US Services PMI Plunges Unexpectedly To 5-Month Lows As Business Outlook Slumps

After US Services PMI (and ISM) unexpectedly plunged from record highs in June, analysts expected the plunge to stop in preliminary July data (despite an ongoing downtrend in ‘hard’ economic data performance)… they were wrong.

While US Manufacturing picked up modestly from 62.1 to 63.1 (better than the 62.0 expected), US Services tumbled further to 59.8 from 64.6 (well below the 64.5 expected).

Source: Bloomberg

That is the weakest Services print since February.

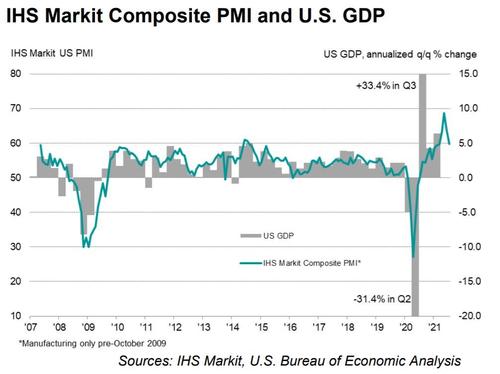

The drop in Services weighed heavily on the US Composite which dropped to 4-month lows.

Commenting on the PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said:

“The provisional PMI data for July point to the pace of economic growth slowing for a second successive month, though importantly this cooling has followed an unprecedented growth spurt in May. Some moderation of service sector growth in particular was always on the cards after the initial reopening of the economy, and importantly we’re now seeing nicely-balanced strong growth across both manufacturing and services.

“While the second quarter may therefore represent a peaking in the pace of economic growth according to the PMI, the third quarter is still looking encouragingly strong.

“Short-term capacity issues remain a concern, constraining output in many manufacturing and service sector companies while simultaneously pushing prices higher as demand exceeds supply. However, we’re already seeing signs of inflationary pressures peaking, with both input cost and selling price gauges falling for a second month in July, albeit remaining elevated.

“Inflationary pressures and supply constraints – both in terms of labour and materials shortages – nevertheless remain major sources of uncertainty among businesses, as does the delta variant, all of which has pushed business optimism about the year ahead to the lowest seen so far this year. The concern is this drop in confidence could feed through to reduced spending, investment and hiring, adding to the possibility that growth could slow further in coming months.”

Tyler Durden

Fri, 07/23/2021 – 09:53

via ZeroHedge News https://ift.tt/3rvQhDX Tyler Durden