Oil Jumps Ahead Of OPEC+ On Speculation Oil Supply Deal May Be Extended

Brent jumped back over $75 this morning, pushed higher by a Reuters report that OPEC+ is expected to discuss the extension of the oil supply deal beyond April 2022 following earlier reports that some minsters are concerned about an oversupplied market in 2022.

The jump reversed however following unconfirmed reports that ahead of tomorrow’s OPEC+ meeting, Russia had expressed its favor for an increase in OPEC+ oil production starting form August, with an increase between 500k-1mln BPD suggested. As OPEC journalist Reza Zandi added, some members disagree with such suggestions out of the fear that COVID might surge again.

As usual, #Russia has expressed its favor for an increase in #OPEC+ #oil production starting form August. An increase between 500 T & 1 M bpd have been suggested. Some members disagree with such suggestions out of the fear that #COVID19 pandemic might surge again…/1 #OOTT

— Reza Zandi (@R_Zandi) June 30, 2021

Earlier in the session, WTI and Brent hit session lows of $72.82/bbl and $73.93 respectively, in a move that coincided with declines across equities, even as a base emerged thanks to reports that Iranian nuclear talks have been postponed to an unspecified date – suggesting a smaller likelihood of Iranian oil returning to the market in the initially expected time frame.

Elsewhere, Tuesday’s OPEC JTC did not provide a recommendation for ministers to consider. The JTC signaled uncertainty about the spread of COVID variants and the speed of vaccine rollouts. It also said that it is monitoring sovereign debt levels, inflation rates, and central bank actions. All*in-all, the technical committee reviewed a range of scenarios and aligned their base case with the June MOMR. Sources suggested Moscow and Riyadh have different views regarding the pace at which oil should be brought back to the market, with the latter favouring a more gradual approach. The Kuwaiti oil minister suggested the group is cautious about raising output amid challenges.

The OPEC, JMMC, and OPEC+ meetings are all slated for Thursday at 12:00BST, 15:30BST and 17:00BEST respectively. The JMMC meeting was pushed back with some citing Russian Deputy PM Novak’s calendar, although sources suggested it is to allow for more time to negotiate a compromise (we have included a primer from Newsquawk at the bottom of this post).

Also ahead of tomorrow’s meeting the banks published various scenarios how they view OPEC+ boosting production:

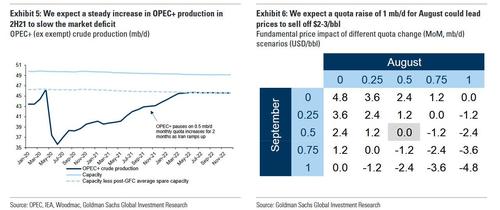

- Goldman Sachs expects base-case increase to OPEC+ output by 500k bpd and forecasts oil demand to rise by additional 2.2mln bpd by year-end resulting to a 5mln bpd shortfall. Goldman Sachs added that while a new infection wave could slow market rebalancing, it expects OPEC+ to continue tactical production hikes and estimates that the current global oil deficit is at 2.3mln bpd.

- Even if the group surprises with a 1m b/d hike, Goldman says it would only represent $2-$3 of downside to bank’s forecast of $80/bbl Brent: “Ultimately, much more OPEC+ supply will be needed to balance the oil market by 2022”

Morgan Stanley analysts said oil should outperform metals markets as the world emerges from lockdowns

- “As the world emerges from lockdown, ‘buying stuff’ makes way for ‘doing things’,” which favors energy over metals, a reversal of the trend seen since the start of the pandemic.”

- “Mobility is picking up sharply now, while spending on durable goods is softening”; this will likely continue

- The medium-term outlook for energy is strong, with shareholder pressure leading to a sharp decline in oil and gas investment, where markets are already tight

JBC Energy report

- Russian refiners are at an advantage over European rivals, partly due to rising carbon costs: “The carbon cost is fixed for European refiners irrespective of the actual margin level, implying that it is a bigger onus on refining in a low margin environment such as we are in now”

- Russian refiners also benefit from an implied subsidy, stemming from the government’s cap on domestic retail prices for fuels

Finally, courtesy of Newsquawk, here is a full primer on tomorrow’s OPEC, JMMC and OPEC+ meetings scheduled for 12:00BST, 15:30BST and 17:00BEST respectively. As a reminder, the JMMC meeting – originally scheduled for today – was pushed back with some citing Russian Deputy PM Novak’s calendar, although sources suggested it is to allow for more time to negotiate a compromise.

