The Secret…Is Out!

Authored by Sven Henrich via NorthmanTrader.com,

The secret is out. It can no longer be denied and it’s up to each and everyone of us to help bring the secret to the forefront of public awareness.

For the mainstream financial media won’t do it, indeed they allow the guardians of the secret to continue to deny its existence.

For years those of us who have been critical as to the negative consequences of easy money policies, QE in particular, were dismissed and mocked as “QE conspiracists” and even as “swashbuckling pirates of free market capitalism” by central bankers directly including yours truly:

1 thing I’ve learned abt twitter is the louder the critic, generally the thinner the skin. I confess finding amusement in needling critics calling them conspiracists or goldbugs. Its fun to watch swashbuckling pirates of free market capitalism get easily upset. I mean no offense. https://t.co/dMgSsk2pBR

— Neel Kashkari (@neelkashkari) January 17, 2020

It’s easier to mock and ignore with a Tweet and then go into hiding versus engaging in substantive debate.

But the lid just got blown off the false narratives that have been propagated by central bankers from Powell on down with his now infamous claim that “Fed policies absolutely don’t add to inequality“.

Of course QE adds to inequality. Even the Bank of Canada just sheepishly admitted it:

WHAT HAVE I BEEN SAYING?

“Bank of Canada says QE can (edit: does) widen wealth inequality”

Seriously, when is the Fed held to account for the consequences of their policies instead of getting away with lying to the public year after year?https://t.co/TzdP3AM593

h/t @mlk1784

— Sven Henrich (@NorthmanTrader) May 14, 2021

But the real hammer just dropped by one of the most successful investors ever, billionaire Stan Druckenmiller. Not only does QE add to inequality it is the main driver:

“I don’t think there has been a greater engine of inequality than the Federal Reserve Bank of the United States”.

Watch this clip for it lays bare not only the brutal reality of how the Fed has reshaped the country for the benefit of the rich, but also who will pay for the consequences:

You know where I stand on the Fed & Powell & their denials on exacerbating wealth inequality & the danger of the insane asset bubble they have created.

Well, here’s Druckenmiller dropping truth bombs on Powell & the Fed on the very same subjects. pic.twitter.com/3PThE2I5B2

— Sven Henrich (@NorthmanTrader) May 15, 2021

The data Druckenmiller is referring to is as obvious as the light of day:

Trillions in wealth:

Since 1995 the bottom 50% have added $1.5T to their combined wealth while the top 1% have added $30T to their combined wealth.

That’s $30T going to 3.2M people versus $1.5T going to 165.5M people.

The wealth gap has never been wider.

Let’s keep printing. pic.twitter.com/gSHWYNJKk7— Sven Henrich (@NorthmanTrader) April 23, 2021

And yet central bankers including former central banker and now Treasury Secretary Janet Yellen, a long defender and enabler of these very policies, keep virtual signaling about the plight of inequality, ignoring any plea to confront the obvious:

Will there be a discussion on how 13 years of central bank balance sheet expansions have greatly contributed to widening inequality by making the top 1% (who benefit the most from liquidity driven asset price inflation) filthy rich and leaving the bottom 50% totally behind? pic.twitter.com/SogCFr3hpw

— Sven Henrich (@NorthmanTrader) May 14, 2021

The financial media? Silent. Central bankers never get confronted by the glaring disconnect of the data versus the public denials of Fed officials.

Sorry media, but you are all doing a disservice to the public treating all these central bankers with kid gloves and permanent submissive reverence as opposed to being real investigative journalists and asking the hard questions and digging into the data and consequences with follow up. “Independence” does not equate immunity from scrutiny. But that’s how the Fed is being treated by Congress and the media. Unchecked, unbalanced, unquestioned, with absolute power. The very antithesis of a constitutional democracy.

