Consumer Credit Hits New Record Despite Unexpected Decline In Credit Card Usage

After several months of blowout consumer credit prints, including two consecutive months in which revolving (i.e., credit card) debt, rose after shrinking 10 of the previous 11 months, America’s credit-funded spending spree abruptly slowed in April, when total consumer credit rose by $18.6BN, down from $25.8BN in March (since revised conveniently to $18.6BN), and missing expectations of $20.5BN. Overall, total consumer credit rose at a 5.3% annual rate in April to a new all time high of $4.238 trillion.

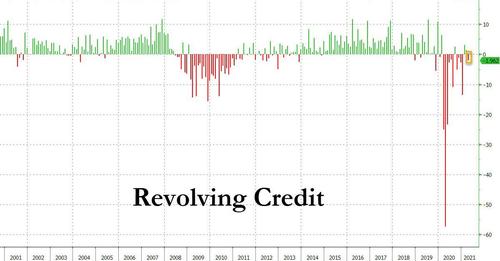

What was most notable about the April data, however, is that revolving credit actually declined by $1.96 billion to $964 billion, well below the record high of $1.094 trillion reached in December 2019.

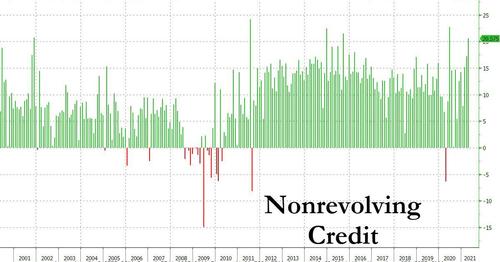

This however was more than offset by yet another burst higher in nonrevolving credit (auto and student loans), which rose $20.6BN to $3.274TN, a new all time high.

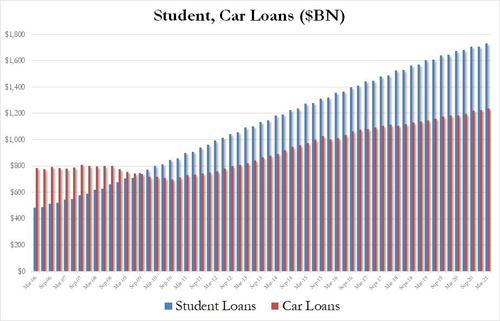

Meanwhile, and there was no surprise here, the total dollar amount of both student and auto loans hit a new all time high in the 1st quarter of 2021, with the former rising by $25.2BN to a new all time high of $1.73TN and the latter rising $11.9BN to $1.236TN.

So after this latest shift in spending patterns, which took place after two months in which we said that “things are now indeed back to normal” as “consumers were spending not just using their debit cards (which is where the stimmy checks arrive) but their credit cards” ostensibly once again “highly confident about the future, and are spending far beyond their means”, something changed in April when perhaps as the bulk of the stimmy payments has passed, Americans are once again slowing down their credit-funded spending. However, as we will show shortly, the latest realtime debit and credit card data from Bank of America shows that after a brief slowdown in April, credit card usage once again spiked, and we expect that this trend will continue until at least September when the bulk of emergency unemployment benefits finally runs out and the bills start coming in.

Tyler Durden

Mon, 06/07/2021 – 15:22

via ZeroHedge News https://ift.tt/3v1tBLO Tyler Durden