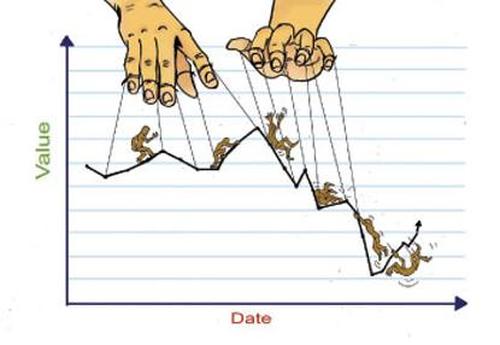

“I F..k The Markets Around A Lot” – Merrill Gold Trader’s Chat Exposes “How Easy It Is” To Manipulate Metals Markets

“They did it over and over and over again. They took pride in their skill to manipulate prices. They took pride in ripping off other traders. They bragged about it.”

That is how Scott Armstrong, a trial attorney in the U.S. Department of Justice’s fraud division, described two former traders at Bank of America’s Merrill Lynch unit charged with manipulating precious-metals markets with fraudulent trades.

According to the government, the pair used spoofing orders in gold and silver markets for several years, mostly in 2010 and 2011.

As Bloomberg’s Bre Bradham reports, chat logs introduced as evidence against Edward Bases and John Pacilio showed the two traders bragging about how easy it is to manipulate prices.

“…that does show u how easy it is to manipulate it sometimes,” Bases wrote minutes after one such manipulation.

“I f..k the mkt around a lot,” Bases said in another message.

John Scheerer, a senior director, testified Tuesday that orders on CME exchanges must be “real, genuine, not fake,” and ready to be executed.

“Globex is not a game,” Scheerer said.

“This is real money.”

The defense angle was interesting – if not entirely fallacious – that “spoofing” was legal before Dodd-Frank. Sorry, no!

The trading activities cited by prosecutors were almost exclusively before then, with two “aberrations” in 2012 and 2014, she said.

“Ed acted in complete good faith, always believing that everything he was doing was lawful,” Porter said.

Once he understood that the technique was viewed as unlawful, he stopped, she said.

Bases and Pacilio face a combined 20 counts of charges, including wire fraud affecting a financial institution, conspiracy to commit wire fraud and commodities fraud. Pacilio faces a count of spoofing.

The judge has set aside three weeks for the trial.

They are not alone in this act. In the last few years, as the government has cracked down on market manipulation, we have seen many banks get pinged for manipulating metals markets…

-

Gold Manipulators Busted After Zero Hedge Report On Flagrant Gold Spoofing

-

Gold Manipulation, Spoofing Futures And Banging Fixes: Same Banks, Same Trading Desks

-

Feds Crack Down On Traders “Spoofing” To Manipulate Prices Amid Record Number Of Cases

-

Deutsche Bank Gold Manipulator: “Spoofing Was So Commonplace I Figured It Was OK”

-

Former Deutsche Bank Traders Convicted Of Fraud For Spoofing Precious Metals Between 2008 And 2013

-

JPM Pays Record $1 Billion Fine; Admits Spoofing Of Gold And Treasuries

As a reminder, in 2015, we concluded one note to “The CFTC”: We won’t stop this until you are forced to address the glaring hypocrisy and utter incompetence of everyone involved in the regulation of market microstructure.

It appears they listened… but remember, these cases are from 10 years ago!!

Tyler Durden

Thu, 07/22/2021 – 17:40

via ZeroHedge News https://ift.tt/3xUXG22 Tyler Durden