This Is Not The Inflation You Are Looking For, Move Along

“This is not the inflation you are looking for. Move along.”

In recent weeks a veritable cottage industry of financial experts has cropped up, seeking to defuse ever louder fears that the burst in inflation observed in the past month is “transitory” and won’t impact the Fed’s medium-term thinking or its timeline for tapering/liftoff (not least of all due to the growing political blowback against soaring inflation as captured in “Biden Aides See Political, Not Economic, Peril in Inflation Data” and “Inflation fears grow for White House“). The latest to hammer the “transitory” point is Goldman economist David Mericle who has doubled down on the bank’s sanguine view on inflation, writing in a Sunday note that the data surprises of the past two weeks “have left our Q1 2022 forecast for the start of QE tapering unchanged” adding that “if our taper timeline is right, then liftoff will probably not be on the table for about two years.” This is because the bank’s economists believe that that the inflation risks that matter most for the Fed’s rate hike decisions are not those that have emerged in the past few weeks, but rather those “that will remain relevant at a multiyear horizon.”

So what are those multiyear horizon inflationary risks? Let’s dig in.

First, we start with Goldman concession that inflation is indeed running amok:

The last ten days produced a flurry of startling data surprises that added fuel to inflation fears: a 0.7% increase in average hourly earnings in April and even larger gains in low-wage industries, the largest increase in core CPI in 40 years, and a 0.4pp jump in the University of Michigan’s measure of long-term household inflation expectations to the highest level in a decade

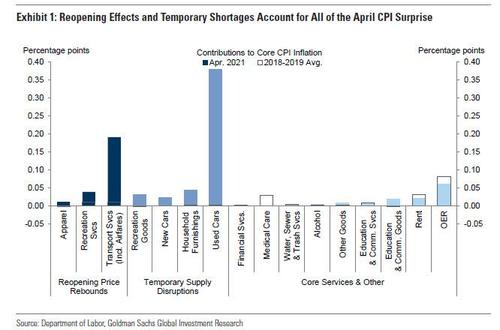

That said, when looking at last week’s show-stopping CPI print, which Goldman admits was “a huge upside surprise” it is one of little lasting significance according to the Goldman and here’s why. As shown in the next chart which decomposes the largest increase in the core since 1981 by category, the main contributors fall into two groups:

- travel and related services categories where prices are experiencing quick reopening rebounds from deeply depressed levels, and

- goods categories like used cars where a pandemic-induced demand surge has run headfirst into temporary shortages, production bottlenecks, and supply chain disruptions. In contrast, other large core service categories remained soft in April.

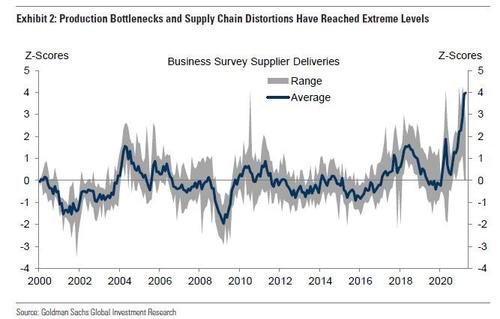

While these forces might also generate high inflation prints in coming months – as the full normalization of prices in pandemic-depressed categories like airfares as reopening progresses would add another 30bps to core CPI and 15bps to core PCE, while supply chain disruptions including the semiconductor shortage also remain severe, as shown in the next chart and their impact on goods prices has probably not yet run its course…

… Goldman again trots the familiar party line that “these disruptions and shortages look unlikely to boost inflation on net beyond this year”.

Many arose because producers initially made the natural assumption last year that demand would fall in a recession, as it usually does. Instead, fiscal support boosted household incomes and the unavailability of services led to a surge in demand for goods, resulting in the supply-demand imbalances that have pushed up prices. But this problem should be resolved from both directions over the rest of the year: producers are ramping up to meet demand and consumers are increasingly free to shift their consumption basket back toward services. And encouragingly, the most prominent example of the current supply chain disruptions—the shortage of microchips for autos—is set to fade later in Q2.

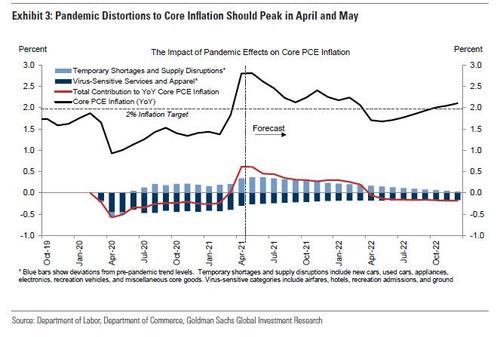

It remains to be seen if the chip shortage somehow resolves itself in the next month, but until we wait here is another chart from Goldman, this time showing the impact of reopening effects and temporary shortages on the year-on-year rate of core inflation, which Goldman believes is likely to peak in April and May, and should gradually fade later this year and will turn negative next year as prices in categories such as used cars normalize from their current elevated levels.

