Stocks & Bonds Soar In ‘Stagflationary’ Q2, June Gloom Crushes Crypto

An ugly year for “hard data”, especially relative to expectations, but that didn’t stop oil prices, big-tech stocks from soaring (as the yield curve flattened dramatically with the long-end well bid)

Source: Bloomberg

And Q2 saw ominous stagflationary signals…

Source: Bloomberg

As Bubble Markets followed The Fed’s balance sheet flow…

Source: Bloomberg

This seemed to sum things up…

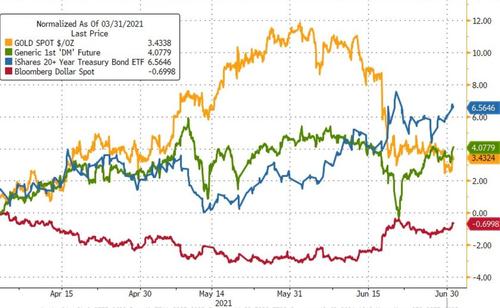

In Q2, the long-bond outperformed The Dow as the dollar sank…

Source: Bloomberg

June saw bonds surged and bullion purged…

Source: Bloomberg

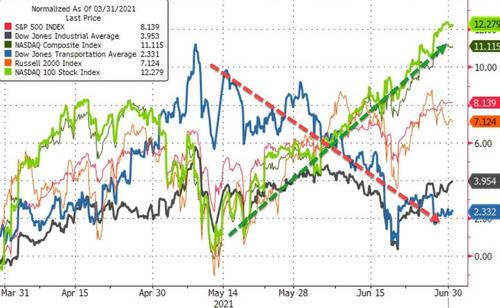

The S&P 500 just had its best first half of the year since 1998. Trannies outperformed in H1 but were rapidly losing gains and Nasdaq underperformed (but was rapidly rallying back)…

Source: Bloomberg

S&P are up 5 straight months (and 5 straight quarters)

All major equity indices were higher in Q2 with Nasdaq the leader and Dow Industrials and Transports lagging…

Source: Bloomberg

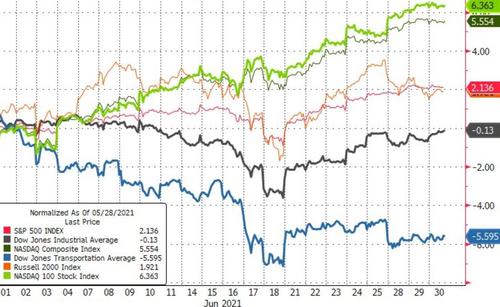

Nasdaq was also June’s best performer, The Dow was unchanged and Trannies tumbled…

Source: Bloomberg

The growth versus value trend regimes have ebbed and flowed but overall both have done sell in 2021 so far…

Source: Bloomberg

Treasury yields were very mixed this quarter with 30Y yields plunging 34bps (biggest yield drop since Q1 2020) as 2Y yields surged almost 11bps (biggest quarterly spike since Q3 2018)…

Source: Bloomberg

With the long end crashing over 20bps in June (biggest yield plunge since March 2020) alone while the short-end yields rose over 10bps (the biggest monthly spike since Sept 2019)…

Source: Bloomberg

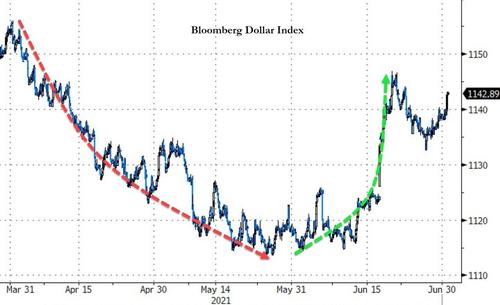

The dollar ended lower for Q2 after its Q1 surge, but rebounded notably in June…

Source: Bloomberg

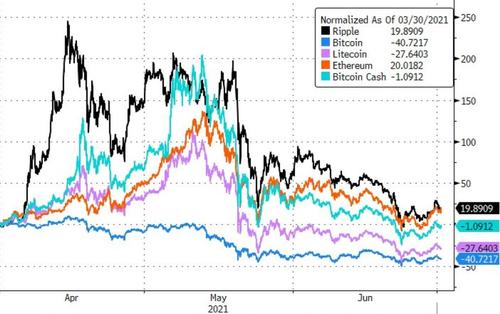

Q2 was a bloodbath for Bitcoin (down 40%), suffering its worth quarter since Q4 2018, but Ethereum managed a 20% gain…

Source: Bloomberg

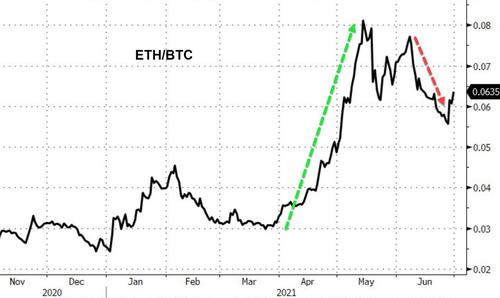

ETH remains significantly higher relative to BTC since the start of the year…

Source: Bloomberg

But all majors Cryptos had a really ugly June…

Source: Bloomberg

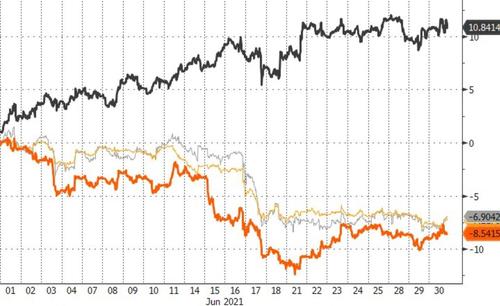

Commodities were up for the 5th straight quarter in Q2. All the majors were higher but oil soared most (with everything decoupling from crude in June)….

Source: Bloomberg

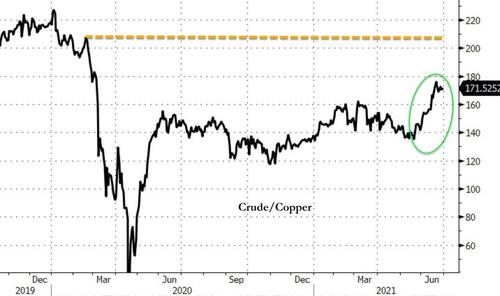

Commodities had a very mixed June with crude soaring while Dr.Copper was clubbed like a baby seal…

Source: Bloomberg

As dramatic as that outperformance was, Crude relative to copper is still not back to pre-COVID levels…

Source: Bloomberg

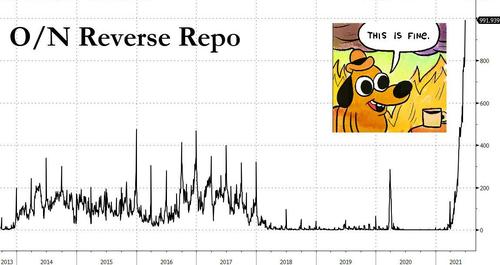

Finally, banks lodged just under one trillion dollars of excess malarkey with The Fed over the month/quarter-end…

Source: Bloomberg

Probably nothing!

Tyler Durden

Wed, 06/30/2021 – 16:00

via ZeroHedge News https://ift.tt/3yf18o5 Tyler Durden