Futures Extend Record Highs As Inflation Fears Fade

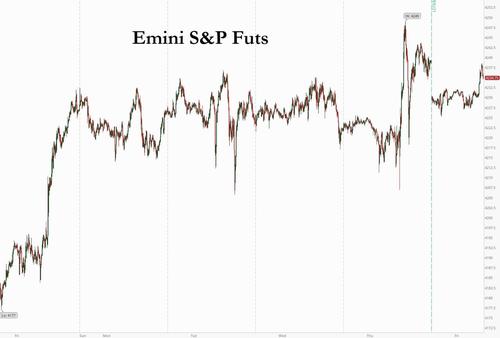

S&P futures – which overnight rolled from the ESM (June) to the ESU (Sept) contract – extended gains on Friday further into record territory as inflation fears receded into the background calming concerns over a possible long-term spike in rising prices, with investors now turning focus to next week’s Federal Reserve meeting for more cues on monetary policy. Treasuries were steady, trading at 1.44% – just above the lowest level since March – amid growing (if wrong, according to BofA and DB) confidence inflation will prove transitory, leaving scope for continued central-bank support. S&P 500 E-minis were up 7.25 points, or 0.17 at 06:36 a.m. ET. Dow E-minis were up 77 points, or 0.22%, while Nasdaq 100 E-minis were up 30.25 points, or 0.22%.

After seeing fresh all-time highs on Thursday, US equity futures have largely been traversing sideways, in wake of Thursday’s dovish ECB confab, and surging US inflation, which has not given too much concern to equity or bond investors ahead of next week’s FOMC, since the Fed is likely to look through what it sees as ‘transitory’ price pressures; some analysts disagree, arguing that there is building evidence of more sticky prices, but whether or not this inflation proves to be transitory will only really be resolved in Q3/Q4, so for now, markets are taking the Fed at its word. BofA reported that US equities have seen the first weekly outflows since March, with more outflows out of growth styles than value styles; by sector, inflows were seen in financials, materials, real estate, energy and health care, while outflows were seen in utilities, communications, consumer sectors, and tech.

“It takes a brave investor to fight the Fed but it is becoming increasingly difficult to hold firm as inflation reaches 5% year-on-year,” Lewis Grant, senior global equities manager at Federated Hermes, wrote in a note. A “combination of attractive valuation and price momentum is likely to lead quantitative investors and systematic strategies to increase their allocation” to cheaper parts of the market, he said.

For those who slept for the past 24 hours, on Thursday, the S&P 500 surged to a record high as investors scaled back expectations for early policy tightening by the Fed, with May’s consumer price data suggesting that a recent spike in inflation was likely to be transitory. The faster-than-expected 5% CPI surge for May was largely driven by categories associated with economic reopenings – such as cars, commodities and airfares – bolstering the view price pressures may ease later in the year. With the Federal Reserve setting a high bar for reconsidering its dovish stance, the data ended up stoking risk appetite across global markets, especially since recent data has also indicated weakness in the labor market, and the Fed is widely expected to maintain accommodative policy through Jackson Hole.

The MSCI All Country World Index was poised for a fourth weekly advance, and the S&P 500 and Nasdaq were set for mild weekly gains, as a lack of major catalysts and a summer lull in trading saw them move in a tight range. But weakness in industrial stocks saw the Dow Jones set for a weekly loss, amid doubts over whether President Joe Biden’s $2.3 trillion infrastructure spending plan would come to pass. At the same time, sto(n)ks favored by small-time investors were set to close higher for the week, even as a rally appeared to be running out of steam on Thursday. Most of the so-called “meme” stocks rose in premarket trade. Here are some of the biggest U.S. movers today:

- AMC Entertainment (AMC) gains 3.3% in premarket trading, rebounding from two days of declines, after S&P Global Ratings raised its credit rating on the company, a favorite of traders on Reddit message boards.

- AI software company Amesite (AMST) rises 89% with over 3 million in shares changing hands in premarket trading.

