Bond Yields Plunge Most In A Year, Dollar Spikes As Inflation Soars

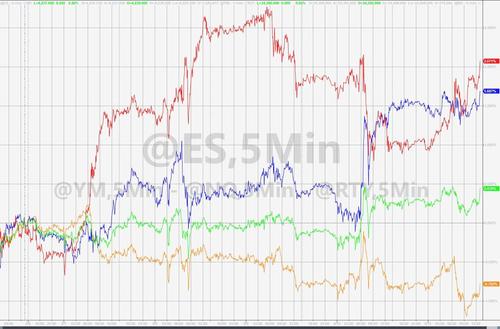

On the week, the major stock indices were mixed with The Dow lower, S&P unch-ish, and Small Caps and Big-Tech leading…

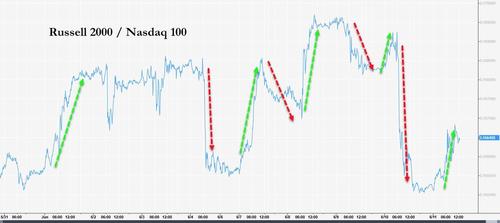

The flip-flopping rotation between big-tech and small caps continued all week…

Growth won the week as traders rotated back from value stocks…

Source: Bloomberg

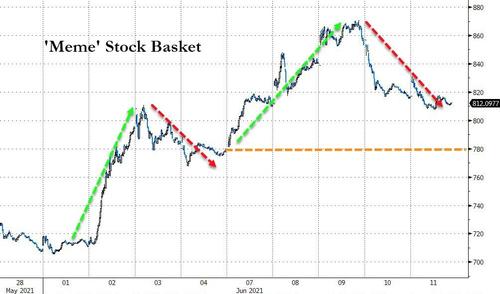

Meme stocks also roller-coastered this week…

Source: Bloomberg

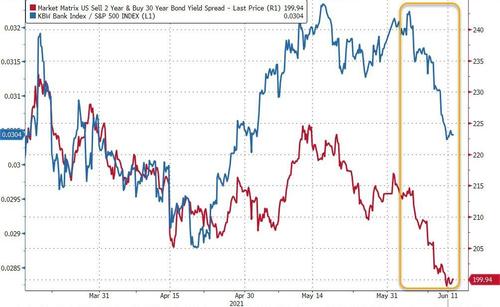

Banks notably underperformed the market this week as yields tumbled…

Source: Bloomberg

Healthcare stocks outperformed as financials lagged…

Source: Bloomberg

VIX closed with a 15 handle for the first time since before the pandemic…

Source: Bloomberg

But, the big story of the week was the collapse in Treasury yields (in the face of a soaring CPI print) as bond shorts were increasingly squeezed…

Source: Bloomberg

Bond shorts this week…

This week saw 10Y Yields drop 10bps – the biggest weekly drop since last June (4th weekly drop in a row)…

Source: Bloomberg

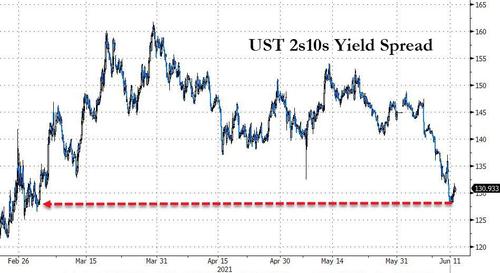

The Treasury yield curve also flattened by the most since last June this week…

Source: Bloomberg

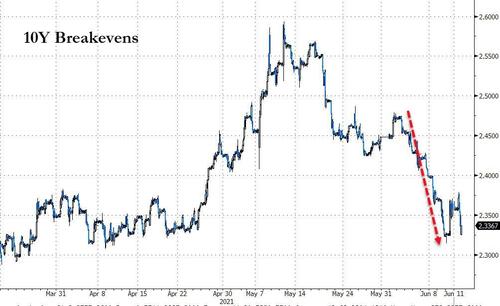

And breakevens saw their biggest weekly drop since April 2020…

Source: Bloomberg

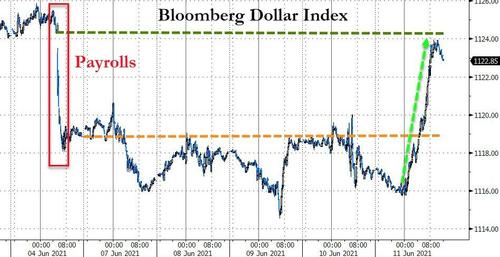

The dollar screamed higher today… erasing all the losses from last Friday’s payrolls plunge…

Source: Bloomberg

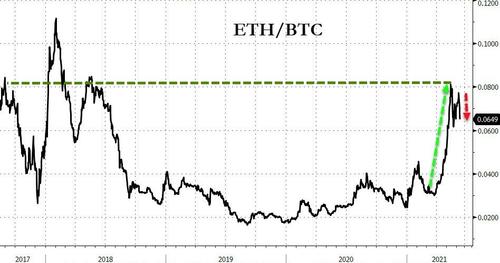

Cryptos ended the week mixed with Ether notably underperforming Bitcoin…

Source: Bloomberg

ETH/BTC saw a big drop on the week (second biggest weekly drop in ETH relative to BTC since Jul 2019)…

Source: Bloomberg

The dollar’s spike today slammed gold to the week’s biggest loser in commodity-land as crude managed gains…

Source: Bloomberg

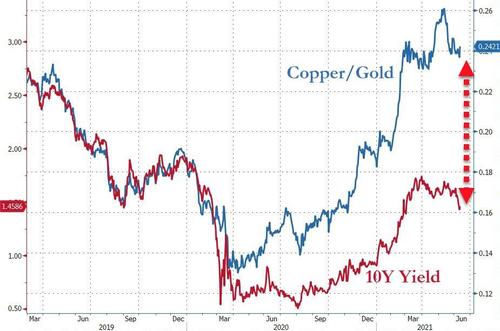

Is it time for copper crash or gold run? Or are yields completely off base still?

Source: Bloomberg

And finally, The Fed’s balance sheet reached $8 trillion this week for the first time ever – basically a double since the start of the pandemic panic-response…

Source: Bloomberg

And the balance sheet keeps expanding despite the collapse of COVID…

Source: Bloomberg

Tyler Durden

Fri, 06/11/2021 – 16:00

via ZeroHedge News https://ift.tt/2RJTBhg Tyler Durden