“This Is All About Stagflation… The U.S. Is Walking Into The Early Stages Of The Fourth Turning”

By Larry McDonald of The Bear Traps Report

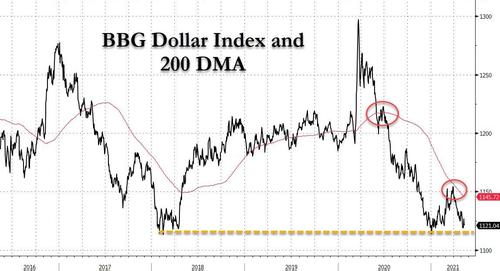

We believe the U.S. is walking into the early stages of the Fourth Turning, a subject entertained below. In this note we break down the ideal 2020-2030 portfolio and why it is so different from the 2010-2020 vintage. Above all, by now it should be clear to a five year old; Global Central Banks are working together in a dollar containment regime. With conviction, we laid out this thesis a year ago (April 2020) in our “Lessons from Omaha” and it became the foundation under our overweight positioning in commodities, global large cap value, and emerging markets.

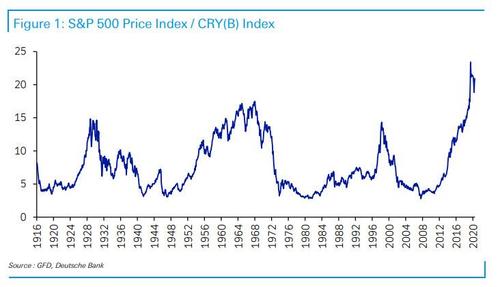

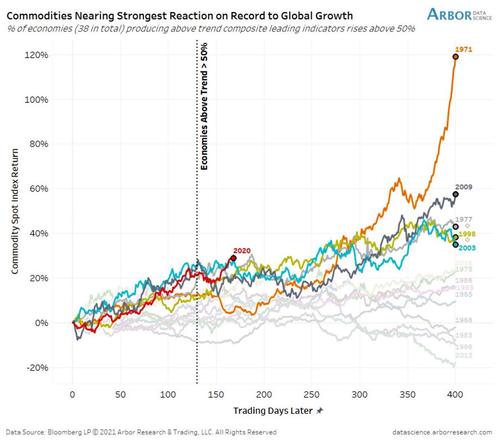

The good news is, the commodity cycle is still in the early innings.

There are trillions of U.S. dollars married to deflation bets (fixed income bonds and tech stocks) and the lawyers are writing up the divorce papers as we speak. Unintended consequences are popping up weekly, the latest variety points to a significant labor shortage developing in the U.S. with colossal side effects moving our way.

It’s going to be hilarious. Just when the last economist threw in the Phillips Curve towel, wrote the long winded obituary it will come roaring back to life. Wage inflation is about to explode, and this sword is swinging in the direction of profit margins.

Above all, the Fed is staring down the barrel of runaway inequality, inequality that the Fed itself has created. The American Dream just isn’t the 1950s-2000s bright blue, a touch of grey has moved in forging left wing populism. If you listen carefully to U.S. Treasury Secretary Janet Yellen and Fed Chair Jay Powell, they are focused on U 6 unemployment near 11% and the 9 million Americans who have left the Non Farm Payrolls since January 2020.

Now listen to the Bank of Canada and the Bank of England, planet earth has new alpha male central banks positioning themselves FAR more hawkish than the FOMC – dollar bearish. Strategically so, it’s all part of the plan. These brain trusts have FINALLY figured out a runaway dollar will obliterate emerging market balance sheets loaded with fresh and deep, Covid 19 wounds.

The $64T of global GDP outside the U.S. is stabilizing relative to the $20T inside the 50 U.S. states. This is a colossal dollar bearish driver just what Powell placed on the menu. Today, inflation expectations are finally moving faster than bond yields, placing a strong bid under the emerging market equities, and delivering a gold silver tailwind that is picking up speed. The dollar is the near term problem solver, but once they lose control of the beast they will move face to face with the inflation shock around the corner.