- CureVac (CVAC) shares fall 8.4% after a report Germany will drop the company’s Covid-19 shot from its current vaccination campaign.

- GameStop (GME) gains 6% after posting its biggest decline since March on Thursday. Other meme stocks like Workhorse (WKHS) rises 4.9% and BlackBerry (BB) climbs 2.2%.

- Precigen (PGEN) jumps 53% in premarket trading after the company announced Thursday that its phase 1b/2a study of AG019 ActoBiotics, a novel therapy designed to address the underlying cause of type 1 diabetes, met primary endpoint.

- Vertex (VRTX) drops 11% after halting a closely watched effort to develop a therapy for a rare genetic disorder that affects the lungs and liver.

- Yucaipa Acquisition Corp. (YAC) climbs 3.2% in premarket trading after announcing it will combine with German online retailer Signa Sports United.

European stocks were poised fo a fourth week of gains, pushing deeper into record territory, with the Stoxx 600 up 0.6%, led by the Stoxx Europe 600 Basic Resources Index (SXPP) which rose as much as 1.4%, climbing for a second day, as base metals gain across the board. Diversified miners rose: Rio Tinto +1%, BHP +1.2%, Glencore +2%, Anglo American +1.3% (those four stocks account for about 64% of the SXPP). Morgan Stanley analysts said European miners are set to generate FCF of ~$28b in 1H21, equivalent to 14% yield, the highest in over 10 years; “With balance sheets largely de- levered and little apparent appetite for M&A or major growth, capital returns to shareholders could exceed consensus expectations by 38%,” say analysts including Alain Gabriel. Here are some of the biggest European movers today:

- Grifols shares climb as much as 16%, the most since May 2006, after U.S. competitor Vertex halted a closely watched effort to develop a therapy for liver disease.

- Orphazyme shares surge in Copenhagen trading, gaining as much as 76%, following a Thursday rally in its ADR, as an experimental drug that it’s helping develop moved potentially closer to hitting the market.

- K+S shares gain as much as 8% after Stifel upgraded the stock to buy from hold and increased earnings estimates on the back of higher potash price assumptions.

- Scor shares climb as much as 6.9% after reaching an agreement on a legal dispute with Covea that Deutsche Bank says is a “very big positive.”

- Sanne shares rise as much as 12% after the asset administration company confirmed a fifth bid from private equity firm Cinven.

- Frontier Developments shares fall as much as 9.5% following a trading update and the delay of a game. Shore Capital downgrades stock to hold from buy.

Earlier in the session, Asian equities rose, tracking gains in U.S. peers overnight as investors saw key inflation data as leaving scope for ongoing central-bank support. Technology stocks contributed most to gains in the MSCI Asia Pacific Index, with Meituan and TSMC the biggest boosts among individual stocks. Financials dipped after the U.S. benchmark Treasury yield declined overnight to the lowest since March.

“Investors risk complacency in ignoring the highest core CPI inflation since April 1992 and another slide in continuing claims signaling another lower unemployment rate ahead,” Philip Wee, a macro strategist at DBS Group Holdings in Singapore, wrote in a report. “With the FOMC meeting around the corner on 16 June, the risk of profit-taking ahead of the weekend cannot be dismissed.” Vietnam and South Korea led gains among key regional equity gauges. Stocks declined in China after the government asserted sweeping powers to seize assets and block business transactions as part of an effort to hit back against sanctions by the U.S. and its allies.

In rates, Treasuries were marginally cheaper across the curve after a calm Asia session, during which Thursday’s bull-flattening was broadly maintained. Treasury 10-year yields around 1.445%, cheaper by ~1bp vs Thursday’s close; session low 1.427% is richest since March 3; 10-year yields headed for their biggest weekly decline in a year amid signs traders are further unwinding short positions in U.S. government debt despite a jump in consumer prices. Bunds outperformed by 3bp, gilts by 6bp in 10-year sector, narrowing gaps with Treasuries that opened Thursday after the European close.

Friday’s focal points include inflation expectations from University of Michigan consumer sentiment survey, while next week brings FOMC rate decision and 20-year bond reopening.