Here Goldman is quick to counter that its observations do not mean that there are no inflation fears. After all, just hours earlier we discussed another Goldman note according to which the bank saw “substantial home price appreciation for at least a couple more years”, in which the bank projected that we projected “that shelter inflation will exceed 4% in 2023, a higher rate than at any point in the prior economic cycle”, even surpassing the housing bubble of 2006-2007.

How does one reconcile the two? As Goldman’s econ team explains, it’s not that there are no inflation fears “but rather that investors should focus on the right risks, those that could have more lasting significance.“

Going down the list, Goldman starts off with the broadest upside inflation risk which is the possibility that fiscal support, pent-up savings, and easy financial conditions could persistently push demand well above potential GDP, leading to a serious inflationary overheating: “our forecast instead implies that GDP will rise about 1% above our estimate of potential, which we would view as consistent with inflation rising moderately but not dramatically above 2%.”

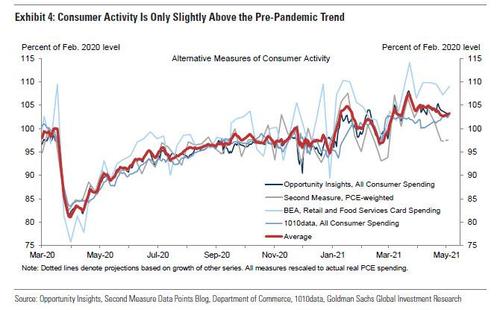

Here, Goldman notes that “so far the consumer spending data appear roughly consistent with our expectations” and the next chart shows that Goldman’s consumer spending tracker jumped after both rounds of stimulus checks, but that spending is now running about 3% above the pre-pandemic level, meaning it is only about 1% above the pre-pandemic trend (Friday’s disappointing retail sales only confirmed this hypothesis). In other words, while further reopening is likely to raise spending, the boost from the stimulus checks is likely to continue to fade.

Next, Goldman lists three specific upside risks that could have more meaningful and lasting consequences for inflation and monetary policy than the current post-pandemic price spikes.

Risk #1: A sharper rise in wage growth

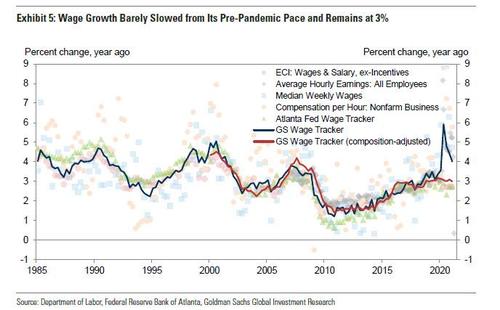

The first risk is that wage growth could rise to a much faster pace than reached last cycle if current signs of worker shortages and labor market tightness prove more persistent than many expect. The starting point for wage growth is unusually high for an economy emerging from a recession. The next chart shows that Goldman’s composition-adjusted wage growth tracker barely slowed from its pre-pandemic pace and remains at about 3% year-on-year.

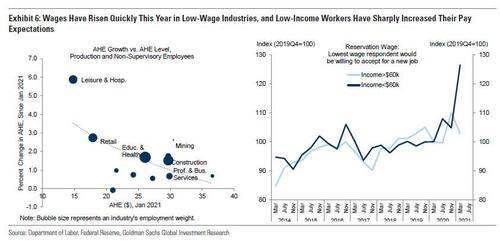

Adding fuel tot he fire, a number of recent labor market indicators hint at an acceleration. Average hourly earnings rose 0.7% in April, wage growth is up sharply over the last year in low-wage industries and industries with particularly tight labor markets, and lower-wage workers report much higher pay expectations for potential jobs.

Moreover, a range of other indicators discussed here, such as a very high job openings rate, a high quits rate, worker surveys reporting that it is easy to find a job, and employer surveys reporting that it is hard to find workers, all point to a very tight labor market where workers have the upper hand.

Incidentally, even Goldman has no problems identifying the reason for this record labor market imbalance: as the bank admits, “the underlying reason seems to be that effective labor supply is much more constrained than the 6.1% unemployment rate suggests, owing to unusually generous unemployment insurance benefits and lingering virus-related impediments to working” but “we expect both of these temporary factors to fade by the fall, which should relax these supply constraints and cool the current wage pressures.”