The implications are profound. While publicly glorified by the media as “heroes” and “saviors” of the economy, the true impact of Fed policy is much more sinister. Inflation, as Druckenmiller rightly points out hurts the poor the most as living expenses take up most if not all of their monthly budgets. That’s of course not the type of inflation the Fed uses as its official guide as CPI as been whittled down to a core basket. And yet Fed officials almost gleefully push for more inflation in their daily speeches. What is this? Open war on the poor who increasingly have issues with accelerating housing and food prices. Increased wages sounds like a welcome reprieve until you realize inflation can easily outpace wage increases and stimulus checks come to an end this year. Then all you got left is higher prices and enormous debt loads. And who will pay for the next bust? The poor of course as Druckenmiller points out.

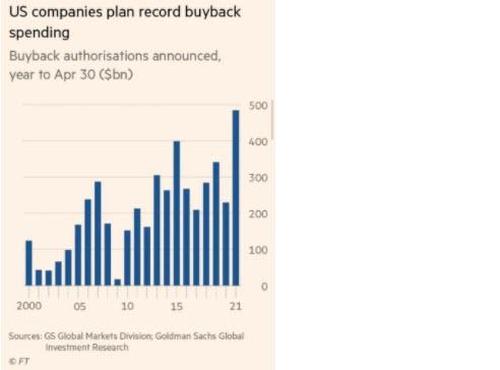

Glaring and expanding wealth inequality is destructive to society. While there will always be inequality and successful capitalism should rightfully reward those that work hard and come up with great business concepts the artificial exponential enrichment of the few by a “government created agency” (Jay Powell) is not in the purview of the Fed’s mandate. Neither is buying corporate bonds of Verizon and AAPL and other corporate giants as they have done last summer. Some of the very same companies who are still laughing and are back to engaging in record buybacks:

And neither is it a mandate of the Fed to overtly lie to the public as they continue to do. Stretching wealth inequality and the Gini coefficient to ever more extremes the Fed itself is fueling political populism, extremism and a complete lack of trust in the governing institutions of America as discontentment spreads, people looks for blame and find themselves increasingly susceptible to misinformation, a dangerous cocktail for any democracy.

Americans should increasingly question the role of the Fed and its impact on society. It’s not normal, nor should it be, that the economy keeps running from bust to bust to bust and requires ever more debt and intervention to “save it” from the fall out of the asset bubbles the Fed has propagated time and time again. And markets are again, as Druckenmiller has pointed out, in a massive asset bubble as the Fed arrogantly and fanatically insists on continuing the run the biggest QE program in history, despite buybacks at record highs, despite inflations concerns skyrocketing, despite historic valuations, despite the fastest GDP growth in 50 years and despite corporate earnings having fully recovered. If not now, then when? When things slow down? When things suddenly become uncertain again? That’s when the Fed will taper and end QE? Don’t believe a word of it.

Why? Because they don’t stop even when a crisis is long over:

The Housing Crisis was in 2009.

The Fed’s acting like we’re still in the middle of one when we’re not.

There is zero economic justification or even a reason compatible with the Fed’s mandate to keep buying MBS.Yet they do, again contributing to a housing bubble.#reckless pic.twitter.com/KO7brQvISn

— Sven Henrich (@NorthmanTrader) May 11, 2021

The Fed runs a big operation in obfuscation and denial with the demonstrated track record of enriching the top 1% and many cases the pockets of its own officials, and that is the Ugly Truth:

We know who benefits:

Come on.

It’s way past time that the American public wakes up to this fact.

When will the media confront the daily barrage of Fed speakers or Powell directly about this glaring disconnect? Between what Fed officials deny and what even now billionaires and some central banks openly admit?

I’m not holding my breath, but the best way to shine the light on this most important yet so ignored issue is for us all to speak out and share the secret that is now out in the open. But it must be shared with as many as possible as to build public pressure for accountability and truth, for this Fed currently is subject to neither, and the media keeps giving them a pass. Why?

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Mon, 05/17/2021 – 06:30

via ZeroHedge News https://ift.tt/2RocHJM Tyler Durden