“The Carry/Theta Bills Are Crushing” – Here’s Why The “Reflation” Trade Is Collapsing

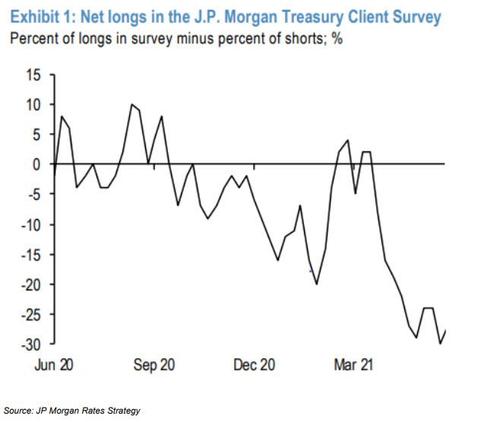

One day before the “most important CPI print in history”, we showed the latest JPM Treasury Client survey and pointed out that “there were virtually no traders left to short Treasurys, with all bears already on board” as net short interest had hit an all time high. As a result, even a red hot CPI had been fully priced in by now, and the result would be sharply lower yields as we got another massive short squeeze, this time in rates.

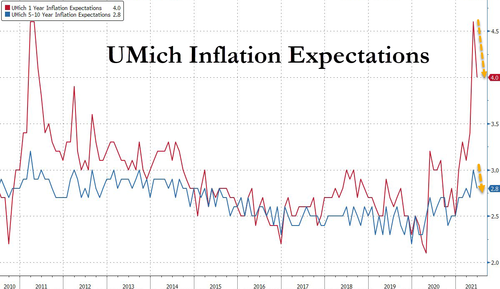

Well, with 10Y yields tumbling to March lows and breakevens in freefall over the past 48 hours, that’s precisely what happened, and since not even yesterday’s scorching inflation print managed to spark some bearish rate sentiment, the market was promptly overrun with speculation that the reflation trade is now largely finished as “inflation has peaked”, an argument which was further bolstered by today’s drop in UMich 1Yr and 5-10Yr inflation expectations.

Commenting on this shift in market sentiment, Nomura’s Charlie McElligott writes that the liquidation of “Reflation” and “Hawkish Fed” trades clearly accelerated into crescendo yesterday, “as despite another really strong US Core CPI print yesterday, the “transitory” nature of a large part of the gains (“Used Vehicles” being 1/3 of the seasonally-adjusted increase, and as a function of supply-chain and semiconductor shortage issues), as well as still-stagnant Wages (AHE YoY cratering with MoM utterly sideways) and most critically, an incredibly disappointing Labor market, all lends further credibility to the Fed’s “slow-play” stance and forces a positioning-cleanse of insanely crowded “Short UST” positioning—which critically, hasn’t been returning for months now.“

And even though evidence is mounting on the “not transitory” side as Bank of America showed yesterday, the Nomura quant says that there is little-to-no willingness to hold out another few months to confirm- or deny- whether inflation is indeed “transitory or not,” because the Carry- and/or Theta- bill is bleeding many of these trades out of existence, with many expressions now losing-money since March entry.

Some places where the collapse of the reflation is most obvious are the following:

- Eurodollar downside plays (1Y midcurve puts / put spreads) continue to see liquidations in 0en (July), 0eq (Aug) and as of yesterday, now 0eu (Sep) as hike premium is taken out of the market—while many of these expressions were funded by selling ED$ Calls, which have exploded higher in Value in pure “pain-trade” fashion

- Curve Caps- (curve steepener options) and High-Strike Payers- being unwound at an accelerated pace

- UST 10Y Treasury (nominal) yields are on-pace for the largest weekly decline in a year as crowded shorts are stopped-out; recall, the CTA Trend model shows that now, 2w, 1m and 3m model windows are all now strong “Long” signals, while as a further qualifier of the magnitude of the algo buying in TY yesterday, our “trade imbalance” analysis shows that the cumulative buy imbalance in 10Y futures was the 2nd largest since July 2019, and 99.7%ile (only second to the buying on 2/26/21)

- 10Y UST Breakevens continue their collapse despite higher Crude Oil, -28bps at the lows yesterday from the May 12th highs (ironically, the release of the prior month’s “inflation shock” April CPI print)

So does this mean that the reflation trade is over even though prices are soaring so much, a record number of Americans are putting off home, car, durable purchasing plans?

Well, as McElligott says, “gun to my head, I’d say that without a “tighter” Labor market to stoke the flames again, 1) “Reflation” is out of gas into this “Goldilocks 2.0” economic backdrop inflection and will continue to moderate on further positioning-cleanse, 2) UST long-end / Duration simply will not be able hold a sell-off and 3) Real Yields will not be able to move higher.”

Why? Because as the Nomura quant elaborates, “this is not simply because the fundamental case for “Reflation” growing tired due to the misalignment of increasingly “transitory” inflation inputs doing much of the heavy-lifting alone, vs still lagging Labor and stagnant Wages” but also “the “flows” are simply overwhelming here—not just 1) the aforementioned stop-out from “Short USTs,” “Reflation” and “Hawkish Fed” bets from the Leveraged community, but 2) Real $ buying from Asset Managers who have been underweight Duration / long Cash; 3) buying from Bank Treasury desks beyond-stuffed on record Deposits continues one-way; 4) Pension rotation back into fixed-income / duration on return to ~100% “funded” ratios….as all are working together to flip recent supply / demand trend.”