An interesting market development this week was Treasuries rallying despite commodities continuing to surge. Bonds likely rallied with growth stocks in major pain again (investors looking for safety) however; wheat, platinum, corn, soybeans, crude oil, etc. were ALL green, so this was not a ‘deflationary scare’.

“This is all about stagflation. I think the yield curve is going to flatten, front end less anchored. The Fed is handcuffed. Not good. Inflation is going to choke growth in 3q/4q into 2022… This is a big problem for high yield and small caps in the longer term.“ – Senior Credit Portfolio Manager

But first inflation gets really hot.

“Larry I spoke to a number of our Food Brokers today (they represent man y manufacturers). Of the 30 Consumer Products Manufacturers, they represent 12 who have already taken a price increase this year. Three took Price Increases YESTERDAY. Increases range from 7% to 10%. (Everything from Frozen Potatoes to Baby Food going up). The companies that are not raising prices are reducing product sizes ( Hidden Cost Increase ) or reducing promotions. Net, Net a Hidden Price Increase. The majority of manufacturers give a 60 90 Day notice on price increases. The increase to consumers in stores will hit in Q3/Q4 2021, and Q1 2022″

Even billionaire Sam Zell is now pitching gold as an antidote to 1970s style inflation: “Obviously one of the natural reactions is to buy gold, it feels very funny because I’ve spent my career talking about why would you want to own gold? It has no income; it costs to store. And yet, when you see the debasement of the currency, you say, what am I going to hold on to? Oh boy, we’re seeing it all over the place,” Zell said of inflation.

“You read about lumber prices, but we’re seeing it in all of our businesses. The obvious bottlenecks in the supply chain arena are pushing up prices. It’s very reminiscent of the ‘70s.”

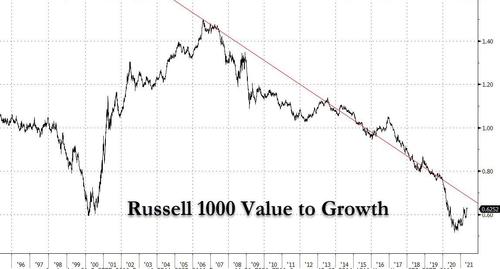

Bloomberg’s Commodity Spot Index hit its highest level in 9 years this week. This is directly correlated to the continued rotation from growth to value equities. Higher inflation and higher yields means a higher discount rate for the net present value of future cash flows. Growth equity valuations discounted DECADES of future cash flows in 2020 when credit risk was ‘taken off the table’. These cash flows are now being eroded by inflation expectations. Meanwhile, the cash flows coming fro m commodity producers will likely surge higher with inflation.

The Long View – The reversal in the Russell 1000 value to growth ratio looks eerily like the early 2000s reversal. This points to a looooong way to go in the value vs. growth trade (value outperformance to continue )… A decade of austerity, tea parties, taper tantrums, brexits trade wars, covid has pushed trillions into overcrowded deflation assets. Exit visas are in many hands today.

Stay overweight global value, EM, and commodities. The tremors have joined us nearly every month this year, but the quake will soon have assets pouring out of tech in search of inflation protection.

Millennials and the Fourth Turning

The commodity bull case and the Fourth Turning go hand in hand. Also known as the Strauss Howe generational theory, our awareness is crucial here. Discovered by William Straus and Neil Howe, historical events are related to repeated, cyclical generation types. Each generation starts a fresh era (a turning) lasting about 20-25 years, after having grown up in the prior era. Every four generations equals a “saeculum” or a long human life of 80-100 years. The Fourth and last phase of a saeculum is a crisis. There follows a First Turning, a recovery. During the recovery generation, community values dominate. The next generations after that attack the communal institutions in the name of autonomy , freedom, and individualism. This eventually leads to another crisis .

On the balance sheet the good news is over the next 15 years $65T to $70T will pass from Baby Boomers and Gen Xers to Millennials. The bad news is the $30T of U.S. national debt and $160T of unfunded liabilities that will be hoisted upon these blossoming youngsters. After a colossal feast at the dinner table, Millennials are NOT happy with being left the check! Can you blame them?