The key action in rates this week was shorts running for cover, closing positions, and helping to support the rally. The question investors are now asking is whether we are in a new range for yields, given that 10yr yields are now over 30bps narrower vs peaks seen in Q1. Technicians are certainly talking up this thesis; SocGen’s techs, for instance, note that the 10yr yields breaking through May’s lows suggests the persistence of downward momentum, which could bring 1.41%, 1.35%, 1.32% into focus (action to be capped by 1.55% and 1.63%). Elsewhere, BofA’s weekly flow data reports that IG bond funds have now seen inflows in the past 13 weeks, and this week we saw the largest outflow of HY bond funds in three weeks. Additionally, government bonds have this week seen the largest inflows in three weeks, though TIPS funds continue to see inflows, as they have for much of the last six-months.

In FX, the Bloomberg Dollar Spot Index was little changed and Group- of-10 currencies extended a period of trading in tight ranges. The euro was steady and European bond yields fell, tracking a decline in Treasury yields Thursday. The pound inched lower against the dollar even as data confirmed economic growth accelerated in April, as concerns rose over a delay to the U.K.’s planned reopening on June 21. Aussie dollar carried a slight bid and rose to its highest in almost two weeks; Australian 10-year sovereign bonds rose for a fifth straight day to see yields post their biggest weekly drop since March 2020.

Elsewhere, crude oil consolidated above $70 a barrel amid an improving demand outlook. Bitcoin extended its rebound to a third day, trading around $37,000.

Looking at the day ahead now, and one of the main highlights today through the weekend will be the G7 summit that commences today. Otherwise, data releases from the US include the University of Michigan’s preliminary consumer sentiment index for June, while from Europe there’s the UK’s GDP reading for April. Finally, central bank speakers include BoE Governor Bailey and Deputy Governors Ramsden and Cunliffe.

Market Snapshot

- S&P 500 futures little changed at 4,240.50

- STOXX Europe 600 up 0.34% to 456.11

- MXAP up 0.2% to 210.04

- MXAPJ up 0.3% to 705.54

- Nikkei little changed at 28,948.73

- Topix down 0.1% to 1,954.02

- Hang Seng Index up 0.4% to 28,842.13

- Shanghai Composite down 0.6% to 3,589.75

- Sensex up 0.4% to 52,516.39

- Australia S&P/ASX 200 up 0.1% to 7,312.33

- Kospi up 0.8% to 3,249.32

- Brent Futures up 0.19% to $72.66/bbl

- Gold spot down 0.21% to $1,894.61

- U.S. Dollar Index little changed at 90.14

- German 10Y yield fell 2.6 bps to -0.282%

- Euro little changed at $1.2164

Top Overnight Stories from Bloomberg

- The ECB needs to keep monetary policy accommodative with the aim of maintaining favorable financing conditions for all economic agents, Bank of France Governor Francois Villeroy de Galhau said on Radio Classique

- Germany’s economy is poised for a strong upswing in the second half of this year, with activity likely to reach pre-crisis levels as soon as this summer, the Bundesbank said. It sees Europe’s largest economy expanding 3.7% this year and 5.2% in 2022

- By signaling that there would be no let-up in the ECB’s pandemic debt-buying program on Thursday, ECB President Christine Lagarde helped put aside fears that the central bank is preparing to withdraw unprecedented monetary support — at least until September.

- Russia is on course Friday for its second big interest-rate increase in a row after inflation accelerated at the fastest pace in more than four years

- The head of Poland’s central bank is set to snuff out any final doubts about his pledge to maintain record-low interest rates in the face of soaring inflation when he faces questions from reporters on Friday

