Lacy Hunt On Debt And Friedman’s Famous Quote Regarding Inflation & Money

Authored by Mike Shedlock via MishTalk.com,

Lacy Hunt takes on the widespread belief that sustained inflation is on the way in his latest quarterly review…

Hoisington Quarterly Review and Outlook 2nd Quarter 2021

Here are some snips to the latest at Hoisington Management Quarterly Review (Emphasis Mine).

Too Much Debt

In highly indebted economies, additional debt triggers the law of diminishing returns. This fact is confirmed when the marginal revenue product of debt (MRP) falls, where MRP is the amount of GDP created by an additional dollar of debt. In microeconomics, when debt is already at extreme levels, a further increase in debt leads to an increase in the risk premium on which a borrower will default suggesting that the bank or other lender will not be repaid.

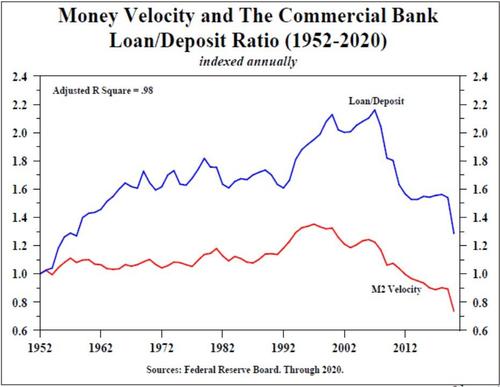

Combining both the falling MRP with a declining loan to deposit (LD) ratio, results in a reduction in the velocity of money. In terms of the impact on monetary activities, a drop in the LD ratio means that more of bank deposits are being directed to the purchase of Federal, Agency and state and local securities in lieu of private sector loans. The macroeconomic result is that funds are shifted to sectors that are the least productive engines of economic growth and away from the high multiplier ones.

More than thirty years ago, Stanford Ph.D. Rod McKnew demonstrated that the money multiplier, referred to as “m”, is higher for bank loans than bank investments in securities. The money multiplier, which is money stock (M2) divided by the monetary base should not be confused with the velocity of money. The latest trends strongly support McKnew’s analysis.

In June, after the 2021 unparalleled monetary and fiscal actions, m is estimated to be 3.2 in the second quarter, less than one-half its post 1952 average of 7.7, and just barely above the all-time low. [Mish comment: This money multiplier theory has nothing to do with the widespread (and false) belief that money gets redeposited and re-lent over and over 10 times.]

The benefit of the debt financed fiscal operation goes away under the weight of the debt. First, there is the evidence of diminished returns, which is derived from the overuse of a factor of production, which is the same as saying the government debt financed multiplier is negative. In other words, one dollar of government debt financed operations, at the end of the day, will reduce GDP by more than a dollar, therefore, the economy is worse off. Increasing deficits in an over indebted economy slows growth after a brief transitory acceleration.

There is an assertion that whenever the Fed creates reserves (i.e., Fed liabilities), banks can be counted on to put those reserves to use since they are like a “hot potato.” The decision by a bank to reach an agreement with a private sector borrower is a much more intricate process in which the risk premium is at the core.

Two of the greatest monetary economists were Irving Fisher and Milton Friedman. Friedman, whose statistical work was based on the time period from the early 1950s until the early 1980s, believed money velocity was stable, although not constant. During that span he was correct, however, due to archival research that resulted over a much longer time period of data, Friedman’s view is not correct. Fisher, working with less data than Friedman and far fewer resources than are available today, did not share Friedman’s critical assumption.

Fisher originally believed that velocity was stable, however, as more evidence became available he wrote, in a 1933 article in Econometrica, that velocity declines in highly indebted economies. The research presented in this article is consistent with Fisher’s view that debt is an increase in current spending in exchange for a decline in future spending unless the debt generates an income stream to repay principal and interest. Thus, Fisher is correct.

Friedman’s famous phrase that “inflation is always and everywhere a monetary phenomenon” would only hold if the central bank’s liabilities were legal tender. But, for that to happen the Federal Reserve Act would need to be rewritten and that is very unlikely, even more so in front of the Congressional elections in 2022.

Is Inflation is Always and Everywhere a Monetary Phenomenon?

Beauty is in the eyes of the beholder. More accurately the beauty or lack thereof is in the definition of the beholder.

If the left understood inflation for what it is, an increase in the money supply, which results not only in higher prices, but the corporate, and banking elite being the first to get their hands on it before inflation kicks in, they’d be screaming #EndTheFed right along with us. pic.twitter.com/5bR4iSovbW

— Libertarian Party NH (@LPNH) July 15, 2021

Commonly Used Definitions of Inflation

-

Decline in purchasing power of the currency held

-

Rising prices in general

-

Rising consumer prices (CPI)

-

Rising prices due to expansion of money supply

-

Rising prices due to expansion of money supply and credit\Expansion of money supply

-

Expansion of money supply

-

Expansion of money supply and credit

The 1957 Merriam Webster definition of inflation was “An Increase in money supply and credit“.

