These Are The Nicest New Cars The Average Buyer In Each State Can Afford

Like homes, new cars have become prohibitively expensive in 2021 as a shortage of critical microprocessors has forced millions of Americans to instead settle for a used car. Unfortunately, Americans have generally been forced to pay more for used cars, leaving some workers overburdened with their car loans and insurance payments.

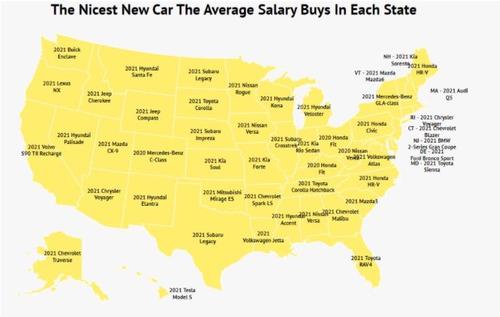

For Americans who are looking for a used car and would like some guidance, Zippia.com recently crunched the numbers using the average income and most common financing structure in each state, and figured out what they claim is “the nicest new car that is affordable in each state.”

It’s certainly an interesting claim. Here are the ten most expensive cars from the company’s list.

10 Most Expensive Cars:

- Hawaii – 2021 Tesla Model S

- California – 2021 Volvo S90 T8 Recharge

- Massachusetts – 2021 Audi Q5

- Colorado – 2020 Mercedes-Benz C-Class

- Washington – 2021 Buick Enclave

- Oregon – 2021 Lexus NX

- New York – 2021 Mercedes-Benz GLA-class

- New Jersey – 2021 BMW 2-Series Gran Coupe

- Maryland – 2021 Toyota Sienna

- Utah – 2021 Mazda CX-9

And the 10 cheapest cars:

- Arkansas – 2021 Chevrolet Spark LS

- West Virginia – 2020 Nissan Versa

- Mississippi – 2021 Hyundai Accent

- Oklahoma – 2021 Mitsubishi Mirage ES

- Indiana – 2021 Kia Rio Sedan

- Ohio – 2020 Honda Fit

- Kentucky – 2020 Honda Fit

- Iowa – 2021 Nissan Versa

- Alabama – 2021 Nissan Versa

- Kansas – 2021 Kia Soul

Here’s how Zippia came to these conclusions.

We started with average salary in each state to US Census. We then divided by 12 for the monthly income.

From there, we applied a 65 month loan (the most common) and 4.67% interest (current average car interest rate) to work out the maximum monthly payment the average salary could sustain without exceeding 10%.

It is recommended by financial advisors that no one have debt payments greater than 36% on total debt servicing. More specifically, it is recommended that car payments and car costs (including gas, maintenance, taxes and other costs) not exceed 20% of your income.

With this in mind, we conservatively allotted a max of 10% of monthly income to account for miscellaneous costs.

From there we used Kelly Blue Book to find the “nicest” (or most expensive) new car that budget could afford.

We tried to get as close as possible, opting to go lower when possible rather than exceeding (and only exceeding by a couple 100 dollars when we did go over). This means, particularly lower cost cars where there are less options, some states share a car type.

Keep reading to see the full list– and the car price that breaks the bank for each state.

Don’t break the bank to buy a car:

Ultimately, personal finances are personal. Someone with excessive student loans, heavy credit card debt, or incoming consuming mortgage, would need a lower car payment.

Before purchasing a car, you should carefully consider your present day circumstances and future goals.

Readers can find the full list here.

Tyler Durden

Sun, 06/13/2021 – 23:30

via ZeroHedge News https://ift.tt/2Tm59I5 Tyler Durden