A quick look at global markets courtesy of Newsquawk

Asian equity markets traded mixed as the region only partially benefitted from the momentum in the US where the Nasdaq outperformed, and the S&P 500 posted fresh record highs after a dovish ECB more than offset the hot US CPI print to pressure yields, which was conducive for risk appetite. ASX 200 (+0.1%) just about kept afloat with outperformance in gold miners and tech counterbalanced by losses in the largest-weighted financials sector and with a non-committal tone heading into the extended weekend. Nikkei 225 (U/C) mirrored the tentative mood in the domestic currency despite reports Japan is considering lifting the COVID emergency for Tokyo on June 20th and with Toshiba shares pressured on allegations the Co. and government officials had previously conspired to lean on foreign investors to back company management in a key vote, while the KOSPI (+0.8%) was underpinned following the early trade figures which showed Exports rising 40.9% Y/Y during the first ten days of June. Hang Seng (+0.4%) and Shanghai Comp. (-0.6%) were varied with participants tentative before the long weekend due to the Dragon Boat Festival across Greater China on Monday, and after China passed the legislation to counter foreign sanctions. IPO newsflow was also in the spotlight after China’s largest ride-hailing company Didi filed for a US listing which is expected to be the world’s largest IPO in 2021. However, this failed to significantly boost key stakeholders SoftBank (21.5% stake) and Tencent (6.8% stake). Finally, 10yr JGBs extended above the 152.00 level as the global bond bid persisted in the aftermath of the dovish ECB and with yields stateside remaining pressured in which both the US 10yr and 20yr yields declined to three-month lows in which the former briefly dipped beneath 1.4350.

Top Asian News

- Ride-Hailing Firm Didi Reveals $1.6 Billion Loss Before IPO

- Evergrande Tycoon Loses $20 Billion as Investors Revolt

- BlackRock Receives Nod to Start China Mutual Fund Business

- Hong Kong Bourse Is Recruiting a Dozen New Risk Managers

European cash kicked off the day in the same directionless manner throughout the week but have since adopted a very mild upside bias (Euro Stoxx 50 +0.3%), despite a lack of fresh macro news flow. US equity futures meanwhile remain closer to the flat mark. Back to Europe, the UK’s FTSE 100 (+0.6%) outperforms as its heavyweight mining sector underpins the index amid tailwinds from the rebound in base metal prices. As such the Basic Resources sector resides as the clear outperformer (Glencore +2.7%, Fresnillo +2.5%, Antofagasta +2.1%, BHP+1.8%), whilst the banking sector bears the brunt of the collapse in yields. Overall, European sectors are mostly firmer but it’s difficult to discern a particular theme/bias. In terms of individual movers, Deutsche Bank (-3.7%) sits at the foot of the Stoxx 600, pressured by the yield environment coupled with source reports suggested the ECB has asked the bank several times in recent months to name a successor to chairman Achleitner as the end of his term nears.

Top European News

- Selfridges Said to Be on Sale for $5.7 Billion After Approach

- Signa Sports to Go Public in Deal With Ron Burkle‘s SPAC

- South Africa Sells State Airline to Private-Equity Venture (1)

- Cinven’s Fifth Bid for Sanne Prompts Board to Start Discussions

In FX, it remains to be seen whether the Dollar can weather any further downside pressure as the global bond revival rages on and the index hovers precariously around the 90.000 handle having failed to glean any real impetus or even traction from the latest US inflation data that surpassed consensus by some distance. Moreover, the Buck got little in the way of support from a back-up in yields following a subdued end to this week’s Treasury refunding, and still looks technically weak in DXY terms between 90.170-89.951 vs Wednesday’s 89.833 w-t-d low and the brief post-CPI spike high at 90.321. Ahead, prelim Michigan sentiment does not offer much hope for a meaningful Greenback recovery, but pre-weekend short covering and position paring may provide a lifeline.

- AUD/NZD – The Aussie and Kiwi continue to extract most from their US counterpart’s predicament, with the former establishing a firmer base above 0.7750 and latter retesting resistance above 0.7200. However, Aud/Usd may yet be hampered by decent option expiry interest straddling the half round number (1.2 bn from 0.7755 to 0.7740) as volumes thin before Monday’s market holiday to mark the Queen’s birthday.

