JPM’s Kolanovic: The Delta Variant Does Not Pose A Risk For Markets

Amid the growing mainstream media panic over the covid Delta variant, which one can only assume is meant to set the stage for another lockdown and even more stimulus payments, earlier today we tried to explain why much of this fearmongering is nothing more than just “panic porn dressed up as science.” However, with the market also starting to freak out about the Delta strain with rates hammered and travel and auto shares sliding on concerns about future lockdowns as the reflation trade fizzles yet again, we note that none other than the market’s biggest cheerleading permabull, JPM’s Marko Kolanovic who has emerged as this generation’s Abby Joseph Cohen, this morning published a report in which he says that “the Delta variant does not pose a risk for markets” and that “yields and value should move higher”, which was to be expected since JPM’s core thesis is to be be balls to the wall long value.

Reminding readers that contrary to the rest of the market which freaked out over the emerging B.1.1.7 variant back in February, Kolanovic was quite optimistic back then (and as always), the Croatian quant then extrapolates the same argument to today, writing that “there is a similar setup now with the so-called Delta COVID-19 variant fears, which resulted in a decline in yields and value stocks.”

So what makes JPM’s resident nuclear physicist-cum-immunologist – who also opines on markets, so certain that the delta strain is a nothingburger, a view that could promptly get him canceled by the “narrative” brigade which is so positive that the D in Delta stands for Doom?

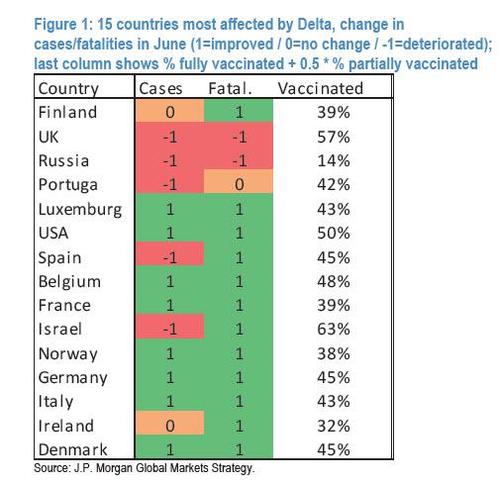

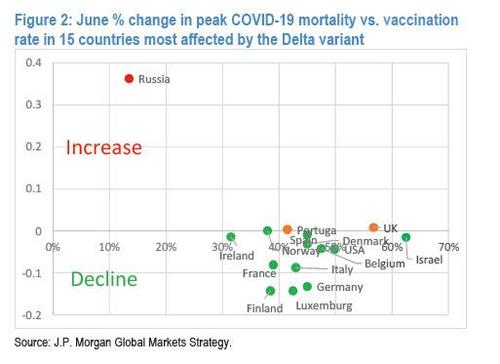

Well, as he writes, “we analyzed the progression of new cases and fatalities in the top 15 countries most affected by the Delta variant over the past month” and looking at the progression of cases (as driven by the Delta variant) and fatalities, “we find that in 10 out of 15 countries cases declined, and in 13 out of 15 countries fatalities declined as the Delta variant increased share of new infections.”

In summary, Kolanovic writes, “spread of the Delta variant has on average coincided with an improvement of the overall COVID-19 situation in affected countries.” He goes on:

Let us analyze the situation in the countries where pandemic conditions deteriorated over the past month. These 3 countries are Portugal, the UK, and Russia. In Portugal, the deterioration resulted in an increase of ~900 cases per day, which is about 7% of cases during the peak pandemic. However, the increase in fatalities is ~1 per day, which is consistent with noise. In the UK, cases increased by ~14,000 per day, which is a significant increase; however, fatalities increased by ~9 per day, which is 0.9% of the peak fatality rate. This is consistent with findings that vaccines effectively prevent worse outcomes in Delta variant infections. One should also note that the current increase of delta cases results in 5-10 times smaller fatality rates compared with the outbreak of B.1.1.7 this winter, likely a result of high vaccination rates and natural immunity. This is further corroborated with that fact that most fatalities occurred in unvaccinated people.”

Kolanovic then looks closer at Russia, where the Delta variant is driving a significant number of cases and fatalities (e.g., 39% increase in cases, and 36% increase in fatality rate in June) and asks “How is the situation in Russia different from other countries?” His answer:

- First, it is important to notice that the % of the population vaccinated in Russia is 4 times smaller than, for example, in the UK and USA (12% vs 48% for fully vaccinated population, 14% vs 57% for full and partially vaccinated).

- Secondly, note that the estimated natural immunity in Russia is at least 2 times smaller based on COVID-19 fatalities per capita than in the UK and USA since March last year. In other words, given that Russia had a much smaller number of COVID-19 cases and vaccines administered, overall immunity of the population in Russia is much smaller.

For this reason, the JPM quant argues that any COVID-19 variant (alpha, beta, gamma, etc.) would result in faster spread and bigger impact in Russia (i.e., similar to the winter wave in the US and UK). Pointing to the chart below, Kolanovic argues that “Russia is an outlier, and not driven by Delta but rather by the level of immunity.”

And while many will be alarmed that a JPM quant is once again practicing virology, that does not stop Kolanovic to conclude that “the Delta variant should not have significant repercussions for the pandemic situation in developed markets (e.g., Europe and North America, which have strong progress in vaccination) due to the level of population immunity, and hence positioning in markets should not be driven by this

or any other subsequent variant of COVID-19 for which current vaccines are effective.”

While Kolanovic is probably right, what is remarkable is that his “Delta” analysis – goalseeked as it may be – only seeks to further JPM’s bullish market thesis.

We reiterate our view to go long reflation, cyclical and value trades, and sell growth and defensive positions.

What if he is wrong? Well, people may die, but more importantly, the value names JPM is long will drop.

Finally, we find it a big paradoxical that in talking down the risk of the Delta variant, Kolanovic reduces the odds of another fiscal intervention which is surprising because if JPM really wants value, oil and yields higher, he should be begging for another cool trillion or two in stimmy checks. But if the Delta variant proves to be a dud, not only will another stimulus bonanza not come, but it is much more likely that any value outperformance is now over not because of any Delta-related fears but because the market still has some forward looking capabilities, and they are all looking to September when Biden’s emergency claims expire, and when wages and income will tumble dragging the broader economy – and yes, value stocks too – with them while the tailwind of government generosity turns into a headwind.

With that in mind, we wonder how long until JPM changes its mind and concludes that the Delta strain is actually far more dangerous than consensus believes and deserves a few more trillion in value-boosting fiscal stimuli.

Tyler Durden

Wed, 06/30/2021 – 15:23

via ZeroHedge News https://ift.tt/364oX5O Tyler Durden