Risk #2: A multi-year boom in home prices boosts rent inflation

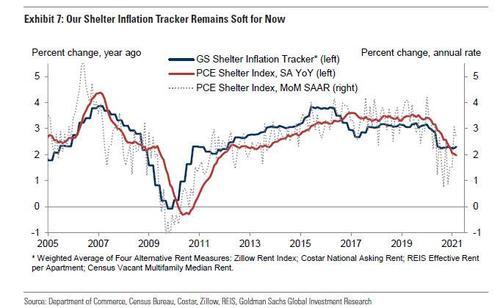

The second risk is one we discussed earlier, namely that a multiyear boom in US home prices could drive shelter inflation much higher. The chart below shows that shelter inflation has fallen during the pandemic, and Goldman’s shelter inflation tracker suggests that rent growth should remain modest for the time being.

But the shelter category is highly cyclical and is very likely to accelerate as the economy improves and the effects of temporary pandemic drags like eviction moratoriums fade. On top of this, Goldman expects that a national housing shortage will fuel substantial house price appreciation for at least a couple more years. Bottom line: “the tightest national housing market since the 1970s nevertheless poses some additional upside risk.”

Risk #3: Temporary price spikes raise inflation expectations substantially

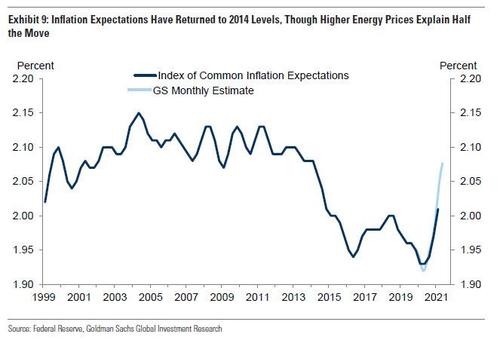

The third risk noted by Goldman is that the current price spikes caused by temporary pandemic effects could have a more lasting impact if they raise long-term inflation expectations substantially (i.e. transitory proves to be non-transitory). Last week brought hints in this direction, including a 0.4% jump in the University of Michigan’s measure of long-term household inflation expectations, a modest increase in long-term inflation expectations in the Survey of Professional Forecasters, and further increases in market-implied inflation compensation.

Goldman’s own monthly version of the Fed’s index of Common Inflation Expectations (CIE) has risen further to 2.08% in a preliminary May reading. The Fed’s index is smoothed, and if the underlying measures held steady at their current levels, the bank estimates that the CIE would eventually rise to 2.1%.

Another point to note is that at least half of the rebound over the last year appears to reflect mundane co-movement with gasoline and other energy prices, which correlate strongly even with longer-term expectations. The remainder of the increase likely reflects other factors, such as the latest price spikes and the Fed’s new average inflation targeting framework. So far, Goldman concludes, that “the increases are healthy, indeed, as Chair Powell said at his last press conference, the Fed’s new framework will only succeed in centering inflation on the 2% target if it succeeds in boosting inflation expectations.” But if the CIE moved well above its historical range as news of sharp prices increases makes headlines this year, Goldman warns of upside risk to its own inflation forecast.

Finally, what does all this mean for Goldman’s inflation outlook and what the Fed will do next?

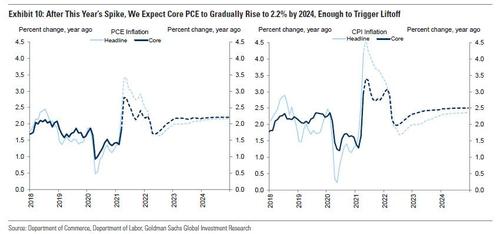

As Goldman’s economists conclude, all three of these sources of upward pressure on inflation are expected to materialize to some degree in the years ahead. Indeed, each of them is an essential contributor to our forecast that core PCE inflation will reach 2.1% by end-2022, 2.15% by end-2023, and 2.2% by end-2024, higher numbers than reached last cycle and enough to generate liftoff in early 2024.

But, as a surprisingly cautious Goldman concedes in its final paragraph, “each of the three factors discussed above also carries some additional upside risk that we take seriously and watch closely in our Monthly Inflation Monitor. While another month of rapidly rising airfares or used car prices would probably not change our medium-run inflation views much, substantial surprises on these three key risks likely.“

In closing, it’s worth reminding readers that earlier today Morgan Stanley’s economists also warned that there is just one substantial threat to the “red hot global recovery”, and that would of course be inflation, i.e., “the biggest threat to this cycle is an overshoot in US core PCE inflation beyond the Fed’s implicit 2.5%Y threshold – a serious concern, in my view, which could emerge from mid-2022 onwards” but like Goldman, MS economists don’t see much risk of runaway (or hyperinflation) just yet and is why Morgan Stanley’s chief US economist Ellen Zentner still expects the Fed to signal its intention to taper asset purchases at the September FOMC meeting, to announce it in March 2022 and to start tapering from April 2022.

Tyler Durden

Sun, 05/16/2021 – 19:09

via ZeroHedge News https://ift.tt/2RWfCcG Tyler Durden