- EUR – 1.2200 is still proving to be elusive for the Euro relative to the Dollar, irrespective of reports from sources about 3 GC members wanting to reduce the pace of PEPP buying and divergence on the amount of asset purchases required over the Summer period when turnover is seasonally lower. Perhaps Eur/Usd bulls are taking heed of ECB President Lagarde’s latest statement about monitoring currency developments and/or the proximity of hefty option expiries is prohibiting buyers (2.5 bn rolls off between 1.2190-1.2200). On the flip-side, expiry interest from 1.2155 down to 1.2150 (2.3 bn) should underpin the headline pair and for good measure there is more at the round number below (also 2.3 bn).

- CAD/GBP/CHF/JPY – No independent direction from BoC’s Lane for the Loonie, so sticking close to 1.2100 against the backdrop of choppy waters in crude and eyeing option expiries stretching from the 1.2080 trough to 1.2085 (1.2 bn) then 1.2090 (1.65 bn) up to 1.2150 (1.3 bn). Meanwhile, the Pound largely shrugged aside UK data and is tracking the Buck and Euro within a 1.4185-52 band and around the 0.8600 axis respectively, and the Franc continues to pivot 0.8950 pre-SNB. Similar constraints for the Yen that is tethered either side of 109.50 and conscious of expiry interest nearby, given downside protection at 109.75-80 (1.2 bn) and the 110.00 strike (1.7 bn) vs a barrier encircling 109.00 (2.3 bn from 109.10 to 108.90).

In commodities, WTI and Brent front-month futures have been uneventful thus far just under the USD 70.50/bbl (69.68-70.52 range) and around USD 72.50.bbl (71.88-72.78 range). The complex was unfazed by the release of the IEA MOMR which – in a slightly unorthodox fashion – noted that demand is set to surpass pre-COVID levels by the end-2022 (as opposed to the typical upgrade/downgrade headlines). The agency also called on OPEC+ to “open the taps” to keep world oil markets adequately supplied, and that production hikes at the current pace set are to be nowhere near the levels needed to prevent further stock draws. Nonetheless, the demand trajectory is still dictated by COVID developments – with reports also noting that the UK could delay its full reopening plans by a month. That being said, the summer period is expected to see demand buoyed by the US driving season, whilst an EU official also notes that EU countries have cleared a plan to ease travel restrictions over the summer. Elsewhere, Iranian nuclear deal talks are poised to resume on June 12th for what would be the sixth round of negotiations. US sources, after the last round wrapped up, poured some cold water over the optimism expressed by the Iranian President. Note – the oil market was briefly in disarray on Thursday as reports that the US lifted sanctions on Iranian oil officials stoked expectations for a return to the nuclear deal and of Iranian oil supply, however, a US official clarified that the Treasury action was routine and had nothing to do with Iran’s nuclear deal talks. Spot gold and silver diverge with the former now trundling lower after failing to meaningfully breach and hold above USD 1,900/oz, whilst the latter gleans support from the lower yields and extends gains above USD 28/oz. Over to base metals, LME copper reclaimed a USD 10,000/t handle as sentiment for the red metals seems more constructive post-US CPI, with some potential tailwinds from the rise in iron ore overnight – with Dalian futures bolstered by signs of strong demand and as Chinese port inventory hit a four-month low last week, according to traders.

US Event Calendar

- 10am: June U. of Mich. Sentiment, est. 84.3, prior 82.9;

- Current Conditions, est. 91.2, prior 89.4

- Expectations, est. 78.7, prior 78.8

- 10am: June U. of Mich. 1 Yr Inflation, est. 4.7%, prior 4.6%; 5-10 Yr Inflation, prior 3.0%

DB’s Jim Reid concludes the overnight wrap

There is one piece of inflation that is undoubtedly not transitory and that’s age. Tomorrow I get to within a birdie of a half century. Predictably I’m celebrating by playing in a golf tournament. This time last year around my birthday I started doing weights to improve my club head speed in golf and to try to offset old age. I’m happy to report that 52 weeks of 3-4 times a week and I’ve increased it by around 5mph on my driver and have confused my wife as to why I’ve suddenly got obsessed with having muscles and who I’m trying to impress. A mid-life crisis unfolding in front of you all.

