consumer confidence. Here, Kostin’s model suggests that the ERP will continue to decline and more than offset higher interest rates in 2021 as the global economy reopens.

So despite predicting no valuation (multiple) expansion in 2021, Goldman’s forecasts imply a nosebleed inducing NTM P/E of 21.3x at year-end 2021, which would rank in the 93rd percentile since 1976 (i.e., crazy asset bubble), but a yield gap vs. Treasuries of 280 bp that would rank in just the 42nd percentile. Should yields jump materially higher than Goldman’s 2.1% 2022 year-end target (and according to many they will), then naturally all bets are off.

Tyler Durden

Sat, 05/15/2021 – 17:00

via ZeroHedge News https://ift.tt/3tKe56E Tyler Durden