COVID ‘Billionaire Boom’ Has Seen Aggregate Wealth More Than Double To $13 Trillion

America’s billionaire class is now the second most “bloated” in the world after…Sweden?

If that sounds strange, it’s just one example of how the global explosion in wealth is impacting the world in unexpected ways.

This is according to research by FT contributing editor Ruchir Sharma, who has been tracking the global rise of billionaires over the past decade while devising metrics to allow for an apples-to-apples comparison. In this way, Sharma has been able to determine whether individual billionaires derived their wealth from “good” sources (“clean” industries like tech or manufacturing) vs. “bad” billionaires who inherited their wealth, or built it in more corrupt corners of the economy, like real-estate or natural resources (primarily oil).

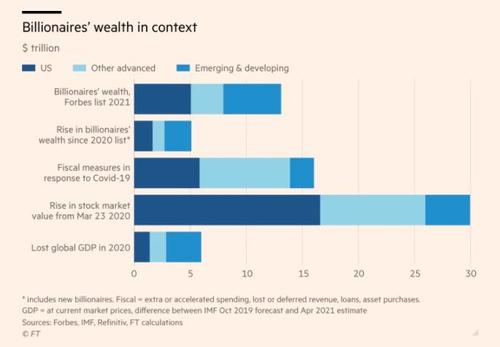

The tremendous surge in prices of assets from stocks, to homes, to used cars to collectibles has benefited the wealthy most of all. Last year, China led the world in billionaire-creation, with 238 billionaires created, roughly one every 36 hours, bringing the country’s total to 626. In aggregate, billionaire wealth climbed to $13 trillion from $5 trillion in the span of a year.

Sharma highlighted wealth inequality across a group of developed and developing economies by comparing total billionaire wealth to GDP, the annual aggregate value of goods and services produced in a given economy.

Source: FT

The surge in equity valuations over the past year accrued primarily to “good” billionaires, as Sharma characterized them (though of course AOC and those like her believe that there are no ‘good’ billionaires, and that billionaires’ existence is a ‘policy error’). “‘Good’ billionaires still rule the class,” he said.

Sharma also found that national reputation had little bearing on billionaire wealth accumulation over the past year, which saw billionaires in left-leaning France see their total assets jump from 11% to 17% of French GDP. Meanwhile, in conservative Britain, billionaires share of wealth remained flat.

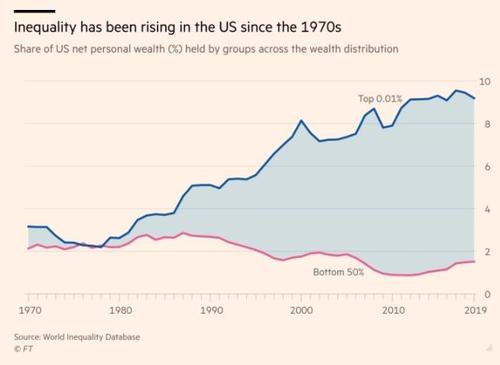

While the population of billionaires exploded in China (something that may have informed Beijing’s crackdown on its tech billionaires) inequality in the US actually decreased slightly, perhaps due to the stimulus that stuffed bank accounts of working-class Americans and those who lost work.

While Jeff Bezos gets a lot of hate as a modern-day robber-baron, Sharma points out that Bezos’ wealth is actually smaller than the Rockefeller fortune in its heyday.

The scale of American wealth is also worth considering in context. As the world’s richest man, Jeff Bezos’s $177bn may seem mind-boggling. But at 0.8 per cent of GDP, it is far from Rockefeller wealth, which at his peak amounted to 1.6 per cent of GDP. There are, however, many real Rockefellers in other countries, including five in Sweden, two each in Mexico, France, India and Indonesia, and one each in Spain, Canada, Italy and Russia. Top of the Rockefellers list are self-made fashion king Amancio Ortega of Spain, telecom titan Carlos Slim of Mexico and Bernard Arnault of France; each has a fortune equivalent to more than 5 per cent of his home country’s GDP.

But there are some billionaires who are more wealthy than Rockefeller, using a ratio of their total wealth to the annual GDP of their respective home economy.

One notable recent development: In the emerging world, Russia has long held the title of world capital for “bad” billionaires. But last year, it ceded that title to Mexico. The 2020 surge took Mexico’s share of “bad” billionaire wealth up to 75%, leaving Russia second worst among the big developing nations, at 60%, or 3x the average for emerging nations.

The backlash to the “billionaire class” typically increases in correlation with the pace of their wealth accumulation. Whatever happens next in terms of the evolution of public attitudes toward the concentration of wealth in family fortunes will depend on where the boom goes from here.

Tyler Durden

Fri, 05/14/2021 – 20:40

via ZeroHedge News https://ift.tt/3buB5QH Tyler Durden