The Fourth Turning gets rid of the old order and replaces it with a new one. The First Turning is “the High,” followed by “the Awakening,” followed by “the Unraveling,” followed by “the Crisis,” which is the Fourth Turning. After that, there is another First Turning, another “High.” The last 1st Turning, the last “High,” was the generation of the post World War II era, starting in 1946. It ended with JFK’s assassination. During “the Awakening,” the Second Turning, formerly beloved institutions are criticized and the focus shifts to spiritual independence. Social progress leads to exhaustion with the discipline that created it. Self awareness becomes more important. The most recent Second Turning lasted from the campus and racial unrest of the 1960’s to the rejection of high taxes in the 1980s. The Third Turning, “the Unraveling,” is quite different than the First. At this point social institutions are weak, and people have lost faith in them. Individualism is now at its height. People of this generation just want to enjoy themselves. Society is not cohesive. The last Third Turning began in the 1980s through the 1990s economic boom and our culture wars.

Then comes the Fourth Turning. The crisis can be extreme and take the form of a war or revolution or civil war. The nation’s survival is at stake. In response, old institutions are replaced with new ones. The slate is wiped clean in a period of creative destruction. A new consensus is formed from selective synthesis of certain ideas generated by both sides of the opposing camps from the prior period.

The last Fourth Turning began with the crash of 1929 and ended with the conclusion of WWII. As traumatic as this period was, it was also foundational for the world we live in today, but that world is going away as new foundations are being prepared. The G.I. generation was the generation of heroes. Born between 1901 and 1924, they had guts, self confidence, and a collective view. In many ways, so does the Millennial Generation, with its confidence in collective action and sensitivity to others (politeness). During the generation of crisis, the nation itself appears to society to be at risk. As a result, profound secular change occurs. The external orders reconfigure, and private behavior goes through profound change. These Fourth Turning crises are not purely bad, provided one survives them.

We are in the Fourth Turning now. It began with the collapse of Lehman Brothers and the crash it engendered. The rise of left wing populism (think AOC) is classic Fourth Turning.

This helps contextualize who the Millennials (also known as Gen Y) really are. And they clearly aren’t Boomers. They hold very different ideals on the government’s role in society, on community, on the goals of the nation, on markets. Millennials were raised by helicopter moms who convinced each one that they are special, but also on the ideal of cooperation. They were protected, coddled, and schooled in the value of teamwork. They are highly attached to their families. They build through consensus and are personally most confident once team consensus has been established. And they care about the world at large. This is just the type of generation that will create the new world order out of the crisis and conflict of the Fourth Turning.

When polled about what is more important, individualism or community, Boomers split close to 50% 50%, but Millennials favor community overwhelmingly, 71% 29%. The favoriting of the community over individualism is irrespective of political party affiliation. These forces are large scale MMT (modern monetary theory) debt forgiveness drivers and are NOT deflationary. Bullish commodities, ten year view.

Generation X, the generation after the Baby Boomers, born 1961-1981, was raised in the opposite way of the Millennials: they were left alone by parents focused on their own self awareness and voyages of self discovery. They were taught to survive on their own, to exercise personal agency. Generation X are often the parents of Millennials. Generation X is also referred to as the “latchkey generation” since they enjoyed (or suffered) much less parental oversight vs prior generations as a result of much higher divorce rates and more mothers in the workforce. This is the disaffected and cynical generation of punk and heavy metal. However, in mid life they often achieve a work life balance precisely because of their rejection of their Baby Boomer parents’ self absorption. Thus, they spent and spend much more time actively and directly engaged in raising the next Greatest Generation: the Millennials. So, it is the Millennials’ collectivism that will create a new cultural norm out of the crisis of the Fourth Turning.

Tyler Durden

Sat, 05/15/2021 – 16:35

via ZeroHedge News https://ift.tt/3uSxljx Tyler Durden