OVERVIEW: Sources suggested the group is mulling a further easing of curbs, although the specifics have not yet been ironed out – with analyst forecasts ranging from 100k BPD to 1mln BPD of oil returning to the market in August. A total of some 2.2mln BPD of OPEC oil (barring Iran, Libya, and Venezuela) is set to return to the market under the May-July quotas (set in April), including Saudi’s 1mln BPD voluntary cut. Russia has argued that markets can absorb more OPEC+ supply amid an expected deficit. OPEC+’s latest forecasts point to the group’s supply falling short of demand by 1.5mln BPD (assuming current output levels are maintained), with the shortfall seen widening to 2.2mln BPD in Q4. As usual, the group will likely test the waters and skew expectations via sources heading into the meeting. Note, Russian Deputy PM Novak earlier this year suggested output adjustments will only move by 500k BPD either way (barring Saudi’s voluntary cuts), although it is unclear if this still stands.

JTC MEETING: The JTC on Tuesday did not provide a recommendation for ministers to consider. The JTC signalled uncertainty about the spread of COVID variants and the speed of vaccine rollouts. It also said that it is monitoring sovereign debt levels, inflation rates, and central bank actions. In fitting with the June MOMR, the JTC expects a rebound in oil demand and strong growth in H2. All-in-all, the technical committee reviewed a range of scenarios and aligned their base case with the June MOMR. Sources suggested Moscow and Riyadh have different views regarding the pace at which oil should be brought back to the market, with the latter favouring a more gradual approach. The Kuwaiti oil minister suggested the group is cautious about raising output amid challenges

MOVING PARTS:

- SUMMER DEMAND: The group expected demand to pick up pace in H2 2021, as per the June MOMR, which forecasts H2 demand at 99mln BPD vs 94.1mln BPD in H1. “With improving mobility in major economies supporting gasoline and on-road diesel demand. Improvements in pandemic containment efforts and seasonal summer demand will allow for positive expectations for 2H21”. The monthly report also suggested that refiners in APAC and Europe showed higher buying interests on the expectation of further recovery of oil demand in the approach of the summer driving season, whilst in the US, “the continued recovery in refinery runs and declining crude stock lent support to prices.” Furthermore, EnergyIntel recently noted that “so far demand scenarios look good and there might be a need to ease the cuts”

- COVID VARIANTS: The emergence of more resilient, and transmissible variants remains a persistent risk. The spread of the Delta variant has prompted economies such as the UK to delay its full reopening, whilst some regions in APAC alongside several Australian cities recently re-entered lockdown – Eurozone economies have warned that the Delta variant is gaining traction in the region. Furthermore, the spread of the highly contagious variant has kept a lid on international travel and thus impacting jet fuel demand. However, at this point, ministers seem less worried about the knock-on effects from variants as the vaccination drives continue at pace.

- IRANIAN OIL: Iranian nuclear talks continue to drag on longer than expected due to outstanding sticking points – although desks and ministers have suggested that this output can be absorbed, with the country also exempt from OPEC quotas in light of US sanctions. Iran’s May output stood at around 2.5mln BPD vs around 3.8mln BPD in 2018, pre-US sanctions. This would suggest the addition of 1.3mln BPD of Iranian oil over the next few months – assuming a deal is struck between Tehran and Washington.

- US SUPPLY: In terms of competing US supply, OPEC+ officials reportedly heard from industry experts that US output growth will likely remain limited this year, according to sources, before a potential sharp rise next year. This gives OPEC+ giving it more power to manage the market in the short term.

ANALYST VIEWS:

- Goldman Sachs, ANZ, ING and S&P Global Platts all expect August quotas to increase by 500k BPD, whilst RBC Capital Markets forecasts OPEC+ to boost output by 500k-1mln BPD at the July 1st meeting. On the other side of the spectrum, Rystad Energy has called on OPEC+ to take a more cautious approach and opt for a production increase of 100-200k BPD in August – citing a jagged path of recovery and fragile demand.

Tyler Durden

Wed, 06/30/2021 – 08:30

via ZeroHedge News https://ift.tt/2URYIxg Tyler Durden