Moving to markets and if this was match play then the inflationists have hit the ball down every fairway, have watched the ball soar onto the green but have then two putted every hole and walked off a bit disappointed. Meanwhile the non-inflationists have hit it in the rough off the tee, chipped out, managed to scrape the ball on to the edge of the green and then repeatedly holed long putts to halve the hole – all with big smiles.

In fact after yesterday’s big CPI beat the very fact that Treasuries rallied very strongly again indicated that something is going on behind the scenes in terms of positioning or with regards to excess liquidity.

However let this statement sink in. In a US economy still suffering from the impact of a global pandemic and still not close to being normalised, the average basket of goods and services in May for the whole economy were +5% above where they were a year before. That’s a stunning sentence in isolation but the market reaction was “meh! Is that all you’ve got”.

In terms of the details, the headline CPI measure increased by +0.6% in May on a monthly basis (vs. +0.5% expected), meaning that the last two months in April and May have been the two strongest months for inflation over the last decade. In turn, that sent the year-on-year number up to +5.0% (vs. +4.7% expected), which marks the fastest pace of price rises we’ve seen since August 2008 and at levels only exceeded for 2 months since the end of 1982. One of the biggest drivers were higher prices for used cars and trucks, which were up +7.3% in May and accounted for around a third of the overall increase, and followed a +10.0% increase in April. Meanwhile the core CPI measure that excludes food and energy rose to +3.8% on a year-on-year basis (vs. +3.5% expected), but the record there was even bigger as you have to go all the way back to June 1992 (29 years ago when I’d just spent my last day at school!) to find the last time that core inflation was that strong. In terms of core, the most we undershot due to the pandemic was around 0.8%. We’ve already overshot the other way by 1.8%. So in terms of make up inflation due to the pandemic the Fed have already achieved this. Next stop is today’s University of Michigan Consumer Confidence release with the all important inflation expectations readings. The 5-10 year one hit 3% last month – the highest since 2013 with 1 year expectations at 4.6% – the highest since April 2011.

Given we think inflation expectations are key to Treasury yields going forward this will be interesting to watch. In terms of the CPI impact on them yesterday, they moved higher immediately after the release, climbing around +4bps to an intraday high of 1.533%, but then swiftly pared back that increase to close -5.9bps lower on the day, at 1.432% – a 10bps intra-day rally. This was the lowest closing level since March 2 and down -30.9bps from late-March’s closing level. To be fair, inflation breakevens were up +3.2bps on the day, but they were more than offset by a -9.0bps decline in real yields, which was the largest one day drop in real yields since late February. But that still marked a big contrast to last month, when real yields rose +4.9bps on the day of the release as investors moved to anticipate a faster withdrawal of monetary stimulus from the Fed.

Speaking of the Fed, their meeting next week will now be the next big focal point for markets, and since the FOMC are currently in a blackout period, we’ll have to wait until that decision on Wednesday before we get their latest thinking. Their last meeting in April actually took place before the two CPI releases we’ve just had, where Fed Chair Powell acknowledged that although “we are likely to see some upward pressure on prices”, in turn they were “likely to be temporary as they are associated with the reopening process.” Let’s see what the line is on Wednesday, but it’ll be fascinating to see the latest forecasts and dot plots, and whether the FOMC’s median dot is still of the view held in March that rates will still be on hold at the end of 2023. The market doesn’t seem at all concerned about the Fed at the moment.

With Fed concerns remaining subdued, US equities rose to fresh all-time highs yesterday, with the S&P 500 (+0.47%) closing at a new record for the first time since May 7. High-growth and defensive industries continued to lead equities higher as yields compressed. Biotech (+2.24%) led the index higher once again, with software (+1.24%) and health care equipment (+1.10%) amongst the best performing industries, whereas cyclicals such as banks (-1.66%), materials (-0.56%) and transportation (-0.43%) all fell back. Banks were the biggest underperformer, pulled down by a flattening yield curve. Small-cap stocks also struggled, with the Russell 2000 down -0.68%, and in Europe the STOXX 600 closed marginally higher with a +0.03% gain. The same sector rotation of health care (+0.98%) and technology (+0.83%) over cyclicals was present in Europe as well, however European banks (+0.33%) remained on the winning side of the ledger but closed before the full treasury rally.

