Biotechs Burst Higher But Bonds, Bitcoin, & The Buck Breakdown

Biotechs stole the headlines today after Biogen’s Alzheimer’s Drug was approved by the FDA…

Source: Bloomberg

And Biogen screamed up over 50% at one point…

Source: Bloomberg

Hopefully a real breakthrough… and think of what’s possible next?

Meme Stocks were also on the run again with AMC surging back up near $60 once again…

As “most shorted” stocks were catching the eye of the Reddit Rebels once again…

Source: Bloomberg

Small Caps massively outperformed today (thanks to the above) with The Dow the biggest laggard. Big-Tech was surprisingly resilient in the face of the G-7 Global Tax grab plan..

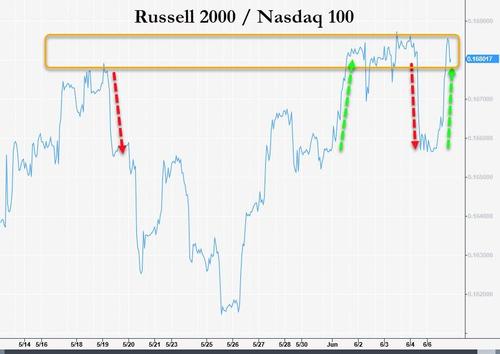

Which lifted Russell 2000 back up to recent resistance levels relative to Nasdaq 100….

Bond yields bounced back very modestly today (+1-2bps on the day) but 10Y remained below 1.60% and well below Friday’s pre-payrolls print…

Source: Bloomberg

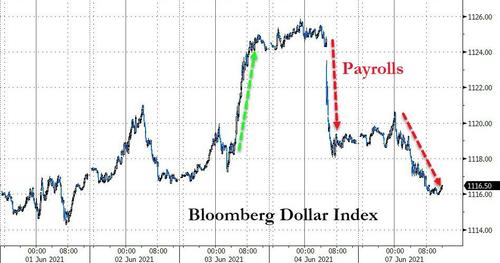

The dollar extended Friday’s losses, selling off after Asia closed…

Source: Bloomberg

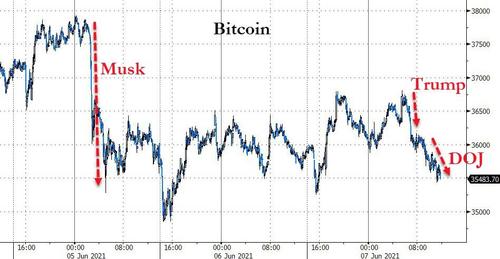

Crypto was hit over the weekend as Elon Musk’s muppetry continued, and wasn’t helped today when Trump called it a “scam” and the DOJ press conference continued to diatribe against crypto being behind the surge in ransomware…

Source: Bloomberg

Gold futures extended Friday’s gains, pushing back above $1900…

WTI tagged $70 late last night but ended the day slightly lower…

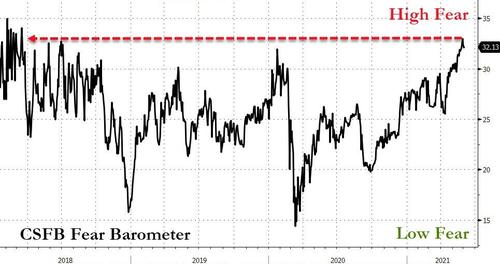

Finally, with U.S. stocks a whisker away from a record high and near-term vol trading near the lowest since mid-April, you’d be forgiven for thinking that all is well. But, as Bloomberg notes, anxiety is still raging for what lies ahead.

Source: Bloomberg

The Credit Suisse Fear Barometer, which tracks the relative cost of bearish-to-bullish 90-day options on the S&P 500 Index, is trading near the highest level since early 2018, despite taking a leg lower last week on the heels of a solid payrolls report and record services figures.

Tyler Durden

Mon, 06/07/2021 – 16:00

via ZeroHedge News https://ift.tt/3ckmVSL Tyler Durden