“We Are Building Up To A Big Accident” – Gap Between 10Y Yields And CPI Is The Highest Since 1980

Even though US CPI smashed expectations again, Deustche Bank’s chief credit strategist Jim Reid correctly points out that “the data isn’t going to change anyone’s mind of whether inflation is transitory or not.”

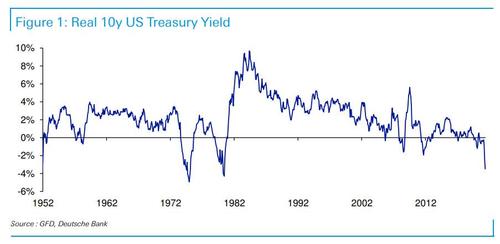

Still, as an aside for those who still care about fundamentals, he notes that the current gap between 10yr US yields (c.1.5%) and US CPI (5.0%) is a whopping 3.5%, the highest since 1980. In fact, the gap has only been more negative for 10 months in the last 70 years, all of which were in 1974, 1975 or 1980.

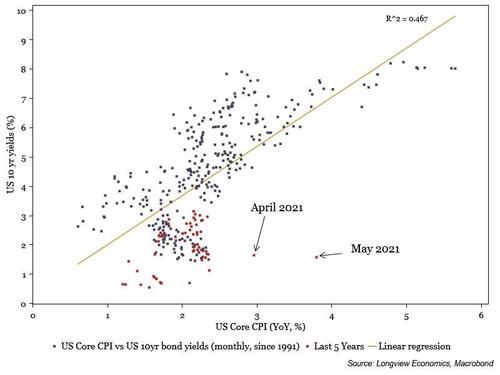

Another way of visualizing the unprecedented divergence between core inflation and 10Y yields is the following scattergram from Longview economics:

While such a deeply negative (albeit crude) proxy for real yields (as opposed to the manipulated ones where the Fed is implicitly setting real rates with its purchases of TIPS) is great for financial conditions today, the DB credit strategist asks, rhetorically, if “we are building up to a big accident with such a mismatch between inflation and bond yields?”

And just as rhetorically, Reid concludes that despite this stunning observation, “no-one is going to have a different opinion to what they had yesterday though” (although If anyone’s mind has changed, Reid would love to hear from you).

Tyler Durden

Fri, 06/11/2021 – 14:20

via ZeroHedge News https://ift.tt/2ToeY8w Tyler Durden