India, A Well Known Source Of Gold Demand, Is Turning A Keen Eye Toward Crypto

India has long been known for being a strong source of demand for gold – not only for wealth preservation, but also for cosmetic and jewelry purposes.

But now it looks as though something else has caught the country’s eye: crypto.

This could mean that the mantra that Bitcoin is equivalent to digital gold could actually be catching on, Bloomberg noted this week.

Households in India own more than 25,000 tons of gold and, despite this, investments in crypto across the country grew from about $200 million to a stunning $40 billion over the past year, the report says.

The demand flies in the face of “outright hostility toward the asset class” from the country’s Central Bank, the piece notes. There are now more than 15 million Indians buying and selling cryptocurrencies, compared to 23 million in the U.S. and 2.3 million in the U.K.

One microcosm of the shift in demand is 32 year old Richi Sood. She put about $13,400 – some of which she borrowed from her family – into crypto instead of gold. After buying Bitcoin, Dogecoin and Ether, she cashed out part of her position to help her fund her startup company. She said: “I’d rather put my money in crypto than gold. Crypto is more transparent than gold or property and returns are more in a short period of time.”

Sood represents where much of the growth in India is coming from: people aged 18-35. “Indian adults under age 34 have less appetite for gold than older consumers,” Bloomberg wrote, citing data from the World Gold Council.

Sandeep Goenka, who co-founded ZebPay, said: “They find it far easier to invest in crypto than gold because the process is very simple. You go online, you can buy crypto, you don’t have to verify it, unlike gold.”

Keneth Alvares, who is 22 years old, said: “I think over time everyone is going to adopt it in every country. Right now the whole thing is scary with regulation but it doesn’t worry me because I’m not planning to remove anything for now.”

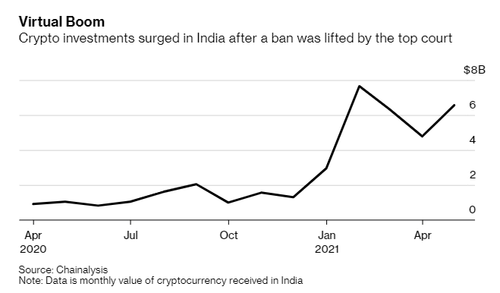

Part of the growth can be attributed to the country’s Supreme Court quashing a rule banning crypto trading by banking entities. This led to a trading surge, despite the fact that the country’s Central Bank shows “no signs” of embracing cryptocurrencies.

Other countries like the U.K. have also cracked down on crypto, with the latter banning Binance Markets from doing regulated business in the country.

This regulatory environment means that larger investors are less likely to talk openly about their holdings. Bloomberg spoke to one investor who owned more than $1 million in crypto; he said he is concerned about the prospect of retrospective tax raids. He has “contingency plans in place to move his trading to an offshore Singapore bank account” if a ban were to be enacted.

The smaller investor in India seems to be taking the regulatory environment in stride, however. Sood concluded: “I am flying blind. I have a risk-taking appetite, so I’m willing to take a risk of a ban.”

Tyler Durden

Tue, 06/29/2021 – 20:25

via ZeroHedge News https://ift.tt/3x7X5tl Tyler Durden