Ex-Credit Suisse Bond Trader “Savant” Made Millions With Risky, Concentrated Bets

Earlier this week, we joked about a Bloomberg story claiming a 30-year-old Credit Suisse credit-trading wunderkind was being cut adrift by the bank amid a bout of “de-risking” inspired by the twin blowups caused by Greensill and Archegos, which might cost the bank up to $10 billion.

When the trader, Moroccan-born Hamza Lemssouguer, was poached by Citadel (to join the company’s hedge fund division as a portfolio manager for a new credit fund), Credit Suisse managed to keep him from leaving with the promise that the firm would seed a new fund for him under its asset management division. Unfortunately for him, the 30-year-old trading superstar, who was in high school when Lehman collapsed, decided to listen.

Hamza Lemssouguer

Six months later, Bloomberg reports that the door to Citadel is now closed, and that Lemssouguer is pressing ahead with his fund. However, he won’t be receiving any money or support from his former employer, which has essentially cut him adrift, according to Bloomberg, which published a lengthy story about Lemssouguer’s situation.

But at the chastened Credit Suisse, which has lurched from one crisis to the next this year, Lemssouguer apparently became a risk too great. The bank on Wednesday canceled plans for the young star’s fund, cutting him loose to pursue his ambition without its money or backing. The episode stands as a marker of the bank’s abrupt change in attitude after embarrassing debacles stemming from Archegos Capital Management and Greensill Capital spiraled into billions of dollars in losses for the firm.

In the story, Bloomberg recounts how this ‘star trader’ rose from a Goldman Sachs intern to a key player in Credit Suisse’s junk-bond trading operation who had a reputation for skirting the rules. According to Bloomberg, several complaints alleging insider trading were filed to various international security-market regulators, but Lemssouguer never faced any formal punishment.

For what it’s worth, the complaints don’t sound like much, having mostly been filed by counterparties who lost money to Lemssouguer. Perhaps this is why they were never taken seriously by Credit Suisse. Or perhaps it’s why the bank decided to cut the trader adrift. Bloomberg didn’t say.

In 2019, at least three rivals and trading customers made complaints against him to the U.K.’s financial watchdog, alleging insider trading and price manipulation, according to people familiar with the matter. One of those complaints came from a hedge fund that lost money on a bet which paid off handsomely for Credit Suisse, while another came from a firm that actually made money on the trade, the people said.

Although Credit Suisse didn’t receive any formal queries from the U.K.’s Financial Conduct Authority after the complaints, some clients informally raised concerns about Lemssouguer’s tactics with contacts working at the bank, one of the people said. Those complaints weren’t escalated by the clients, the person said.

It’s not clear if the U.K. regulator looked into the complaints against Lemssouguer. The FCA will typically acknowledge any complaint to parties who file them, but may not always provide any information on how it is handling the complaint. The FCA declined to comment.

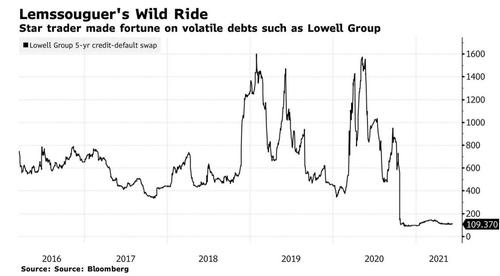

According to BBG, Lemssouguer, praised in some of CS’s marketing materials as a “savant” when it comes to managing risk, generated most of his outsize profits with a relatively straightforward strategy: He placed big, concentrated bets on the debt of distressed companies, then collected a massive premium when prices improved as the companies improved. Some accused Lemssouguer of trading on inside information, particularly regarding one trade involving the bonds of Lowell Group.

While we’re unsure whether that makes him a risk-management “savant”, or just lucky.

It’s easy to understand why Credit Suisse wanted the trader back: he ranked as one of the firm’s top performers, helping the bank’s European high-yield desk generate about $220 million in 2020 by making outsize bets in risky junk bonds, distressed debt and illiquid securities, according to people familiar with the matter. That’s about 5.5% of the bank’s total fixed income trading revenues.

In recent marketing materials, Credit Suisse described the youthful trader as a savant of the junk-bond market who generated historic profits as he wagered on the fortunes of troubled European businesses.

“His ability to understand the psychology and risk tolerance across market participants and assess liquidity in that context led to some of the most profitable years in the trading desk’s history,” according to a presentation advertising his new credit fund seen by Bloomberg News. “He was instrumental in the visibility and risk-taking capacity of the group and introduced rigorous investment and risk-management processes.”

Lemssouguer had started to meet prospective investors for his new fund, named Arini after a type of parrot he used to breed in Morocco, in 2021 and planned to raise as much as $500MM for the debut fund. However, now it’s unclear how much he has actually raised, since Credit Suisse has pulled the seed money it promised.

But the whole incident with the trader might be a learning opportunity for others: a bird in the hand is sometimes worth two in the bush.

Tyler Durden

Fri, 06/11/2021 – 14:41

via ZeroHedge News https://ift.tt/35j3xkV Tyler Durden