OK, but what money supply? And how does one accurately measure the value of bank credit?

What is the Best Measure of Monetary Inflation?

I had not read Lacy’s article but discussed many of the same points on July 21 in What is the Best Measure of Monetary Inflation?

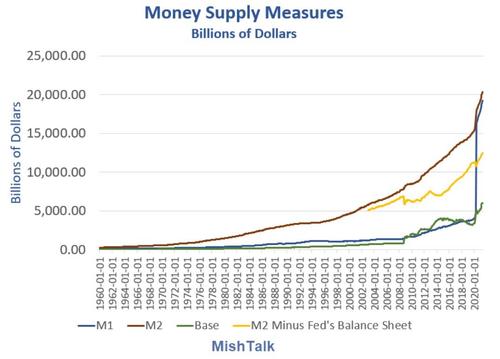

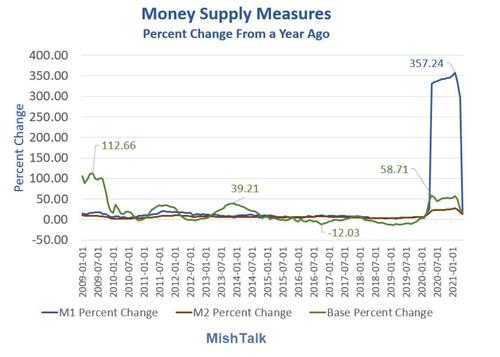

If you believe an increase in M1 is the measure of an increase in inflation, then year-over-year inflation hit 357% in February of 2021.

How Does QE Fit In?

Last week the Fed’s balance sheet exploded by $103.9 billion hitting a new record high of $8.202 trillion. Since the Fed had to print the money to buy those bonds, consumer prices will rise as the newly printed money gets spent into circulation. High #inflation is the new normal.

— Peter Schiff (@PeterSchiff) July 15, 2021

The Fed’s Balance Sheet is Not Spendable Money

On July 19, I addressed Peter Schiff’s claim in Will the Fed Balance Sheet Get Spent into Circulation Causing Inflation?

Schiff is wrong because QE is not spendable money, nor is it money on deck waiting to be spent.

Lacy said the same thing but in different words. Let’s review.

Friedman’s famous phrase that “inflation is always and everywhere a monetary phenomenon” would only hold if the central bank’s liabilities were legal tender.

Lacy and I concur that IF central bank liabilities became legal tender, inflation would run rampant.

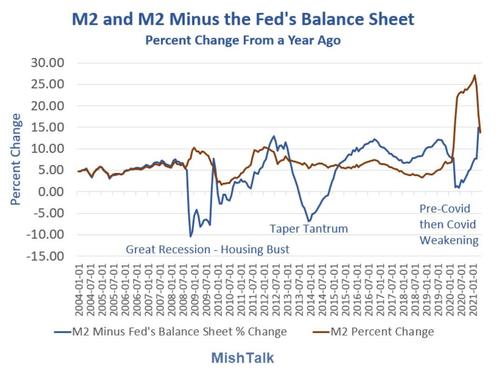

For now, the Fed’s balance sheet and the money banks get in return inflate money supply measures on paper but are not the same as customer deposits.

At a minimum, one would have to subtract QE from money supply measures to be in the ballpark.

M2 and M2 Minus the Fed’s Balance Sheet Percent Change

Difficult Subjects

For years I regarded inflation as “an increase money supply and credit marked to market“. I used Austrian Money Supply as a measure and that is nearly the same as M2.

However, the Fed suspended mark-to-market rules in 2009 and never reinstated proper accounting. Even prior to the rule change, mark-market accounting was really mark-to-fantasy.

Measurement by my definition was impossible and I missed subtracting QE.

Lacy touched on what I was attempting to get at.

A further increase in debt leads to an increase in the risk premium on which a borrower will default suggesting that the bank or other lender will not be repaid.

In a period of rising defaults such as the housing bust, banks become capital impaired and cannot or will not make loans. In other words, it’s credit deflation with very negative consequences as we have seen.

The hyperinflationists miss all of that and they do not even understand QE.

Addicted to QE

Whatever your measure of money, it should not include QE but that does not mean QE is harmless.

QE sponsors bubbles and central banks are addicted to it. For discussion, please see The House of Lords is Concerned Over a Dangerous Addiction to QE.

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Tyler Durden

Fri, 07/23/2021 – 12:30

via ZeroHedge News https://ift.tt/3wVaeFv Tyler Durden