China Politburo Meeting Points To New Phase For Domestic Markets

Chinese markets will enter a new cycle for the remainder of this year and at least the early part of 2022, given the fresh policy signals from Friday’s all important Politburo meeting, writes Bloomberg’s Shen Hong.

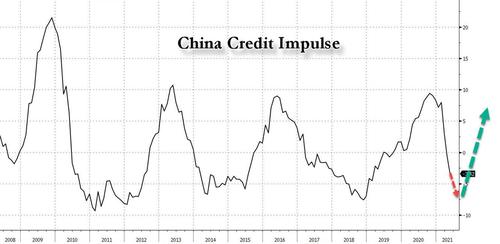

As we first noted in “China’s Credit Impulse Just Bottomed With Profound Implications For Global Economies And Markets“, Hong explains that the message from China’s top leadership is that the economy might be weaker than “we” all think (although “we” clearly made just this case in mid-July so it’s not sure just who comprises the “we” that Hong referred to) and fiscal and even monetary support is on its way.

This weakness was confirmed over the weekend, when China’s Caixin manufacturing PMI fell to 50.3 in July from 51.3 in June. The output sub-index edged down to 50.8 in July from 51.0, while the new orders sub-index fell to 49.2 from 51.6, the first time below 50 since last May. The new export orders sub-index edged up to 50.3 from 50.1. Some surveyed companies mentioned higher output prices reduced customer demand, according to Caixin.

Additionally, the employment sub-index fell to 50.1 (vs. 50.8 in June), and while staying above 50 for the fourth month in a row it signals that even China’s all important labor market may be on the verge. As noted by the survey, some enterprises hired more employees to expand capacity while some kept a cautious stance on increasing hiring. Price indicators suggest inflationary pressure continued to ease in July. The input price index fell to 55.6 in July (vs. 56.7 in June) and the output price index fell to 50.7 (vs. 53.6 in June). However, surveyed companies said raw material prices remained high, especially for industrial metals.

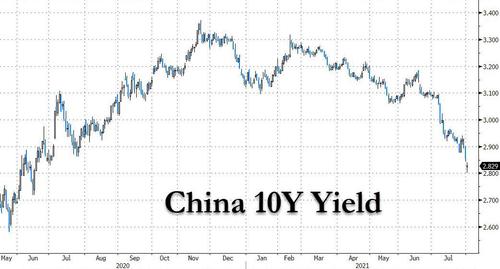

And while Beijing is about to unleash another major stimulus, at the same time financial stability remains on the agenda and while the crackdowns on a few wayward industries will continue, no one will be allowed to cause systemic risk. So bonds look to have the best prospect, followed by hesitant stocks that need more evidence of policy easing, while credit stress is set to ease. It’s why China’s 10Y yield has tumbled to the lowest level since June 2020.

As Shen Hong adds, apart from describing the current economic recovery “unstable and unbalanced,” the latest Politburo meeting also removed the description of “making use of the window period of relatively light pressure of stabilizing growth” that was conspicuous in its April session. In other words, the pressure is real and imminent and you can well expect another reduction in banks’ reserve requirement ratio later this year.

It all sounds good for bonds, but the latter have already rallied really hard in recent weeks. The 10-year yield on government debt at 2.82% is well below the 2.95% one-year rate for the PBOC’s medium-term loan, and given the likelihood of stronger supply pressure in the coming months, it may need some correction before entering a new, lower trading range. Having said that, the curve may have further scope of flattening.

Big blue chips and cyclical stocks rose this morning but tech-heavy ChiNext looked unimpressed. The latter is still reeling from the ongoing regulatory storm, and won’t take off until it sees another RRR cut.

The Politburo meeting also bodes well for credit and one can expect onshore corporate-bond spreads to keep tightening and fewer defaults, especially in the state sector.

At the April meeting, the Politburo called for “establishing” a mechanism that holds local government leaders accountable for handling financial risk. On Friday, the wording changed to “implementing.” That means even stronger incentives for provincial governors and mayors to prevent their state-owned enterprises or government financing vehicles from suffering debt blowups. The same thing goes to systemically important firms like China Huarong and Evergrande.

Tyler Durden

Mon, 08/02/2021 – 08:39

via ZeroHedge News https://ift.tt/37tSSW1 Tyler Durden