The Nomura strategist also notes that further “Reflation” push-back from clients grew louder over the course of Thursday, “with a multitude of convos making the case that by the time that we do begin to see “Labor tightening” (say, after unemployment benefits run out), many believe that this will then be offset the later we push into ’21 by the following mix:”

- A fading impulse from the “reopening / pent-up demand” phenomenon

- A (disinflationary) push from Retailers to discount into said fading demand from the initial “renormalization impulse”

- Price-inputs like used-vehicles—which have done a lot of the Core CPI “heavy lifting”—will increasingly moderate (resolve supply-chain / semi-shortage issues) in-time;

- And all as the infamous inflation “base-effect” then too will begin to cut the other way and provide “drag” (CPI troughed in May 2020—so here on out, base-effect is likely a incrementally growing headwind)

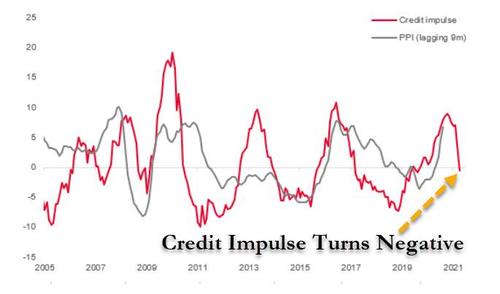

To this we would also add the global economic “grand-daddy” signal of all: China’s collapsing credit impulse which as we showed last month, just went negative, and is about to unleash a global deflationary shockwave:

“Net-net”, McElligott says, “the conversations from clients yesterday voiced a turn towards the idea that we are nearing a “best (of the reflation impulse) is behind us” attitude shift now into “Goldilocks,” and speak to preference to move away from hard “directional” trades like “Reflation,” and instead accelerate into “Short Vol / Carry / Roll” types of trades, built-upon a dovish-Fed now having further “air-cover” to delay and “slow-play” tapering / tightening and squelch Volatility for another few months.”

Meanwhile, thanks to the stabilization in Bonds/Duration/“Bull-Flattening” in Curves, we get heavy a knock-on effect into Equities thematic / risk-premia space, as the impulse rotation and rebalancing over the past year into the new Momentum-trade of “From Duration to Reflation” (bullish economically-sensitive “Cyclical Value” / Leveraged Balance-Sheet / High-Beta and bearish duration / bond proxy “Secular Growth” / “Min Vol” / “Quality”) received a robust jolt of reversal of “leaders / laggards”

Thus, “new” Equities Momentum was rocked yesterday, with “Long-Term Momentum Factor “-2.3% on day, as the YTD Winners got spanked on this pivot back into economic “Goldilocks” while YTD laggards / source of funds “Secular Growth” Nasdaq / Tech saw a resurgence on the bond rally:

- “Reflation” Winners over the past 1Y / YTD hit lower: “10Yr Yield Sensitive Factor” (-2.8% on the day), “Growth Nowcast (-2.1%), “Cyclical Value” (-1.5%), “Leverage” (-1.2%), “Short Interest” (-0.7%) and “Defensive Value” (-0.5%) all dragging

- “Reflation” Losers rallied (with USTs / Duration): “Low Risk Factor” (+1.5%), “Size (Big-Small)” (+1.5%), “Hedge Fund Crowding” (+1.5%), “HF L/S” (+1.4%), “(Fed) Liquidity Beneficiaries” (+1.1%)

- Critically, “Vol Control” strategies likely kept the market held with a latent bid despite the “reverse rotation” under the surface, as the absolute destruction in rVol (1m realized at 9.8 / 6.5%ile, 3m realized 11.9 / 0.6%ile) continues to feed the EPIC mechanical exposure adding

Finally, the Nomura quant observes that the vol-control exposure add notionals are stunning: a whopping +$16.8Billion was added on the day (98.1%ile), +$33.1B on the past week (95%ile) and a staggering +$40.7BN over the past 2w period (91.2%ile)!

So with rates flatlining and unlikely to move higher, sparking a VaR shock/equity selloff, is the market party back on full force?

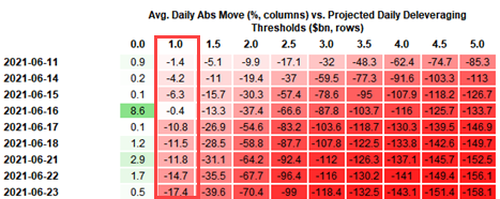

Perhaps, but we first need to get through next week when as observed previously, we get a critical Quad-witch Op-Ex, when a massive amount of market stabilizing dealer Gamma- and Delta roll-off – 80% of SPX / SPY Net Delta and 84% of QQQ Net Delta rolling-off front-month – potentially becoming a source of de-risking flows (which threatens the loss of an exceedingly large portion of this currently “insulation,” which could then see an evolution towards “accelerant” flow into new, wider price-distribution/range.

And as previously-stated (in “4 Reasons Why The Market Doldrums End With Next Friday’s Op-Ex“), from a “Vol Control” perspective, buying could grind to a relative halt over the next two weeks without a further repricing (lower) in realized Vol, while instead the potential sums of exposure to sell into wider daily market move potentials jumps precipitously.

So for those looking for a pullback window, keep a close eye on and around next week’s Op-Ex cycle turn, as all of the abovementioned flows are likely digested… even though as McElligott concludes, “clients will happily “buy that dip” when it happens, on account of a “passive / dovish Fed” further emboldening “short Vol” environment and re-risking.”

Tyler Durden

Fri, 06/11/2021 – 12:40

via ZeroHedge News https://ift.tt/2SrStzk Tyler Durden