Overnight in Asia markets are trading mixed with the Nikkei (+0.03%) flat while the Hang Seng (+0.39%) and the Kospi (+0.69%) are up. The Shanghai Comp (-0.25%) is down. Meanwhile, futures on the S&P 500 are up +0.05% while those on the Stoxx 50 are up +0.20%.

Back to yesterday, and the other main highlight aside from the CPI release in the US was the latest ECB meeting, where the Governing Council left interest rates unchanged as expected, and said that they would continue to conduct their purchases under the PEPP over the coming quarter “at a significantly higher pace than during the first months of the year”. The move to maintain the pace of purchases came in spite of upgrades to their economic forecasts, with growth this year now expected to come in at +4.6% (vs. +4.0% in March), and 2022 growth at +4.7% (vs. +4.1% in March). They also upgraded their inflation profile over the next couple of years, now seeing HICP at +1.9% in 2021 and 1.5% in 2022 (vs. +1.5% for 2021 and +1.2% for 2022 before). See our economists’ review here.

The market reaction to the ECB was totally overshadowed by the CPI with sovereign bonds more following Treasuries by selling off immediately post the numbers but rallying strongly thereafter. By the close of trade, 10yr yields had moved lower on most of the continent, with those on 10yr bunds (-1.2bps), OATs (-0.7bps) and BTPs (-3.4bps) all falling back.

Elsewhere, there were fresh moves higher for commodities yesterday, which have been one of the forces putting upward pressure on inflation recently. Both Brent Crude (+0.42%) and WTI (+0.47%) oil prices hit a 2-year high of $70.52/bbl and $70.29/bbl respectively, while gold prices reversed their earlier losses following the CPI release to close up +0.53%. Other commodities ended the day higher as well, including corn (+1.19%), wheat (+0.22%), and iron (+3.14%).

Here in the UK, we had a second day in a row where cases were above the 7,000 mark, as we await an announcement on Monday as to what will happen to restrictions in England. It came as the Health Secretary said that the delta variant first discovered in India now accounted to 91% of new cases. Japan’s government is considering lifting the state of emergency in most areas of the country, including Tokyo and Osaka, on June 20 as originally planned. Though some strict measures may remain in place ahead of this Summer’s Olympic games. On the other hand, Chile announced a full lockdown of its capital, Santiago, as the Health ministry announced that there were only 30 ICU beds in the entire city (c.8mn residents) yesterday. Separately on the vaccines, Moderna filed for an Emergency Use Authorization from the US FDA for its vaccine in the 12-17 year old group. If approved, it would join the Pfizer vaccine in having been approved for the over-12s.

Looking at yesterday’s other data, the weekly initial jobless claims from the US for the week through June 5 fell to a post-pandemic low of 376k (vs. 370k expected), marking their 6th consecutive weekly decline. Continuing claims for the week through May 29 were similarly at a post-pandemic low of 3.499m (vs. 3.665m expected). Meanwhile in Europe, French industrial production unexpectedly fell -0.1% in April (vs. +0.6% expected), though Italy’s industrial production for the same month saw much stronger-than-expected growth of +1.8% (vs. +0.3% expected).

To the day ahead now, and one of the main highlights today through the weekend will be the G7 summit that commences today. Otherwise, data releases from the US include the University of Michigan’s preliminary consumer sentiment index for June, while from Europe there’s the UK’s GDP reading for April. Finally, central bank speakers include BoE Governor Bailey and Deputy Governors Ramsden and Cunliffe.

Tyler Durden

Fri, 06/11/2021 – 08:09

via ZeroHedge News https://ift.tt/3gdYGYy Tyler Durden